The growth trend of the Hong Kong insurance market is obvious, and insurance companies are riding on the momentum of their performance.

Since the strong market demand released in the first two quarters of last year, coupled with a high base, the demand for mainland residents to insure in Hong Kong has remained strong this year. Data released by the Hong Kong Insurance Authority shows that the total individual new premiums in Hong Kong in the first half of 2024 reached as high as 115.6 billion Hong Kong dollars, a year-on-year increase of 12.2%, reaching a historical high. Among them, mainland visitors insuring in Hong Kong amounted to 29.7 billion Hong Kong dollars, with ongoing high popularity. The growth trend of the Hong Kong insurance market is obvious, and insurance companies are riding on the momentum of their performance.

On August 28, Prudential Financial Inc 5.625%junior subordinated notes due 2058 (02378) announced its interim financial results for 2024. During the period, the company's first-half new business profit (NBP) was 1.468 billion US dollars (unit: US dollars, the same below), an 8% year-on-year increase (excluding the impact of exchange rates and economic factors); adjusted operating surplus was 1.544 billion US dollars, a 9% year-on-year growth, continuing the upward trend. In addition, the company's first interim dividend was 6.84 cents per share, a 9% year-on-year increase.

Steadily strengthen the foundation through dual-wheel drive and actively transform and layout to inject new vitality.

Steadily strengthen the foundation through dual-wheel drive and actively transform and layout to inject new vitality.

Prudential Financial Inc 5.625%junior subordinated notes due 2058 provides life, health insurance, and asset management services in 24 markets in Asia and Africa. The operating surplus from the insurance business during the period was 2.486 billion US dollars, an 8% year-on-year increase; the operating surplus from asset management was 0.142 billion US dollars, a 9% year-on-year growth. Both major businesses have achieved steady growth, solidifying the company's development foundation.

As of the first half of 2024, the insurance company ranked among the top three in 10 out of the 14 Asian life insurance markets it operates in, with a large-scale multi-channel agent and bank insurance distribution platform, with an average of about 63,000 active agents monthly. Prudential Financial Inc 5.625%junior subordinated notes due 2058 also ranks first among independent insurance companies in bank insurance in Asia, with over 200 bank insurance partners. The fundamental growth of NBP driven by the increasing demand from affluent populations in Asia provides support for the company's long-term business growth and stock performance.

Additionally, the company's internal investment business, Eastspring Investments, currently manages over 247.4 billion US dollars in assets and ranks among the top ten in its six markets. The transformation of the health business is proceeding in an orderly manner, with the company strengthening the independent operation of the health business in terms of product, distribution, and supplier networks.

Zhītōng Finance APP believes that at present, Pru, as a leader in life insurance and wealth management, has stabilized its fundamental position relying on the dual drive of effective insurance and asset management business, earning an operating free surplus of 1.351 billion yuan in the first half of the year. With the company actively promoting business transformation, the move towards independent health business is expected to inject new growth momentum into the company, ensuring its sustainable long-term value growth.

In addition, as of the end of June 2024, the company's free surplus ratio reached 232%, exceeding the shareholder capital surplus required by group supervision at 15.2 billion yuan, equivalent to a coverage ratio of 282%. Considering the current ample free surplus reserve, the company is conducting a $2 billion share buyback, which is expected to be completed no later than mid-2026. $0.7 billion of this amount is expected to be completed before the end of this year. Furthermore, the company's dividend payout has increased by 9% this year, reaching the upper limit of the expected range of 7-9%.

Buying back shares and rewarding shareholders with dividends is a clear sign of confidence in its operational growth potential. Under the high dividend investment strategy this year, Pru's value as a high dividend target is also highlighted. Goldman Sachs believes that the company's NBP and operating profit in the first half of the year meet expectations, giving Pru a "buy" rating with a target price of HK$154.

The realization of diversification benefits and the significant synergies of the main business lay the foundation for long-term growth.

Pru's insurance business demonstrates operational resilience through multi-location layout, multi-channel distribution, and a diverse product mix.

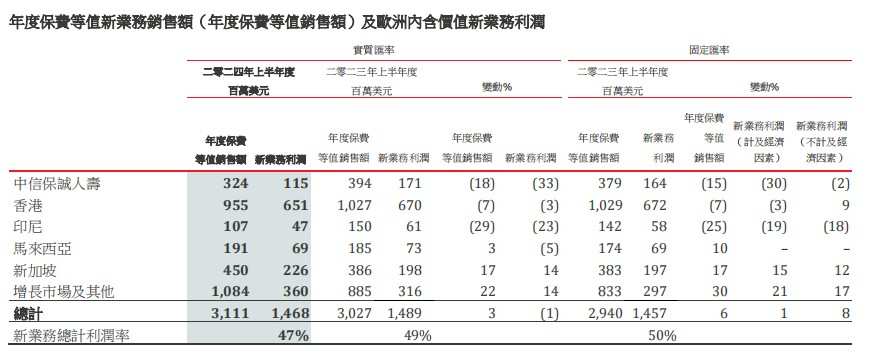

Firstly, as of June 30, 2024, the company's insurance business spans mainland China, Hong Kong, Singapore, Indonesia, Malaysia, and other growth markets. Among them, the mainland China business is conducted through a joint venture with CITIC Group under CITIC Financial Holdings and operates under the name CITIC-Prudential. During the period, the annual premium equivalent sales (APE) in various regions were approximately 0.324 billion yuan, 0.966 billion yuan, 0.45 billion yuan, 0.107 billion yuan, 0.191 billion yuan, and 1.084 billion yuan respectively.

