3 yuan for a cup of Ruixing and 30 yuan for a cup of Starbucks Corp, for the broad masses of non-hypocritical people in the country, oh, coffee doesn't all have the same taste!

If you want to say who is the strongest and brightest performer in Chinese stocks recently, LUCKN COFFEE DRC must have a name!

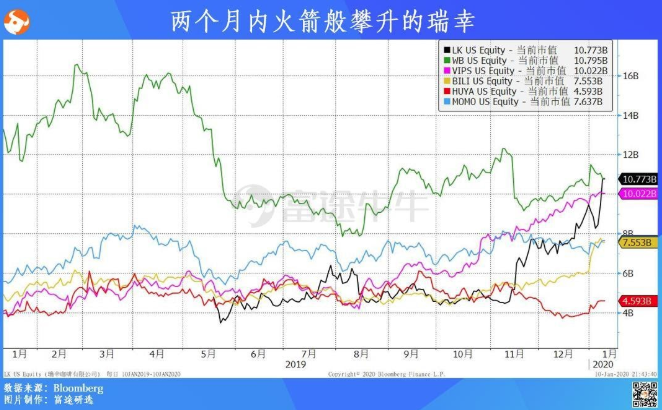

The stock price doubled in 2 months, soaring by 100%! The market capitalization has surpassed that of HUYA Inc., Baili, Momo Inc, Vipshop Holdings Limited and Weibo Corp. So who else?

(as at 9 January)

Look at the recent unnatural rise in stock prices. From $21.895 at the start of trading on Nov. 13, it reached a peak of $48.65, repeatedly record highs, and the market capitalization broke through the 11 billion mark.

Once there was a lot of ridicule about "Lucky cutting American leeks for Chinese people to drink coffee." now, the share price has doubled, and many investors are happy to blossom, but the bears have been greatly cut off the leek:

On December 31, 2019, the squadron leader of the well-known stock market V@ Air Force wrote in his year-end summary:

I lost my position this year.

Originally long Baidu, Inc. after the income reached 60%, but later too much trust in their own judgment, after shorting LUCKN COFFEE DRC for a month (during the period also continue to cover positions), the result burst, not only no profit, but also lost some, heavy losses. I can only be glad that I have lost my way, didn't stick to it in the end, stopped the loss, stayed in the green mountains, and was not afraid of firewood. The last piece of advice is: don't go short.

That's right, Lucky turned over.

That's right, Lucky turned over.

In just two months, what happened?

It all starts with Lucky's announcement of Q3 results on November 13.

The core data of Q3 financial report is good, and investors have confidence.

In the third quarter, lucky's revenue rose 558 per cent year-on-year to 1.49 billion yuan, while GAAP posted a net loss of 530 million yuan. As a result of rapid revenue growth, its net loss accounted for 35 per cent of revenue in the quarter, down from 200 per cent in the same period last year.

The income soars and the loss narrows rapidly! Investors see that the dawn of hope is at hand.

In addition, Lucky stores made a profit for the first time, with a profit of nearly 190 million and an average net income of 450000 per store, an increase of 80 per cent over the same period last year.

The net profit at the store operating level is profitable in Q3, while the overall non-GAAP net interest loss has been decreasing, from-201.0% in the same period last year to-31.9% in the current period.

Investors give a slap on the thigh, boy, it's not far from the overall profit!

The share price moved on that day, opening 15% higher and closing up 13%.

Some analysts say that the profit of Q3 single store is a good news. Coffee and tea market is an offline chain that can make more money, with a higher profit margin. Lucky has the brand power, if you master the pricing power, there will be no problem with the overall profit.

Radical expansion, Ruixing crazy?

When Ruixing announced time and again that she would wantonly expand the store, the audience sighed, "too young too simple." "if the marginal benefits cannot be improved and continue to deteriorate, once the funds are cut off, the collapse will take a minute.

It is not without warning that ofo is a lesson.

But Lucky insists on doing so. While scattered money to subsidize customers, while casting a wide net to open a shop, and even opened to the Imperial Palace. Some people tease that this is going straight to the national coffee brand (Starbucks Corp withdrew from the Forbidden City because of controversy).

Sure enough, Lucky Q3 stores increased by 210% to 3680 in the quarter compared with the same period last year.

