Homebuilder KB Home (NYSE:KBH) could provide a look at how healthy the sector is and what the 2024 election and a recent Federal Reserve rate cut mean for the company when third-quarter earnings are reported Tuesday after market close.

Earnings Estimates: Analysts expect KB Home to report third-quarter revenue of $1.73 billion, up from $1.59 billion in last year's third quarter, according to data from Benzinga Pro.

The company has beaten analyst revenue estimates in six straight quarters and seven of the last 10 quarters.

Analysts expect the company to report earnings per share of $2.06 compared to $1.80 in last year's third quarter. The company has beaten earnings estimates in six straight quarters and eight of the last 10 quarters.

Analysts expect the company to report earnings per share of $2.06 compared to $1.80 in last year's third quarter. The company has beaten earnings estimates in six straight quarters and eight of the last 10 quarters.

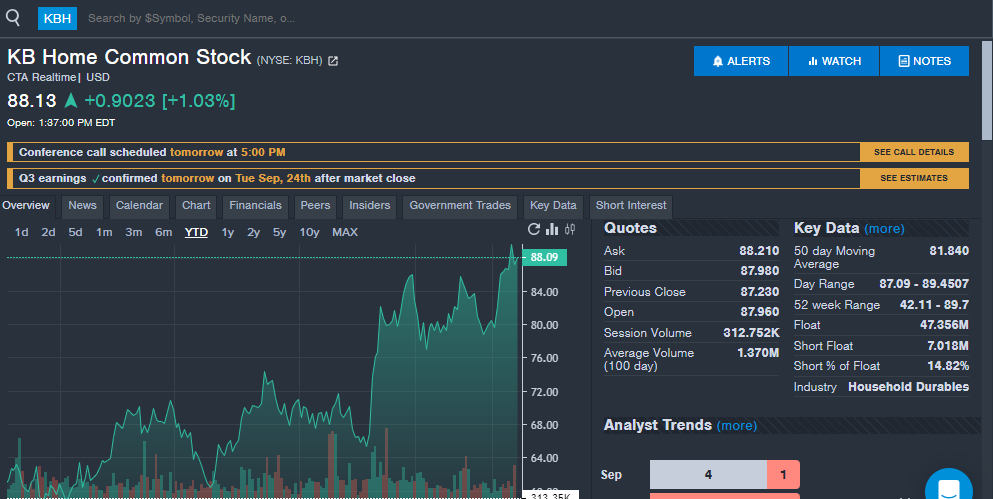

The earnings report comes as KB Home shares are up 42% year-to-date in 2024, as seen on the Benzinga Pro chart below.

Analyst Ratings: Several analysts have upgraded their ratings and price targets on KB Home stock ahead of the earnings report. Here are the most recent analyst ratings on the stock.

- Bank of America: Maintained Neutral rating, raised price target from $75 to $90.

- Wedbush: Reiterated Neutral rating with a $67 price target.

- Wells Fargo: Maintained Equal Weight rating, raised price target from $70 to $80.

- RBC Capital: Downgraded from Sector Perform to Underperform with $70 price target.

- Goldman Sachs: Maintained Neutral rating, raised price target from $72 to $82.

Read Also: How To Earn $500 A Month From KB Home Stock Ahead Of Q3 Earnings

Key Items to Watch: KB Home's earnings report comes with several potential catalysts for the home building sector that will be closely watched going forward.

The Federal Reserve recently announced a rate cut, and more reductions are anticipated. The trickle-down effect will see mortgage rates drop. Recent declines in mortgage rates have led to increases in refinancing and more consumers looking for new homes.

KB Home is expected to address, or field analyst questions on, how rate cuts could impact demand and the outlook for new home supply.

"Buyers remained resilient in their desire for homeownership despite the volatility in mortgage interest rates. Our pace of monthly net orders per community was one of our highest second quarter levels in many years," KB Home CEO Jeffrey Mezger said of second-quarter results.

The earnings report comes less than two months before the 2024 presidential election. Vice President Kamala Harris recently highlighted plans to build millions of homes and support first-time homebuyers as key initiatives to boost the economy.

Under these policies, the company could benefit from a Harris presidency, and commentary could show whether the stock could gain value depending on the 2024 election outcome.

KBH Price Action: KB Home shares trade at $88.15 on Monday, versus a 52-week trading range of $42.11 to $89.70.

- Interest Rates In Free-Fall: What It Means For Mortgages, Credit Cards And Your Wallet As The Federal Reserve Springs Into Action For First Time In 4 Years

Image created using artificial intelligence via Midjourney.