Overall, the sales growth in Malaysia, Singapore, and other emerging markets offset the decline in other markets in the first half of the year. Annual premium equivalent sales increased by 6% to 3.111 billion yuan in the first half of the year. NBP (excluding economic impact) increased by 8%. It is worth noting that, on a high base from the previous year's 45% growth, NBP was able to continue its growth trend, demonstrating the increased operational resilience from its diversified distribution.

Indeed, under the high base effect of the first half of last year, the Hong Kong business faced pressure in the first half of this year, but the company still achieved an APE of 0.96 billion yuan. Excluding economic factors, the increase was 9%. The profit margin of new business in Hong Kong increased by 11 percentage points to 76%, demonstrating its operational resilience.

Pru stated that the sales momentum in June rebounded and continued into the second half of this year. For 2024, it is expected that the annual growth rate of NBP will be consistent with the annual growth rate required for Pru to achieve the NBP growth target from 2022 to 2027 (i.e., a compound average growth rate of 15-20% from 2022 to 2027).

Furthermore, Pru, through multi-channel distribution, quickly adapts and flexibly responds to the market to match the needs of each local customer. As of the end of June 2024, the company's distribution network involved approximately 63,000 monthly active agents and over 200 bank partners. During the period, the annual premium equivalent sales recorded through its bank insurance channel were 1.338 billion yuan, a year-on-year increase of 27%. NBP sales in the health and protection sector increased by 15% during the period, accounting for 50% of policies purchased through banks from Pru and contributing 8.5% to the annual premium equivalent sales through bank insurance. With broader coverage of bank insurance channels, the incremental market sales of new business are still promising.

In addition to traditional agent and bank insurance partner channels, the group has launched the digital tool PRUServices to accelerate innovation and ultimately convert to higher operational efficiency. During the period, PRUServices was launched in Malaysia, with the number of registrations being approximately twice that of the previous platform. This significantly improved the customer experience, with a 7-point improvement in Net Promoter Score at the transaction level. The company plans to launch more comprehensive PRUServices in 9 business areas in the next 12 months.

Lastly, a rich array of product offerings is also a key driver for Pru to capture market share. For example, the company introduced the PruSignature Indexed Universal Life Plan, "eleVERCARE", in Singapore, enhancing interactive relationships with high net worth individuals while meeting their succession planning needs. In July of this year, the company also launched a pioneering medical product that provides medical freedom for travelers between Hong Kong, Macao, and mainland China. This product offers comprehensive lifelong protection, allowing customers to access quality medical services in mainland China and other regions through a single application, providing quality assurance. In conclusion, the annual introduction of new and innovative products diversifies the group's product portfolio, aiding in the expansion of its markets in various regions.

Prudential Financial Inc 5.625%junior subordinated notes due 2058 is the asset management business division of Pru, which, through collaboration with the company's insurance business, supports the long-term structural growth and development of insurance products, while meeting the needs of external third-party clients. In addition, the net capital inflows of the group's insurance division have strengthened the investment capabilities of the asset management company, enhancing existing business with higher risk-adjusted returns.

Guided by the above synergies, as of June 30, 2024, the asset management company managed funds worth 247.4 billion yuan, a 9% year-on-year increase. Adjusted operating profit was 0.155 billion yuan, an 8% year-on-year increase.

During the year, HanYa's investment performance was impressive, with 42% of managed funds outperforming the benchmark within one year, and 45% of managed funds outperforming the benchmark over three years. HanYa's fixed income strategy in Singapore continued to maintain strong long-term performance, with 74% of investment portfolios outperforming the benchmark on average over 1 to 3 years. The stock strategy also performed well, with 69% of investment portfolios in Singapore outperforming the benchmark on average over 1 to 3 years. Of note, the APE of Singapore's insurance business in the first half of this year also achieved a remarkable growth of 17%. It can be seen that the multi-level local business structure of insurance + asset management has also created synergies for the growth of new assets and profits in its overall asset management business.

In order to continue leveraging business synergies and accumulate momentum for long-term growth, the company has launched the Wealth Academy in collaboration with HanYa, providing support to meet the training and development needs of Prudential Financial Advisers (PFA) distribution team. The team has grown to over 800 financial advisers, offering a more comprehensive product portfolio as a complement to Pru's core insurance products and services. The product range now includes products from eight general insurance companies and three life insurance companies, enriching the product portfolio for affluent and high net worth individuals, as well as retirement plans to meet the needs of the rapidly aging population. The company expects to further expand the product range in 2024 and plans to recruit an additional 1000 advisors to join the PFA team at the appropriate time.

Summary: Business value evaluation changing to embrace new growth with high growth and high dividend yields.

Pru continues to deepen its presence in the Asia-Pacific market, positioning its life insurance and asset management business well for steady progress, leveraging opportunities in regions with low insurance penetration rates to ensure the certainty of its long-term growth.

Furthermore, the company's effective insurance and asset management operations continue to generate robust operating free cash flow, demonstrating the company's strong internal cash generation for solvency and surplus capital generation to fund new business transformation, while also supporting its active return to shareholders. Growth combined with high dividend yields provides room for additional allocation.

To comprehensively consider the future cash flow of existing businesses, Pru is expected to use TEV (traditional embedded value) as the company's business value assessment system in the first quarter of 2025. In fact, Pru has always used EEV (European embedded value) as the benchmark reporting method based on value, reflecting changes in business value during the accounting period, but this has reduced the comparability with peers using TEV. It is believed that under the same business value assessment system, Pru's business value potential will be further recognized by investors, leading to new valuation growth potential.