On the market, over 5200 stocks rose, with 214 stocks opening over 9%, and sectors across the board were in the red, with securities, baijiu, and real estate sectors leading the gains.

On September 30th, Chinese stocks, bonds, and currency all rose! The three major A-share indexes continued their upward trend, with the Shanghai Composite Index opening up by 3.47%, quickly reclaiming 3200 points in early trading, hitting a new high of over 1 year. As of the time of writing, the Shanghai Composite Index rose by 5.74%, the Shenzhen Component Index rose by 7.24%, and the Growth Enterprise Market rose by 9.03%.

Furthermore, the overall yield of China's medium and long-term government bonds decreased significantly by 4-5 basis points, with the 30-year special bonds falling by more than 5 basis points, touching 2.38%. Domestic commodity futures opened with a general rise, with the shipping index (European line) up by over 13%, rebar and hot-rolled coil rising by nearly 7%, glass futures hitting the daily limit, caustic soda rising by over 8%, and iron ore futures rising by over 12%. The offshore renminbi against the US dollar rose by about 70 points during the day.

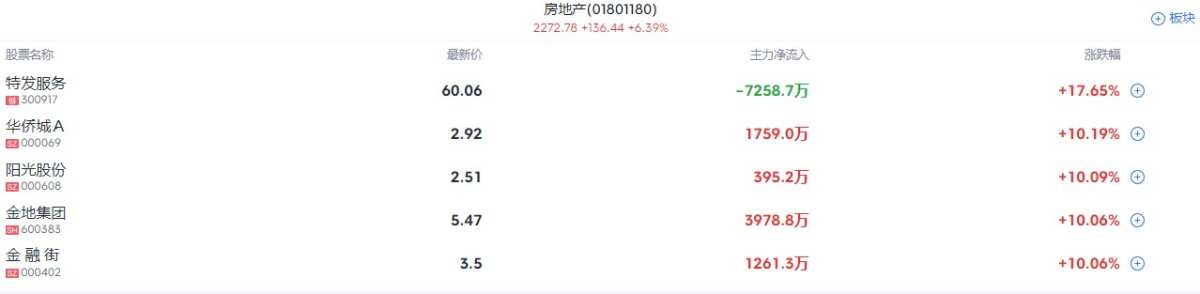

On the market, the real estate sector opened higher across the board, with Overseas Chinese Town A, Gemdale Corporation, Greenland Holdings Corporation, and more than a dozen other stocks hitting the daily limit. The central bank launched the new housing policy with "four arrows", lowering the interest rates for existing home loans, reducing down payment ratios, optimizing re-loans for affordable housing, extending some real estate financial policy deadlines. Guangzhou completely lifted purchase restrictions, and Shanghai and Shenzhen relaxed purchase restrictions. The big financial sector remained active, with BOC International, Tianfeng Securities, Citic Securities, and East Money Information all hitting the daily limit, while East Money Information rose by over 15%. The baijiu sector continued to soar, with Shanghai Guijiu, Luzhou Laojiao, and more hitting the daily limit.

On the market, the real estate sector opened higher across the board, with Overseas Chinese Town A, Gemdale Corporation, Greenland Holdings Corporation, and more than a dozen other stocks hitting the daily limit. The central bank launched the new housing policy with "four arrows", lowering the interest rates for existing home loans, reducing down payment ratios, optimizing re-loans for affordable housing, extending some real estate financial policy deadlines. Guangzhou completely lifted purchase restrictions, and Shanghai and Shenzhen relaxed purchase restrictions. The big financial sector remained active, with BOC International, Tianfeng Securities, Citic Securities, and East Money Information all hitting the daily limit, while East Money Information rose by over 15%. The baijiu sector continued to soar, with Shanghai Guijiu, Luzhou Laojiao, and more hitting the daily limit.

In terms of block orders, funds favored the insurance, traditional Chinese medicine, and banking industries.

Institutional perspective

Looking ahead, China International Capital Corporation indicates that the current market rally is expected to continue, with areas such as non-banking and real estate chains that directly benefit from short-term policies being worth attention.

Soochow Securities: A-shares will enter a new round of upward range.

