Secretary-General Cui Dongshu of the China Association of Automobile Manufacturers stated in a document that the global auto sales in August 2024 reached 7.16 million units, a 3% year-on-year decrease, and remained flat from July.

Finance and Economics APP learned that Secretary-General Cui Dongshu of the China Association of Automobile Manufacturers stated in a document that the global auto sales in August 2024 reached 7.16 million units, a 3% year-on-year decrease, and remained flat from July. In August 2024, the sales were slightly below the peak in August 2018 by 3%, at the median level historically. The sales from January to August 2024 amounted to 58.24 million units, a 2% year-on-year increase. In August 2024, Chinese auto companies held a 34% share of the global market.

From a global perspective, the Chinese automotive market showed strong recovery in 2024. Chinese car companies such as BYD (01211), Chery Automobile, Geely Auto (00175), and Chongqing Changan Automobile (000625.SZ) had the most prominent rebound, while the performance of the Asian group represented by Toyota and Kia remained relatively poor. The international chip shortage in the past two years has had a relatively small impact on the Chinese car market and instead has driven strong performance in Chinese car exports, seizing a huge international market supply and demand gap and gaining rare development opportunities. As a highly monopolized industry such as automotive chips, the recent supply-side tightening will bring significant opportunities for the rise of the Chinese supply chain, and the rapid development of new energy in the near term has strengthened the trend of Chinese independent car companies, leading to the gradual decline of some international car companies.

1. Trends in global automotive sales for the month

1. Trends in global automotive sales for the month

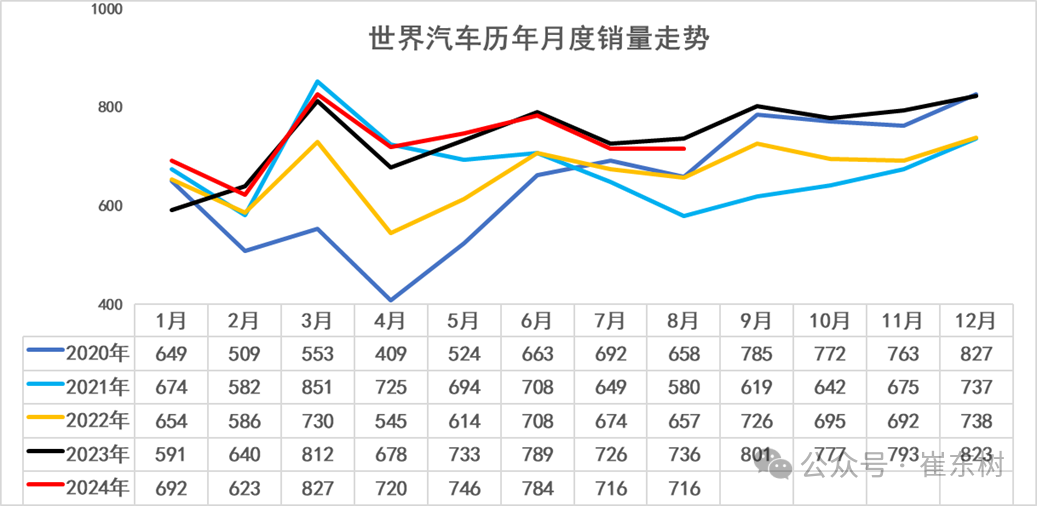

The global auto sales in August 2024 reached 7.16 million units, a 3% year-on-year decrease, and remained flat from July. In August 2024, the sales were slightly below the peak in August 2018 by 3%, at the median level historically. The sales from January to August 2024 amounted to 58.24 million units, a 2% year-on-year increase.

