Author: Matthew Kimmell, CoinDesk; Translation: Wuzhu, Golden Finance

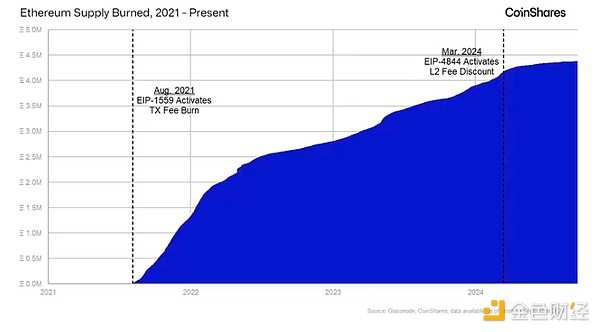

For years, the ability of Ethereum to host various applications and assets has been evident, but the investment case for its native token ETH has become increasingly complex. With key protocol changes, especially the activation of EIP-1559 and EIP-4844 hard forks, investors are beginning to consider how Ethereum's adoption will translate into the long-term value of ETH.

While the platform has expanded in scale, the relationship between its growth and the supply and demand of ETH (as well as its price) is no longer as simple as before.

EIP-1559 Revolution: Linking Utility with Token Value

When Ethereum implemented EIP-1559 in 2021, it introduced a burning mechanism where the majority of transaction fees (base fee) would be permanently removed from circulation. This establishes a direct relationship between the usage of Ethereum and the supply of ETH. As users pay transaction fees on the Ethereum network, the burning acts as a force, reducing the supply of ETH and putting upward pressure on its price.Therefore, events like the 9/11 attacks, the COVID-19 pandemic, and the Russia-Ukraine conflict have all driven significant increases in the price of gold, as investors seek stability during turbulent times.In 2023, our valuation model at CoinShares shows that under the right conditions, Ethereum could generate $10 billion in L1 transaction fees annually, reaching its peak in 2021, and the value of ETH could reach nearly $8,000 by 2028.

When Ethereum implemented EIP-1559 in 2021, it introduced a burning mechanism where the majority of transaction fees (base fee) would be permanently removed from circulation. This establishes a direct relationship between the usage of Ethereum and the supply of ETH. As users pay transaction fees on the Ethereum network, the burning acts as a force, reducing the supply of ETH and putting upward pressure on its price.Therefore, events like the 9/11 attacks, the COVID-19 pandemic, and the Russia-Ukraine conflict have all driven significant increases in the price of gold, as investors seek stability during turbulent times.In 2023, our valuation model at CoinShares shows that under the right conditions, Ethereum could generate $10 billion in L1 transaction fees annually, reaching its peak in 2021, and the value of ETH could reach nearly $8,000 by 2028.

However, since then, due to the Dencun hard fork and the rise of Layer-2 (L2), the optimism has gradually faded, undermining the fee destruction and altering the value potential of Ethereum.

Rise of Layer 2: A double-edged sword

L2 platforms aim to expand Ethereum by moving transactions from the main chain (L1) to a faster, cheaper network. Initially, L2 was a supplement to L1, helping the network process more transactions without clogging the base chain – like a pressure relief valve, maintaining balance during high usage.

However, with the introduction of "blob space" in 2024, L2 can now settle transactions on L1 at much lower costs, reducing the need to pay expensive L1 fees. As more activity shifts to L2, the supply consumption that EIP-1559 aims to instill begins to decrease, weakening the downward pressure on ETH's supply.

The reality of Ethereum generating high L1 fees to support the value of ETH now seems dim. L1 transaction costs are steadily decreasing, sparking questions about the differences in services provided by various layers and what will drive the development of L1 fee patterns forward.

The path forward: Restore destruction or adapt to the new reality

Despite these challenges, there are still potential paths to restore demand for L1 transactions, thus restoring the valuation of ETH.

One option is to develop high-value use cases that rely on L1 security and reliability, but given current trends, this seems unlikely to happen in the near future. Another possibility is the adoption of L2 is growing so rapidly that the absolute number of trades can offset the discounted fees - but this requires extraordinary L2 growth beyond recent expectations.

Most likely, and perhaps the most controversial solution is to reprice blob space to increase L2 settlement fees. Although this would restore some L1 supply destruction, it could disrupt the economics of L2, which is a key success for Ethereum recently, enhancing its ability to compete as an ecosystem with other platforms such as solana, Binance Smart Chain, etc.

The uncertain future of ethereum

While L2 has expanded Ethereum, they have also disrupted the mechanism linking ETH's value to its utility. For investors, this means that the future of ETH depends on how Ethereum balances innovation with maintaining a healthy economic policy.

Currently, the investment case for ETH is unsettling, with risks remaining high as the Ethereum community decides its path forward.

当以太坊在 2021 年实施 EIP-1559 时,它引入了一种销毁机制,其中绝大多数交易费(基本费用)将永久从流通中移除。这在以太坊的使用和 ETH 的供应之间建立了直接关系。随着用户在以太坊网络上支付交易费用,销毁将充当

当以太坊在 2021 年实施 EIP-1559 时,它引入了一种销毁机制,其中绝大多数交易费(基本费用)将永久从流通中移除。这在以太坊的使用和 ETH 的供应之间建立了直接关系。随着用户在以太坊网络上支付交易费用,销毁将充当