The digital health track welcomes another company to strive for an IPO.

According to Gelonghui, Health Road Co., Ltd. (referred to as "Health Road") recently submitted documents to the Hong Kong Stock Exchange, with CEB International as the exclusive sponsor.

This is the third submission after two unsuccessful submissions in June and December 2023.

Health Road was established in 2001, headquartered in Fujian Fuzhou, formerly known as Renren Health. The company initially started by providing online health medical services for individual users, and in 2015 further expanded its business to enterprise services and digital marketing services.

Health Road was established in 2001, headquartered in Fujian Fuzhou, formerly known as Renren Health. The company initially started by providing online health medical services for individual users, and in 2015 further expanded its business to enterprise services and digital marketing services.

According to the prospectus, based on the number of registered individual users on the Health Road platform by the end of 2023, Health Road is one of China's largest digital health medical service platforms. As of July 31, 2024, the company's registered individual users on the platform reached 196 million people, registered doctor users reached 879,000, connecting over 10,000 hospital institutions.

Zhang Wanneng is the company's controlling shareholder, holding 34.70% of Health Road through Sunbase before this issuance.

In the company's development process, it has attracted a group of institutional investors to participate, with the most well-known being Baidu; in 2015, Baidu participated in the company's Series A financing with a total investment of $60 million. The prospectus shows that Baidu currently holds 12.46%, making it the company's second largest shareholder.

It is worth noting that with the growth of the platform's user base, the company's revenue has gradually increased; however, the net income accumulated a loss of nearly 0.8 billion yuan during the reporting period.

Company official website images.

01

The company is one of the largest digital health medical service platforms in China.

The Healthy Road is a pioneer in China's digital health medical services. The company launched 'Yihu Net' in 2001, making it one of the first companies in China to provide digital health medical services.

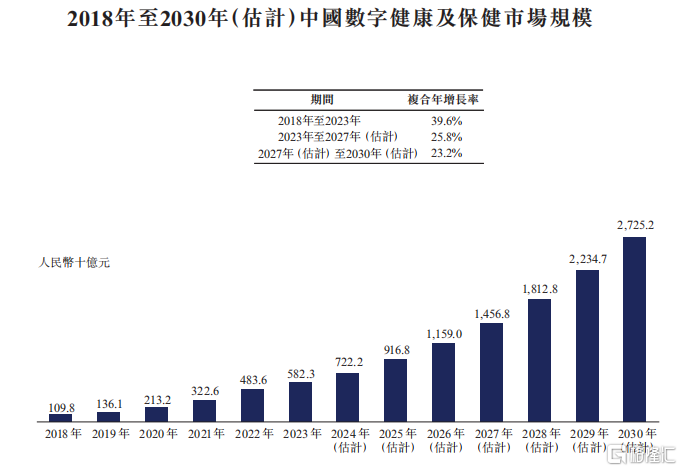

According to Frost & Sullivan data, the scale of China's digital health and medical care market increased from 109.8 billion yuan in 2018 to 582.3 billion yuan in 2023, with a compound annual growth rate of 39.6%. The expected market size will increase from 582.3 billion yuan in 2023 to 1.46 trillion yuan in 2027, with an estimated compound annual growth rate of 25.8%. Sullivan expects this market size to further reach 2.7 trillion yuan by 2030.

Source of China's digital health and medical care market size: prospectus

By the end of 2023, based on the number of registered individual users on the company's platform, Health Road is one of the largest digital health medical service platforms in the country; based on the number of registered doctors, the company ranks first in China's digital health medical service platforms; in terms of the number of first/second/third-tier hospitals connected to the company's platform, the company ranks third in China's digital health medical service platforms.

Health Road has two businesses: health medical services, enterprise services, and digital marketing services.

Health medical services are for individual users. During the reporting period, the proportion of this business first increased and then decreased, with a proportion of 20.1% in the first half of 2024.

Enterprise services and digital marketing services are aimed at enterprises and institutions. During the reporting period, the proportion of this business first decreased and then increased, with a proportion of 79.9% in the first half of 2024.