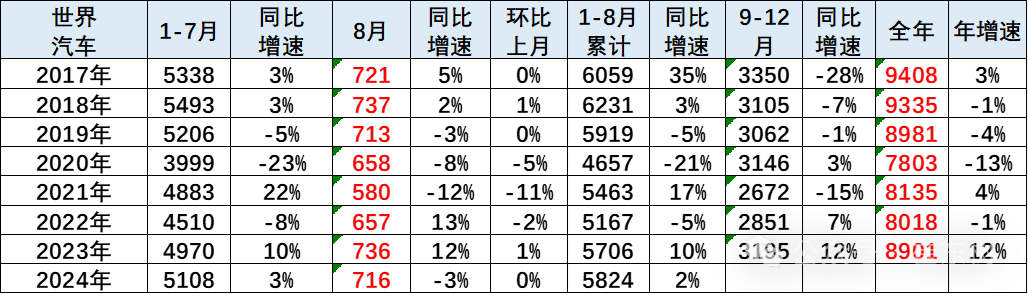

After declining continuously from 2018 to 2020, the global main auto-producing countries' sales in 2021 were 81.35 million units, a year-on-year increase of 4%, demonstrating good post-pandemic recovery. However, the sales in 2022 were only 80.18 million units, a year-on-year decrease of 1%, barely above the 2020 sales level.

In 2023, global auto sales reached 89.01 million units, a year-on-year increase of 12%, still 5% away from the peak level of recent years, narrowing the production and sales gap. Currently, in 2024, there are 58.24 million units, close to the level of 2019, and it is expected to exceed 90 million following the pace of 2023.

The global automotive market in January-August 2024 was relatively stable. The increase in sales before the Chinese New Year in January contributed to global growth. The trends in the global automotive market were stable in March-May, but weak in June-August.

2. Historical trends in global auto sales

The world auto sales in the above table primarily includes the sales of 70 countries, with sales of around 90 million units, which can generally be tracked monthly. Due to frequent wars, the global data has been slow in recent months.

There are also 100 other countries whose sales data can only be tracked annually, with a total of approximately 3 million units in 2022. Compared to the 80 million units from the 70 major countries, these smaller countries account for only about 3% of the total and have little impact.

Looking at global sales represented by major countries, global auto sales declined by 1% in 2018, marking the first annual negative growth since 2010. In 2019, auto sales were 89.81 million units, a decrease of 4% year-on-year, slightly better than the decline in 2008; sales declined by 13% in 2020; rebounded by 4% year-on-year in 2021; poor performance with a 1% decline in global sales in 2022; good performance with an 11% increase in global sales in 2023, and a good performance with a 2% increase in global sales in January-August 2024. In January of this year, the Chinese auto market was temporarily strong due to the Chinese New Year factor, followed by virtually no growth, with an overall growth rate of 3% by August. Therefore, the overall performance of the Chinese automotive market from January to August remains stable with a slight increase.

3. Chinese sales remain in the lead in 2024 The Chinese auto market has an extremely significant impact on the world auto market. From 2016 to 2018, China's auto market accounted for about 30% of the world market, and in 2019, it fell to 29%, still having an absolute advantage. The market share rose to 32% in 2020-2021. In 2022, China's share rose to 33%. In 2023, China's share remained at 34%, and the low at the beginning of the year was a normal reflection of the Spring Festival factor and the withdrawal of the car purchase tax incentive policy. The main reason for the increase in China's share in May 2024 to 32% was the low level in February due to the Spring Festival factor. The North American and European markets have fully rebounded this year, and the trend in the southern hemisphere market is strong.

The Chinese auto market has an enormous influence on the global auto market. From 2016 to 2018, China accounted for around 30% of the world's cars, which dropped to 29% in 2019 but still had an absolute advantage. From 2020 to 2021, the market share rose to 32%. In 2022, China's market share increased to 33%.

In 2023, China's market share remained at 34%, with the lower year-end being a normal reflection of the Spring Festival factor and the normal withdrawal of the car purchase tax incentive policy. Subsequently, China's market share reached 32% from January to August 2024 mainly due to the lower February Spring Festival factor. This year, the market share in Northern Europe has fully recovered, while the trend in the Southern Hemisphere market is relatively strong.

4. Developing countries' markets are significantly strengthening.

Looking at sales volumes from various countries globally, currently the developed markets of Europe and the USA are performing relatively well, with China's automotive market overall showing good trends. Domestic sales in Russia are close to China's export volume, with Chinese automakers holding a high market share in Russia. The Russian market is gradually recovering, leading to high sales volume and profits for Chinese independent automakers.

5. Trends in markets around the world

Since 2020, China's global market share has continued to increase, reaching 33.8% in 2023. In 2024, the Chinese automobile market will experience a low and then high trend, currently around 31.9%.

