Whales with a lot of money to spend have taken a noticeably bullish stance on JD.com.

Looking at options history for JD.com (NASDAQ:JD) we detected 38 trades.

If we consider the specifics of each trade, it is accurate to state that 39% of the investors opened trades with bullish expectations and 31% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $109,680 and 36, calls, for a total amount of $4,764,935.

From the overall spotted trades, 2 are puts, for a total amount of $109,680 and 36, calls, for a total amount of $4,764,935.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $22.5 to $60.0 for JD.com over the last 3 months.

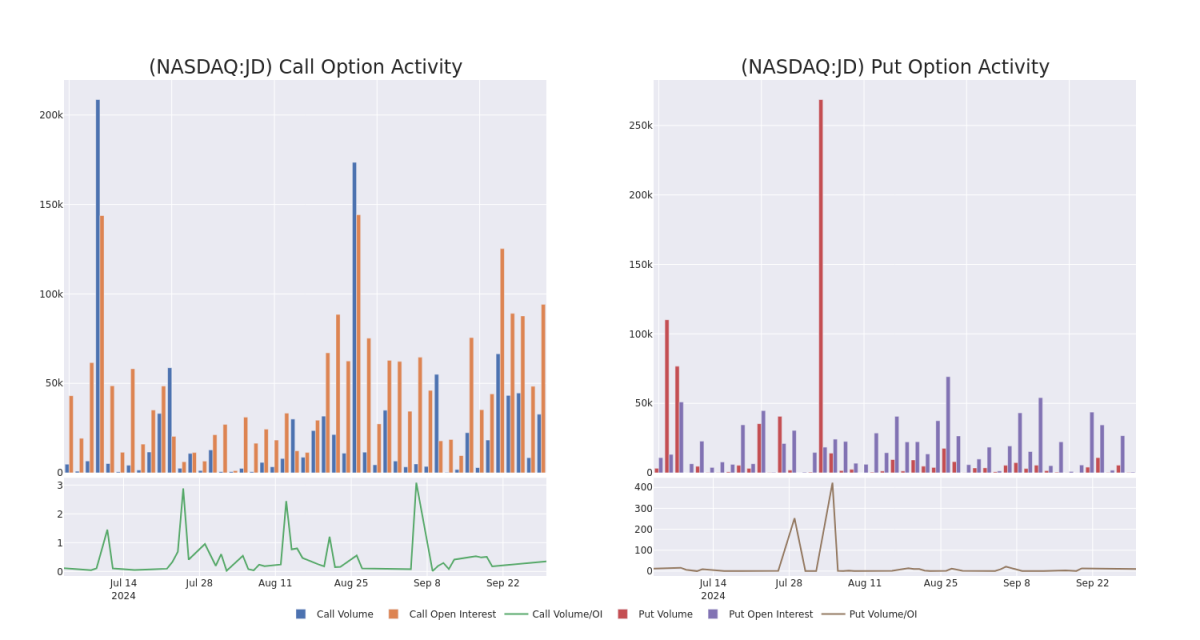

Analyzing Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for JD.com's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across JD.com's significant trades, within a strike price range of $22.5 to $60.0, over the past month.

JD.com 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JD | CALL | TRADE | BULLISH | 11/15/24 | $1.99 | $1.89 | $1.98 | $48.00 | $792.0K | 3.0K | 4.0K |

| JD | CALL | TRADE | NEUTRAL | 10/18/24 | $2.77 | $2.71 | $2.74 | $42.00 | $548.0K | 1.5K | 375 |

| JD | CALL | SWEEP | NEUTRAL | 10/04/24 | $3.2 | $3.1 | $3.15 | $40.00 | $523.0K | 8.3K | 3.9K |

| JD | CALL | SWEEP | NEUTRAL | 10/04/24 | $1.7 | $1.65 | $1.67 | $42.50 | $326.1K | 153 | 3.2K |

| JD | CALL | TRADE | BULLISH | 12/19/25 | $4.15 | $3.95 | $4.1 | $60.00 | $246.0K | 4.9K | 611 |

About JD.com

JD.com is a leading e-commerce platform with its 2022 China GMV being similar to Pinduoduo (GMV not reported), on our estimate, but still lower than Alibaba. it offers a wide selection of authentic products with speedy and reliable delivery. The company has built its own nationwide fulfilment infrastructure and last-mile delivery network, staffed by its own employees, which supports both its online direct sales, its online marketplace and omnichannel businesses.

Having examined the options trading patterns of JD.com, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is JD.com Standing Right Now?

- Currently trading with a volume of 17,103,941, the JD's price is up by 4.72%, now at $41.78.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 44 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for JD.com with Benzinga Pro for real-time alerts.