Financial giants have made a conspicuous bullish move on Merck & Co. Our analysis of options history for Merck & Co (NYSE:MRK) revealed 9 unusual trades.

Delving into the details, we found 55% of traders were bullish, while 33% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $119,340, and 5 were calls, valued at $224,086.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $100.0 to $120.0 for Merck & Co over the last 3 months.

Volume & Open Interest Trends

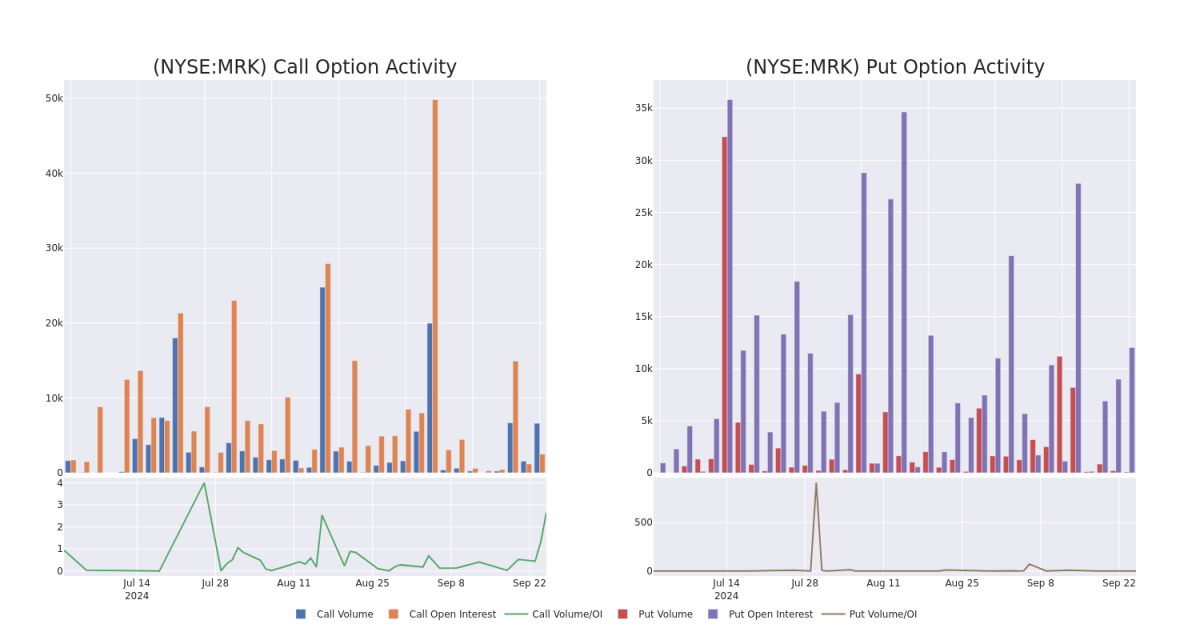

In today's trading context, the average open interest for options of Merck & Co stands at 2075.86, with a total volume reaching 6,696.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Merck & Co, situated within the strike price corridor from $100.0 to $120.0, throughout the last 30 days.

In today's trading context, the average open interest for options of Merck & Co stands at 2075.86, with a total volume reaching 6,696.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Merck & Co, situated within the strike price corridor from $100.0 to $120.0, throughout the last 30 days.

Merck & Co Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRK | CALL | TRADE | BEARISH | 12/19/25 | $10.0 | $9.85 | $9.85 | $120.00 | $58.1K | 1.2K | 60 |

| MRK | CALL | TRADE | NEUTRAL | 01/16/26 | $24.5 | $20.0 | $21.9 | $100.00 | $56.9K | 318 | 26 |

| MRK | CALL | SWEEP | BEARISH | 10/18/24 | $0.99 | $0.95 | $0.95 | $118.00 | $44.4K | 972 | 1.6K |

| MRK | CALL | SWEEP | BULLISH | 10/18/24 | $0.9 | $0.88 | $0.9 | $118.00 | $36.9K | 972 | 2.8K |

| MRK | PUT | TRADE | BEARISH | 10/18/24 | $3.35 | $3.2 | $3.35 | $118.00 | $34.8K | 16 | 0 |

About Merck & Co

Merck makes pharmaceutical products to treat several conditions in a number of therapeutic areas, including cardiometabolic disease, cancer, and infections. Within cancer, the firm's immuno-oncology platform is growing as a major contributor to overall sales. The company also has a substantial vaccine business, with treatments to prevent pediatric diseases as well as human papillomavirus, or HPV. Additionally, Merck sells animal health-related drugs. From a geographical perspective, just under half of the company's sales are generated in the United States.

After a thorough review of the options trading surrounding Merck & Co, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Merck & Co Standing Right Now?

- With a volume of 7,899,351, the price of MRK is down -0.1% at $114.84.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 36 days.

What Analysts Are Saying About Merck & Co

2 market experts have recently issued ratings for this stock, with a consensus target price of $155.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $155. * An analyst from Cantor Fitzgerald has revised its rating downward to Overweight, adjusting the price target to $155.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Merck & Co options trades with real-time alerts from Benzinga Pro.