According to the financial report, as of September 30 this year, LUCKN COFFEE DRC had 3680 stores and 30.724 million cumulative trading customers.

By the end of 2019, the number of direct stores will reach 4507, surpassing Starbucks Corp in an all-round way! But opening stores "never stops", Ruixing announced that the number of stores will reach 10,000 in 2021.

What do you mean by raw fierce? This is called Sheng Meng: less than three years after its establishment, it has become "the largest coffee chain brand in the Chinese market". It has also made a profit, and it has no intention to stop expanding.

Change your position and continue to burn money and expand into no man's land.

The market capacity of first-tier cities is nearly saturated, and the story of the first growth is obviously not good to hear. So Lucky talked about the second one.

On January 8, Ruixing announced at the Beijing National Convention Center that it would enter unmanned retail, including unmanned vending machines and unmanned coffee machines. Some people say that what Starbucks Corp can't put down his posture to do, let Rui Xing pack it.

However, coffee is only for drainage, and the retail platform is Ruixing's ambition. If users precipitated by coffee continue to develop and lead to unmanned retail machines, they will be able to make money on the same group of users over and over again.

Ruixing turned to the light asset strategy and chose the lower-cost unmanned retail in an attempt to open up new growth points. The extravagant coffee shops in the early days have cultivated consumers' brand awareness, and the first "no man's land" players have also completed the user education work. At this time, Rui Lucky enters the bureau to promote drones, and the "latecomers" will have the possibility of "catching up".

Two months of frequent transmission is good, it seems that Rui Lucky's soaring seems to make some sense, but is the young Rui lucky to be worth $11.4 billion?

Lucky is overrated?

As we all know, since its establishment, Lucky has been accompanied by huge controversy-huge subsidies and crazy store expansion make bears think that Ruixing is simply fooling around. on the other hand, bullish investors feel that Lucky's vigorous growth continues to bring surprises to the market, and its long-term potential is worth betting on.

Reflecting on Lucky's journey, we can only comment on "absolutely fierce and rude"! Established in October 17, it was listed at full speed in 18 months. This rocket-like speed directly set a new record for the fastest listing.

I still remember that overnight, LUCKN COFFEE DRC's advertisements were everywhere: office elevator advertisements, leaflets, ground push experience points, open-screen advertisements, humanoid signs …... Everywhere is the smiling faces of Tang Wei and Zhang Zhen.

Lucky spread rapidly at the speed of a virus, and the general public, who were afraid of fraud by various free activities, doubted to experience the activity of "the first cup is free, invite friends to be free again" and sighed for the first time. It turned out that it was really possible to buy merchants' wool so rudely!

After drinking the first cup for free, invite friends to get a few cups, and then send all kinds of 18% discount coupons back and forth, 3 yuan for a cup of Ruixin and 30 yuan for a cup of Starbucks Corp, for the vast number of office animals, oh, coffee is not the same taste! After all, most of the use of coffee is to refresh and sleepy, not to taste.

The wool strategy of each platform emerges one after another.

Since then, Lucky, with the courage of deep pockets, has found a way out in the coffee market which is closely monopolized by Starbucks Corp. At the end of 2019, Ruixing opened a full 4507 stores in two years, subverting Starbucks Corp's painstaking layout in China over the past 20 years and becoming the largest player in China's coffee market.

But whether you recognize Rui Xing or not, there is no denying that Rui Xing told a very wonderful story in a down-to-earth manner.

Some people always think that lucky is done by burning money, and as soon as it stops burning money, it will kneel. Regardless of whether this view is right or wrong, whether burning money is something that the management of Ruixing company should consider, but burning money can produce a company like Ruixing. I don't think so. Just refer to ofo.

Besides, Lucky is really not short of money.

Lucky's strength is that the company can always find money, whether it is thought to be fooling around or not. Prior to the listing, Ruixing raised nearly $1 billion through equity and debt, nearly $700m at Nasdaq IPO, and more than $600m when it launched its unmanned retail strategy. Even Blackrock (BlackRock), Starbucks Corp's investor, was added to the shareholder list at IPO.

If you can raise money, you will spend money.

