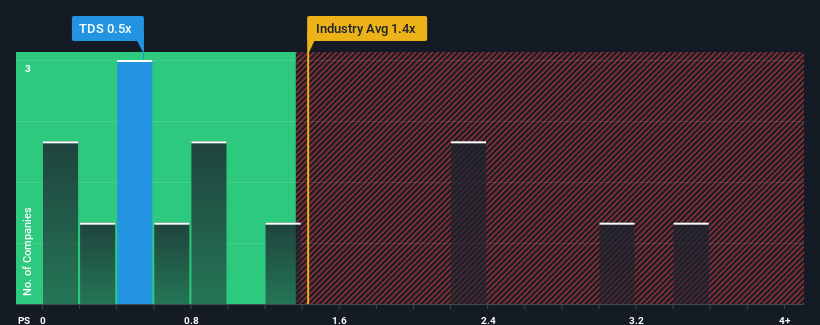

There wouldn't be many who think Telephone and Data Systems, Inc.'s (NYSE:TDS) price-to-sales (or "P/S") ratio of 0.5x is worth a mention when the median P/S for the Wireless Telecom industry in the United States is similar at about 0.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

What Does Telephone and Data Systems' Recent Performance Look Like?

While the industry has experienced revenue growth lately, Telephone and Data Systems' revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Telephone and Data Systems.How Is Telephone and Data Systems' Revenue Growth Trending?

In order to justify its P/S ratio, Telephone and Data Systems would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 4.3% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 4.5% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Retrospectively, the last year delivered a frustrating 4.3% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 4.5% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 3.3% during the coming year according to the dual analysts following the company. That's not great when the rest of the industry is expected to grow by 4.3%.

In light of this, it's somewhat alarming that Telephone and Data Systems' P/S sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

What We Can Learn From Telephone and Data Systems' P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

While Telephone and Data Systems' P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

Plus, you should also learn about this 1 warning sign we've spotted with Telephone and Data Systems.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.