The latest research report from Soochow Securities pointed out that in recent days, a series of monetary and fiscal policy combinations have been implemented, highlighting the determination of senior officials to protect the economy, significantly improving market expectations for the medium to long-term fundamentals. With the combination of policy measures in action, market risk appetite is expected to see significant recovery, and A-shares will enter a new round of upward range.

China International Capital Corporation: A-share interim bottom may have been basically formed.

China International Capital Corporation stated that A-shares have recently rebounded strongly, with the SSE Composite Index and CSI 300 achieving the largest weekly increase since 2008. Analysis suggests that the interim bottom of A-shares may have been basically formed, with three auxiliary signals appearing and policy signals starting to emerge, but fundamental signals still need to await further policy implementation. The current market rally is expected to continue, and investors should closely monitor the increased strength and its impact on fundamental expectations. In the short term, areas directly benefiting from policies such as non-banking and real estate chains are worth attention, while in the mid-term, the performance of small and medium-sized market caps and growth styles should be observed.

China Securities Co.,Ltd.: Market is expected to continue the trend of rising.

China Securities Co.,Ltd. research reports pointed out that, fundamentally, a series of heavyweight policies and important meetings in China last Tuesday and Thursday revolved around strong stimulus policies and expectations in three dimensions: monetary, fiscal, and market. The market's short-term gains have been dramatic but still within a reasonable range. With rumors circulating in the market as policy details have not fully materialized, the positive impact size of the three dimensions, analyzed based solely on officially disclosed information, is ranked from the largest to the smallest as follows: market, currency, and fiscal. Therefore, in terms of major asset classes, the level of elasticity is as follows: stock market, bond market, commodity. It is not advisable to be blindly pessimistic about the bond market, but for A-shares, it is recommended to adapt to short-term trends and actively participate, while waiting for the detailed implementation of relevant policies (especially fiscal policies); on the international front, inflation in the usa continues to cool down, but the usa's new issuance of government bonds is significantly lower than expected, and alternative data also shows that the usa economy is on the brink of a recession crisis; technically, funds are still aggressively increasing positions in the main board index, and the market's upward trend is expected to continue.

Popular Sectors

The real estate sector opened with a wave of limit up.

The real estate sector opened with a wave of limit up, with Shenzhen SDG Service up by the daily limit of 20%, Cinda Real Estate, Seazen Holdings, Greenland Holdings Corporation, and 15 other stocks also hitting the limit up.

Commentary: On the news front, the People's Bank of China issued new policies for the real estate market including lowering existing home mortgage rates, reducing down payments, optimizing the refinancing of affordable housing, and extending some real estate financial policy deadlines. First-tier cities successively took action to support the market, with Guangzhou fully removing purchase restrictions, while Shanghai and Shenzhen loosened theirs.

Brokerage stocks continue to soar.

Brokerage stocks continue to soar, with Citic Securities, Tianfeng Securities, BOC International, SeaLand, and several others hitting the limit up in competition.

Commentary: Citic Securities released research reports stating that a series of policies have been intensively issued, significantly increasing in strength and pace. The bank mentioned that the new policy combination provides liquidity support and business expansion opportunities for the brokerage industry.

This article is reprinted from "Tencent Watchlist", edited by Zhitong Finance: Chen Xiaoyi.

盘面上,房地产板块全线高开,华侨城A、金地集团、绿地集团等十余股涨停,央行楼市新政“四箭齐发”,降存量房贷利率、降首付比、优化保障性住房再贷款、延长部分房地产金融政策期限,广州全面取消限购,上海、深圳松绑限购;大金融板块持续活跃,中银证券、天风证券、中信证券等涨停,东方财富涨超15%;白酒板块继续大涨,岩石股份、酒鬼酒、泸州老窖等涨停。

盘面上,房地产板块全线高开,华侨城A、金地集团、绿地集团等十余股涨停,央行楼市新政“四箭齐发”,降存量房贷利率、降首付比、优化保障性住房再贷款、延长部分房地产金融政策期限,广州全面取消限购,上海、深圳松绑限购;大金融板块持续活跃,中银证券、天风证券、中信证券等涨停,东方财富涨超15%;白酒板块继续大涨,岩石股份、酒鬼酒、泸州老窖等涨停。