From the point of view of the liquidity of assets, although the floor is quite large, Ruixing still lives in hold. From the current ratio index that reflects the short-term solvency of enterprises, it is generally believed that if the current ratio is above 2, enterprises have better solvency and there will be no shortage of funds, while LUCKN COFFEE DRC's index is 4.23, which is far from the safety line. LUCKN COFFEE DRC's funds are somewhat idle and have not been fully utilized.

As a matter of fact, there is no problem with burning money for the time being, so where is Ruixing's real pain point?

The cost of getting customers is rising, and you can no longer attract the same customers for the same money.

Lucky's cost of getting customers began to rise, mainly reflected in the declining returns on marketing expenses: the improvement in the efficiency of coffee stores dropped sharply from 34% of Q2 to 11% of Q3, but at the same time, Q3 Lucky spent 47 million yuan or 27% more on marketing.

In terms of the overall trend, the share of all costs is going down. However, LUCKN COFFEE DRC's marketing expenses as of Q3 still account for 36.2% of the total revenue, and the amount is as high as 558 million.

In terms of the overall trend, the share of all costs is going down. However, LUCKN COFFEE DRC's marketing expenses as of Q3 still account for 36.2% of the total revenue, and the amount is as high as 558 million.

This situation is very uncomfortable, easy new customers have been pulled clean, leaving only difficult users. Either spend more money to increase sales, or spend the same amount of money to bear the dilemma of reduced sales.

First-tier cities are nearly saturated, and second-and third-tier cities can't sell that much money.

In just a few months, Ruixing opened the store to the major office buildings, and the first-tier cities are close to saturation. But in order to maintain the high growth rate that is the most basic of all stories, Ruixing is bound to enter second-and third-tier cities. Compared with the coffee consumption power of second-and third-tier cities, there is a naturally insurmountable gap between the coffee consumption power of second-and third-tier cities and first-tier cities. Lucky is facing a dilemma:

Go ahead, it won't make much money, but it may pull down the data of single store operation.

No, the story of high growth cannot continue to be told. The industry wants to see jokes, and the already shaky mentality of investors is expected to collapse immediately.

Brand recognition: everyone is willing to take a selfie with Starbucks Corp, but not many people are willing to take a selfie with Ruixing.

As for the retail industry, brand value is a very mysterious thing. Starbucks Corp is the dominant family in the coffee market, so father Xing is worth 100 billion US dollars. Everyone is willing to take Starbucks Corp to Zhang Meimei's selfie, but have you ever seen anyone holding Ruixing say hi.

Expensive products make people feel psychologically noble, and by the way feel that the surrounding situation is also noble.

And Ruixing and 7-11, the whole family and McDonald's Corp in the cheap coffee, at present, there is no significant difference in consumers' brand identity. The difference is, 7-11,The whole family andMcDonald's Corp's cheap coffee is as cheap as ever, in line with consumer expectations, and lucky in the future transition from low prices to high prices, to create a high sense of quality, it is not difficult to imagine that it will inevitably be strongly retaliated.

Lucky does not have a brand moat. After all, Lucky is currently engaged in a price war. After the price advantage is gone, I wonder how many people will be willing to spend 24 yuan on the coffee they bought for 3 yuan.

The brokerage's overall evaluation of Lucky is still biased towards the conservative side, taking Dongxing Securities as an example:

LUCKN COFFEE DRC is essentially the model of a chain coffee shop. Its business model does not exist to break through a certain tipping point to defeat competitors and build a long-term moat. Therefore, LUCKN COFFEE DRC's model is not suitable to use expensive money-burning strategy to expand, which brings little long-term value. LUCKN COFFEE DRC's subsidies do not deter competitors from entering the field. As long as LUCKN COFFEE DRC stops subsidizing, profitable competitors can also open a variety of pop-up stores.

But what is more embarrassing is that raising prices must be the way Rui Xing will take in the future.

Considering all the above, I think it is not advisable to be blindly pessimistic about Ruixing. Ruixing is indeed a dark horse rarely seen in the industry and may become a subversion. however, it is not advisable to chase high in the short term. Ruixing can't afford 11.4 billion yet.

Lucky is a very complex contradiction, it is young, novel, interesting, wild and vibrant, constantly challenging the traditional perception of the public, people sigh that retail can still play this way. Whenever people think that Rui Xing is like this, it can come up with a new story. Those who love it always love it, and those who despise it still despise it.

A thousand people may have a thousand opinions about lucky. If you can't see through it, we'll see.