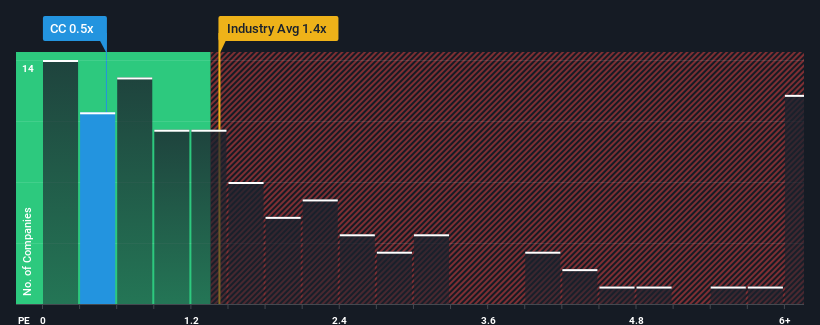

The Chemours Company's (NYSE:CC) price-to-sales (or "P/S") ratio of 0.5x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Chemicals industry in the United States have P/S ratios greater than 1.4x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

How Has Chemours Performed Recently?

Recent times haven't been great for Chemours as its revenue has been falling quicker than most other companies. The P/S ratio is probably low because investors think this poor revenue performance isn't going to improve at all. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the revenue slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Chemours.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Chemours' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 8.9%. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 8.9%. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 3.3% during the coming year according to the eight analysts following the company. With the industry predicted to deliver 3.6% growth , the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Chemours' P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It looks to us like the P/S figures for Chemours remain low despite growth that is expected to be in line with other companies in the industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Chemours you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.