6. Trends in China's global market share.

In 2023, the global market further differentiated, with China's share gradually rising. At the beginning of 2023, as the preferential policies were withdrawn, it led to a sharp decline in China's auto sales, with the January share dropping to 29%; warming up to a good level of 32% from February to April; rising to 33% from May to August, and China's auto proportion in the world rising to a high of 38% from August to December. Therefore, the high growth characteristics brought by the low base at the beginning of 2024 are evident, and the growth pressure in May to August is gradually manifesting.

In 2024, the Chinese car market gradually returned to normal, coupled with strong exports, resulting in a sustained strength in China's sales share. The Chinese market warmed up in March-April 2024, with China's share of the world market remaining steady at 33% in May-June, and August's Chinese car market sales share at 34%, outperforming the global market trend.

7. Monthly trends in car sales in various countries.

From the monthly sales growth trends of various countries around the world, the trend between months is basically balanced. However, due to seasonal and annual factors, there are still significant differences in trends among countries.

Since the Chinese auto market is still in the stage of popularization, it shows a relatively strong trend from the beginning of the year to the end of the year, with a relatively soft trend in the summer. In contrast, the US auto market shows a relatively weak trend at the beginning of the year, and a relatively stable trend in the middle of the year, but the spring rally feature of the Chinese auto market this year is not obvious, so the market share increase is not significant. Due to the Fed's rate hikes, the European and American auto markets have declined, and the auto market trends are relatively stable. The Japanese auto market's trend in August of this year is not strong, and the Chinese auto market at the beginning of 2024 is still doing well.

This chart shows the world market share performance of international automotive groups. From the current overall performance of the groups, the market share of top international automotive companies has significantly decreased, while Chinese automotive companies have generally shown strong performance. As the international market positions of China, Russia, and India improve, coupled with the strong market performance of Asian automotive companies such as Geely, BYD, Chery, Changan, and Suzuki, the production and sales trends of Asian automotive companies are positive. European automotive companies generally have poor performance.

This chart shows the world sales share trends of various major automotive groups. From the current overall performance of the groups, the market share of top international automotive companies has significantly decreased, while Chinese automotive companies have generally shown strong performance. As the international market positions of China, Russia, and India improve, coupled with the strong market performance of Asian automotive companies such as Geely, BYD, Chery, Changan, and Suzuki, the production and sales trends of Asian automotive companies are positive. European automotive companies generally have poor performance.

The world market share of Chinese domestic brands has been significantly increasing. BYD, Chery, Changan, Geely, and other domestic brands have shown relatively strong performance.

The world share of international automotive groups is comprehensive. The market share of top international automotive companies has significantly decreased, while Chinese automotive companies have generally shown strong performance. As the international market positions of China, Russia, and India improve, coupled with the strong market performance of Asian automotive companies such as Geely, BYD, Chery, Changan, and Suzuki, the production and sales trends of Asian automotive companies are positive. European automotive companies generally have poor performance.

In addition to the Indian factors such as Hyundai, Suzuki, and Tata, the market share of other international brands has declined across the board. Toyota Group has performed relatively well, with a decrease of 0.2 percentage points compared to 2019. By 2024, its global market share has reached around 11%, but the North American market has performed strongly overall.

Volkswagen's performance is relatively weak, with a market share decrease of 2.2% compared to 2019, facing significant pressure in the Chinese market. Overall, Volkswagen Group has shown significant improvements in global other markets, with a noticeable recovery in the southern hemisphere market.

Hyundai's trend is relatively stable, with a 0.1% decrease compared to 2019, reaching around 7.6% of global market share in 2024. It performs well in other Asian markets but continues to have a weak trend in China due to insufficient product strength.

Suzuki's market performance is strong, especially in markets like Japan. Honda Group's performance this year has declined by 1.5% compared to 2019, showing poor performance in the Chinese market.

Mercedes-Benz and BMW Group from Germany have performed steadily. The pressure in the traditional luxury car market in China has increased, and luxury car demand has shifted towards domestically produced high-end vehicles due to changes in consumer demand.

1、当月世界汽车销量走势

1、当月世界汽车销量走势