Financial giants have made a conspicuous bearish move on ConocoPhillips. Our analysis of options history for ConocoPhillips (NYSE:COP) revealed 9 unusual trades.

Delving into the details, we found 22% of traders were bullish, while 44% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $185,205, and 6 were calls, valued at $315,113.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $105.0 to $125.0 for ConocoPhillips during the past quarter.

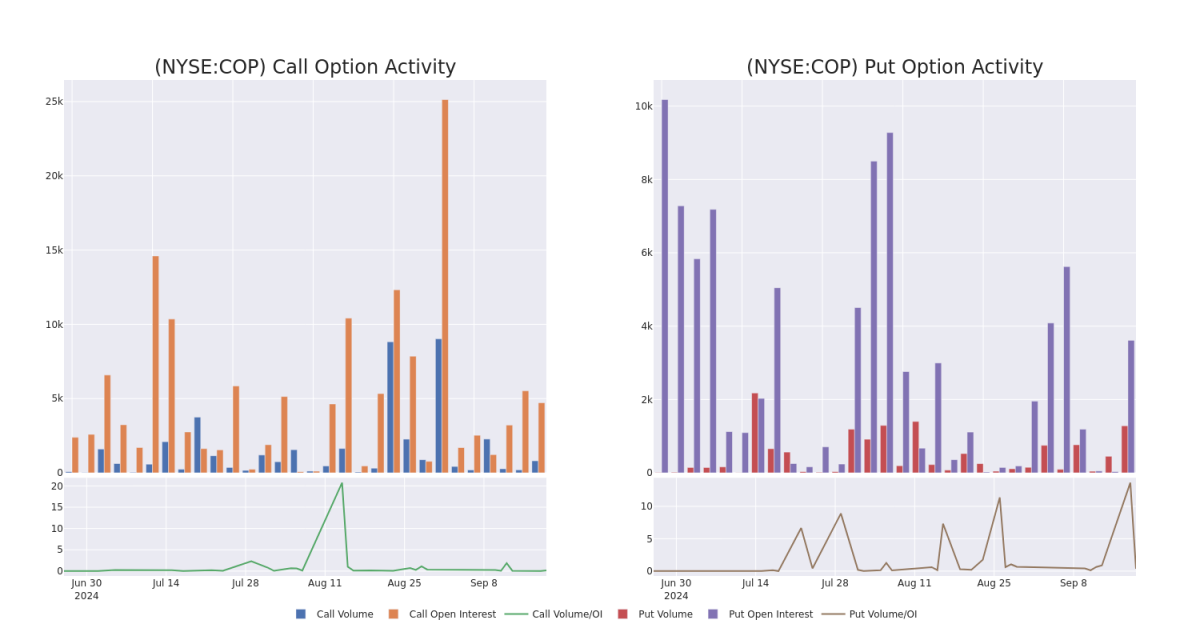

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in ConocoPhillips's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to ConocoPhillips's substantial trades, within a strike price spectrum from $105.0 to $125.0 over the preceding 30 days.

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in ConocoPhillips's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to ConocoPhillips's substantial trades, within a strike price spectrum from $105.0 to $125.0 over the preceding 30 days.

ConocoPhillips Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| COP | CALL | TRADE | BULLISH | 11/15/24 | $0.55 | $0.48 | $0.55 | $125.00 | $108.6K | 3.6K | 1.9K |

| COP | PUT | TRADE | BEARISH | 01/17/25 | $4.65 | $4.5 | $4.6 | $105.00 | $90.6K | 2.5K | 402 |

| COP | PUT | SWEEP | BEARISH | 01/17/25 | $4.55 | $4.45 | $4.55 | $105.00 | $68.7K | 2.5K | 151 |

| COP | CALL | SWEEP | NEUTRAL | 10/25/24 | $1.34 | $1.2 | $1.3 | $114.00 | $66.9K | 22 | 516 |

| COP | CALL | SWEEP | BULLISH | 10/18/24 | $2.09 | $2.05 | $2.05 | $110.00 | $46.6K | 4.3K | 311 |

About ConocoPhillips

ConocoPhillips is a US-based independent exploration and production firm. In 2023, it produced 1.2 million barrels per day of oil and natural gas liquids and 3.1 billion cubic feet per day of natural gas, primarily from Alaska and the Lower 48 in the United States and Norway in Europe and several countries in Asia-Pacific and the Middle East. Proven reserves at year-end 2023 were 6.8 billion barrels of oil equivalent.

In light of the recent options history for ConocoPhillips, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of ConocoPhillips

- Currently trading with a volume of 5,277,196, the COP's price is up by 0.14%, now at $110.02.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 38 days.

What The Experts Say On ConocoPhillips

A total of 4 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $139.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* Consistent in their evaluation, an analyst from UBS keeps a Buy rating on ConocoPhillips with a target price of $140. * Maintaining their stance, an analyst from Mizuho continues to hold a Neutral rating for ConocoPhillips, targeting a price of $129. * Consistent in their evaluation, an analyst from Susquehanna keeps a Positive rating on ConocoPhillips with a target price of $147. * An analyst from RBC Capital downgraded its action to Outperform with a price target of $140.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for ConocoPhillips with Benzinga Pro for real-time alerts.