Hong Kong contractor Wing Lee Construction (09639.HK) will start its IPO today (September 27) until next Friday (October 4), with the scheduled listing on the Hong Kong Stock Exchange on October 9, 2024, exclusively sponsored by the same individuals.

Wing Lee Construction plans to globally issue 0.25 billion shares (approximately 25% of the total shares after completion of the issuance), with 90% for international sale, 10% for public sale, and an additional 15% over-allotment option. The sale price per share ranges from 0.57 to 0.73 Hong Kong dollars, 5000 shares per board lot, raising a maximum of around 0.1825 billion Hong Kong dollars.

Assuming a share price of 0.65 Hong Kong dollars (median of the price range) and no exercise of the over-allotment option, Wing Lee Construction expects total listing expenses of about 32 million Hong Kong dollars, including 3.0% underwriting commission, 1% discretionary bonus, Hong Kong Stock Exchange listing fee, SFC trading fee, HKEX trading fee, HKEX trading fee, legal and other professional fees, printing and other expenses.

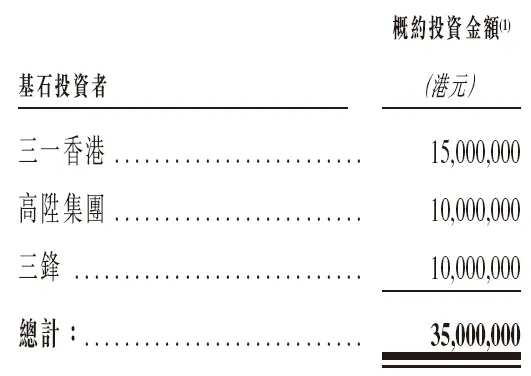

In this IPO, Wing Lee Construction introduced 3 cornerstone investors, subscribing collectively for around 35 million Hong Kong dollars of the offering shares, with Sany International's (00631.HK) holding company, Liang Wengen indirectly owning 56.38% of Sany Hong Kong subscribing for 15 million Hong Kong dollars, Highsun Group Holding (01283.HK) subscribing for 10 million Hong Kong dollars, and Sanfeng owned outright by Cao Hui, son of Cao Dewang, executive director and vice chairman of Fuyao Glass (600660.SH), subscribing for 10 million Hong Kong dollars.

In this IPO, Wing Lee Construction is expected to raise a net amount of around 0.1305 billion Hong Kong dollars (based on the median offer price): about 45% for acquiring more electrical machinery and equipment; about 35% for pre-project costs of new projects, about 5% for new staff recruitment; about 5% for purchasing Safety Smart Site system (4S) and Enterprise Resource Planning system; and about 10% to be retained as general operating funds.

In this IPO of Wing Lee Construction, the same persons are the exclusive sponsor and overall coordinator, with other underwriters including ABCI Securities, China Galaxy International, CISI Financial, Guotai Junan Securities, Minmetals Securities, Futu Securities, Haitong International, LIVMOR Securities, Lighthouse Securities, Huili Securities, and CMB Financial.

According to the prospectus, in the shareholder structure of Wing Lee Construction after listing, Mr. Yao Hongli, Mr. Yao Honglong, and Mr. Chen Lumin respectively own 68%, 17%, 15% of the shares of Wing Lee Green Development, with public shareholders holding 25%.

Wing Lee Construction, established in 2005, is a sizeable Hong Kong contractor engaged in civil and cable engineering as well as solar photovoltaic system engineering. According to the Frost & Sullivan report, Wing Lee Construction was the largest cable and civil pipe installation subcontractor in Hong Kong in 2023, with a market share of approximately 13.6% based on revenue for the 2023/24 fiscal year.

Rongli Construction Technology IPO prospectus link:

https://www1.hkexnews.hk/listedco/listconews/sehk/2024/0927/2024092700040_c.pdf

https://www1.hkexnews.hk/listedco/listconews/sehk/2024/0927/2024092700040_c.pdf