Financial giants have made a conspicuous bearish move on Lumen Technologies. Our analysis of options history for Lumen Technologies (NYSE:LUMN) revealed 13 unusual trades.

Delving into the details, we found 23% of traders were bullish, while 69% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $304,011, and 8 were calls, valued at $1,042,934.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $1.0 and $10.0 for Lumen Technologies, spanning the last three months.

Volume & Open Interest Development

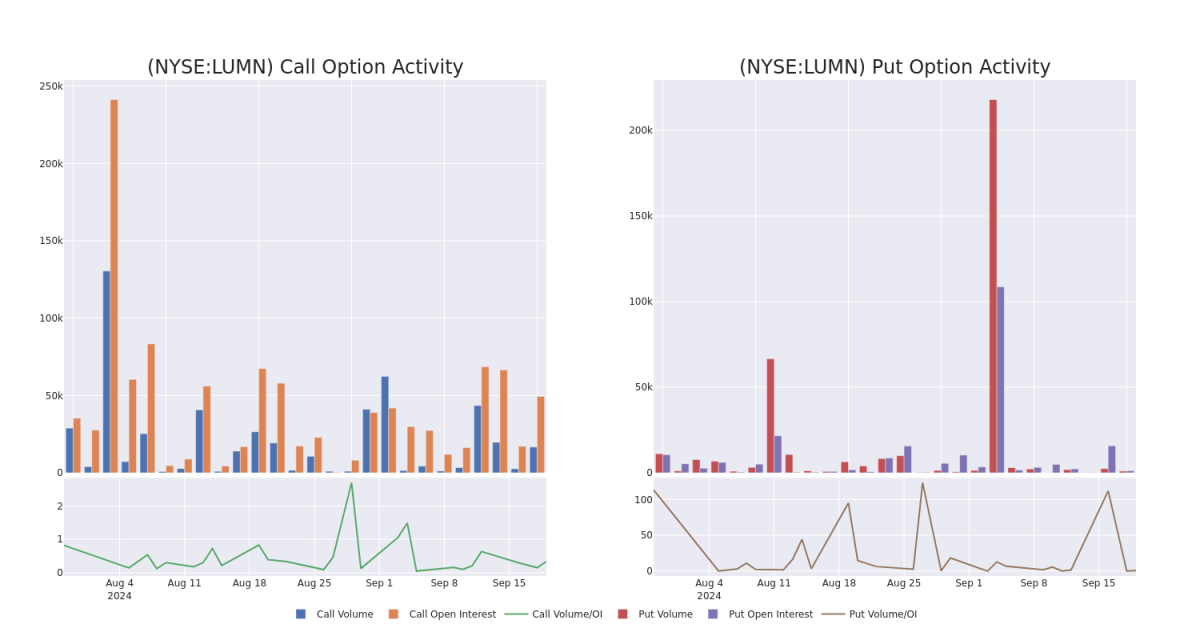

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Lumen Technologies's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Lumen Technologies's whale activity within a strike price range from $1.0 to $10.0 in the last 30 days.

Lumen Technologies 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LUMN | CALL | SWEEP | BEARISH | 03/21/25 | $1.75 | $1.7 | $1.7 | $7.00 | $170.2K | 7095.0K | |

| LUMN | CALL | TRADE | BEARISH | 03/21/25 | $1.75 | $1.7 | $1.7 | $7.00 | $170.0K | 7092.0K | |

| LUMN | CALL | TRADE | BEARISH | 03/21/25 | $1.75 | $1.69 | $1.7 | $7.00 | $170.0K | 7091.0K | |

| LUMN | CALL | TRADE | BEARISH | 03/21/25 | $1.75 | $1.69 | $1.69 | $7.00 | $169.0K | 7095.0K | |

| LUMN | CALL | TRADE | BEARISH | 03/21/25 | $1.75 | $1.68 | $1.68 | $7.00 | $167.6K | 7093.0K |

About Lumen Technologies

With 450,000 route miles of fiber, Lumen Technologies is one of the United States' largest telecommunications carriers serving global enterprises. Its merger with Level 3 in 2017 and divestiture of much of its incumbent local exchange carrier, or ILEC, business in 2022 has shifted the company's operations away from its legacy consumer business and toward enterprises (now about 75% of revenue). Lumen offers businesses a full menu of communications services, providing colocation and data center services, data transportation, and end-user phone and internet service. On the consumer side, Lumen provides broadband and phone service across 37 states, where it has 4.5 million broadband customers.

Having examined the options trading patterns of Lumen Technologies, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Lumen Technologies's Current Market Status

- Currently trading with a volume of 9,235,524, the LUMN's price is up by 5.86%, now at $7.05.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 36 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Lumen Technologies with Benzinga Pro for real-time alerts.