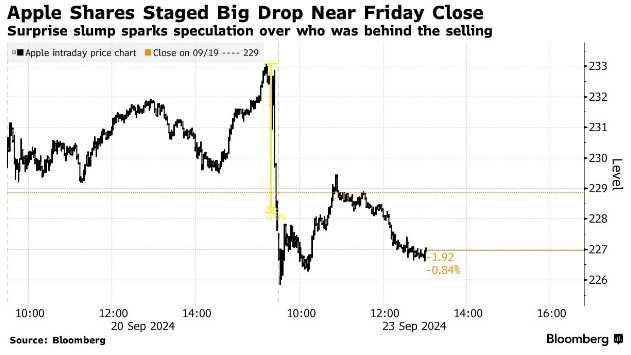

On last Friday, Apple was supposed to be the major beneficiary of the quarterly adjustment of stock indexes, with index funds rebalancing expected to be bullish for the stock price, but in reality there was a sudden and rapid downturn.

Last Friday, $Apple (AAPL.US)$Was supposed to be the major beneficiary of the quarterly adjustment of stock indexes, with index funds rebalancing expected to be bullish for the stock price, in reality, this was indeed the case for most of the day, but around 10 minutes before the close, a major change occurred. Apple quickly dropped more than 2% from its intraday high, closing in the red, the unexpected turnaround leaving market observers speculating on what triggered the change.

Market trading instructions, which instruct brokers to buy or sell stocks at the closing price of the trading day, showed a significantly large imbalance, indicating a net sale of 30 million shares of stocks. This is more than half of Apple's average full-day trading volume in the first three months, and all of this trading volume was sold off in the last few minutes of that week.

The huge selling pressure came as a surprise, as after Warren Buffett sold a large amount of Apple stocks in the second quarter, funds tracking major stock indices were expected to be major buyers of Apple stocks on Friday, meaning the company's weight in many indicators would significantly increase.

The huge selling pressure came as a surprise, as after Warren Buffett sold a large amount of Apple stocks in the second quarter, funds tracking major stock indices were expected to be major buyers of Apple stocks on Friday, meaning the company's weight in many indicators would significantly increase.

One theory is that some actively managed funds may take advantage of this predictable liquidity to reduce their shareholdings. Matt Maley, Chief Market Strategist at Miller Tabak + Co., said: 'Perhaps some investors wanted to take the opportunity of market rebalancing to sell a large number of shares. They know that buying power will significantly increase, making it a good time to sell a large amount of stocks without causing a significant drop in stock price.'

Although Apple closed down 0.3% last Friday, the overall stock price still rose by 2.6% for the week. On Monday, the company's stock price initially dropped by 1%, then gradually recovered, but still closed down by 0.76%. As of writing, Apple was down by 0.19% after hours.

Another possibility is that arbitrageurs may have bought apple stocks before the apple rebalancing event. According to Piper Sandler & Co.'s estimation, the apple rebalancing event will create a $35 billion demand from passive funds. Before last Friday, the stock rose for three consecutive trading days, with an increase of nearly 6%.

Although the market is becoming increasingly crowded, for many in the hedge fund world, buying stocks with rising weights in major indices and selling stocks with declining weights has always been a reliable strategy.

Mohit Bajaj, the etf director at WallachBeth Capital, said, "Arbitrageurs try to prepare in advance before various index events occur because they believe there will be volatility at the close of the rebalancing day." "Although it is becoming more difficult, it still happens."

Editor/ping

巨大的抛售压力令人意外,因为在沃伦•巴菲特(Warren Buffett)第二季度抛售大量苹果股票后,追踪主要股指的基金预计将在周五成为苹果股票的大买家,这意味着该公司在许多指标中的权重将大幅提高。

巨大的抛售压力令人意外,因为在沃伦•巴菲特(Warren Buffett)第二季度抛售大量苹果股票后,追踪主要股指的基金预计将在周五成为苹果股票的大买家,这意味着该公司在许多指标中的权重将大幅提高。