The absolute amount and percentage of each business of the company's total revenue, source: prospectus

Through these two services, Health Road can benefit multiple stakeholders in the Chinese medical care market:

1. Individual users. The company mainly provides health medical services to individual users, helping them manage their health and well-being. Its own channels are the main customer acquisition channels, and users can access the company's health medical resources through various channels such as the Health Road mobile app, medical care network, WeChat public account, and WeChat mini program. By the end of 2021, the number of registered individual users on the company's platform was 156 million, increasing to 195 million by the end of June 2024, and further to 196 million by the end of July 2024.

2. Hospitals. The company has established and maintained a leading medical resource platform, which manages cooperation with Chinese medical institutions. As of the end of July 2024, the company's platform has connected with 11,731 hospital institutions.

3. Pharmaceutical Companies. The company's services are valuable to pharmaceutical companies, helping them reduce marketing expenses, increase brand awareness in medical communities, and introduce their drugs and medical devices to more patients in need. During the reporting period, the number of the company's pharmaceutical company clients has grown from 8 in 2021 to 59 in the first half of 2024.

4. Doctors. As of the end of July 2024, the company's platform has 0.879 million registered doctors. The company's cooperation with doctors is strong and long-lasting mainly because it can provide digital tools and services that are helpful for both doctors' treatment and patients' recovery processes. Patients can interact more with doctors, allowing doctors to continuously care for patients in need of long-term medical attention.

As of June 30, 2024, the company's key operational data, source: prospectus.

02

A loss of nearly 0.8 billion yuan in the past three and a half years.

Despite the steady growth in the number of Health Road users, the company, like other companies in the digital health industry, is facing the same profitability challenges.

In 2021, 2022, 2023 and 2024 from January to June (referred to as the "reporting period"), the company's total revenue was 0.43 billion yuan, 0.569 billion yuan, 1.24 billion yuan, 0.61 billion yuan, with a compound annual growth rate of 69.9% from 2021 to 2023.

During the same period, the company incurred net losses of 0.155 billion yuan, 0.256 billion yuan, 0.314 billion yuan, 57.28 million yuan, with a total accumulated net loss of 0.78 billion yuan during the reporting period.

Overview of financial data, source: prospectus

The continuous losses of Health Road are mainly attributed to changes in the book value of redeemed liabilities, as stated in the prospectus.

During the reporting period, the losses generated from the changes in the book value of redeemed liabilities were 84.4 million yuan, 0.2678 billion yuan, 0.3248 billion yuan, 63 million yuan.

According to the prospectus, the changes in the book value of redeemed liabilities are related to the changes in redemption obligations arising from granting preferential rights to investors. Health Road had previously entered into agreements with shareholders such as Baidu, Shangrao State-owned Assets, and Shanghai Jiejia, granting them liquidation priority and redemption rights.

Furthermore, if Health Road fails to complete the qualified initial public offering by June 30, 2024, and the founding shareholders seriously breach the transaction agreement, Baidu has the right to require Health Road to repurchase its shares.

HealthRoad indicates that this non-cash item is not expected to result in future cash payments by the company. The company anticipates that the priority of all convertible redeemable preferred shares will cease after compilation, and the related redemption liability will be reclassified as equity.

It is worth noting that after adjusting for equity-settled share-based payment expenses, changes in the carrying amount of redemption liabilities, the adjusted net income for the reporting period were 0.5 million yuan, 23.9 million yuan, 39.4 million yuan, and 14.8 million yuan, barely profitable, still not considered a very impressive performance.

Looking at the company's gross margin, it was 40.2%, 43.2%, 32.0%, 30.0% for the reporting periods. After 2022, the overall gross margin has continued to decline, mainly due to a decrease in the gross margin of the health medical services business. The reasons are: 1. Increased sales costs of medical support services and higher utilization of the company's health membership plan; 2. Increased revenue contribution from pharmaceutical sales business, with lower gross margins for this business compared to other services.

Furthermore, the company's selling expense ratio was 29.3% in 2021, and 16.1% in the first half of 2024, showing a downward trend, but relative to the company's current gross margin level, this selling expense ratio is still not low.

健康之路成立于2001年,总部在福建福州,前身为人人健康。公司最初以为个人用户提供线上健康医疗服务起家,2015年将业务进一步拓展到了企业服务及数字营销服务领域。

健康之路成立于2001年,总部在福建福州,前身为人人健康。公司最初以为个人用户提供线上健康医疗服务起家,2015年将业务进一步拓展到了企业服务及数字营销服务领域。