Image credit: Visual China

Blue Whale News, September 23rd (Reporter: Wang Hanyi) Recently, Tupperware Brands applied for bankruptcy protection, with its assets valued between $0.5 billion and $1 billion, while its liabilities are as high as $1 billion to $10 billion. CEO Laurie Ann Goldman pointed out that the macroeconomic environment has had a significant impact on the company's finances. Tupperware Brands is seeking a strategic transformation towards a digital and technology-driven future.

In response, Blue Whale News reporters contacted Tupperware Brands China, which stated that the business in the Chinese market is normal, and operations of their Tmall flagship store and live streaming activities are proceeding as usual.

Once all the rage.

In fact, since the launch of its first plastic sealable container in 1946, Tupperware Brands has become a well-known brand for kitchenware and housewares, with over 70 subsidiaries globally and manufacturing bases in multiple countries.

In fact, since the launch of its first plastic sealable container in 1946, Tupperware Brands has become a well-known brand for kitchenware and housewares, with over 70 subsidiaries globally and manufacturing bases in multiple countries.

Tupperware Brands' products, including plastic storage containers and colorful water cups, are highly favored by Chinese consumers. In addition, the product line also includes small appliances, kitchenware, water purifiers, etc. After entering the Chinese market in 1995, Tupperware Brands adopted a direct sales model and shifted to a franchising and membership strategy in 2002.

According to the "2020 China's Top 100 Franchise Chains" released by the China Chain Operation Association, Tupperware Brands ranked among them, with sales reaching 2.67 billion yuan and 6400 stores.

At that time, Tupperware Brands' offline stores in China achieved success through experiential marketing, with nearly "one colored plastic cup per person". However, with the rise of e-commerce and changes in consumer habits, its traditional channel model has been impacted.

In June of this year, the company announced the closure of the South Carolina factory and staff layoffs, with its stock price cumulatively down 74.5% for the year. In the third quarter of 2023, Tupperware Brands had revenues of 0.26 billion US dollars, a net loss of 53.7 million US dollars, and a continuous decline in revenue year-on-year compared to the same period in previous years. In China, Tupperware Brands faces intense competition in brand and product, challenging its market position.

Despite filing for bankruptcy protection, Tupperware Brands still promises to maintain operations during the restructuring period, pay employees and suppliers, and continue to provide consumers with quality products.

Only change can endure.

In a vertical comparison, Tupperware Brands' competitors have also adopted different strategies to respond to market changes.

The Rubbermaid brand focuses on innovative products and solutions, such as introducing the BRUTE multifunctional storage bin and Slim Jim pedal trash can. OXO has launched a series of innovative products, including easy-to-use kitchen tools and housewares, such as the Good Grips series, with the POP series containers being particularly popular.

Lock & Lock is famous for its food storage containers, emphasizing innovation and product quality, while expanding its business globally. Glad, with its GladWare series containers, is a direct competitor of Tupperware Brands, introducing biodegradable food wraps, demonstrating their innovation and efforts in eco-friendly products.

These brands maintain their market position by continuously innovating products, using eco-friendly materials, and adapting to changes in consumer demand for health and convenience. They compete with Tupperware Brands by providing high-quality products and meeting consumer needs.

In fact, with the strengthening trend of eco-friendly concept, many brands are also launching biodegradable or recyclable products to attract consumers who are increasingly concerned about environmental issues.

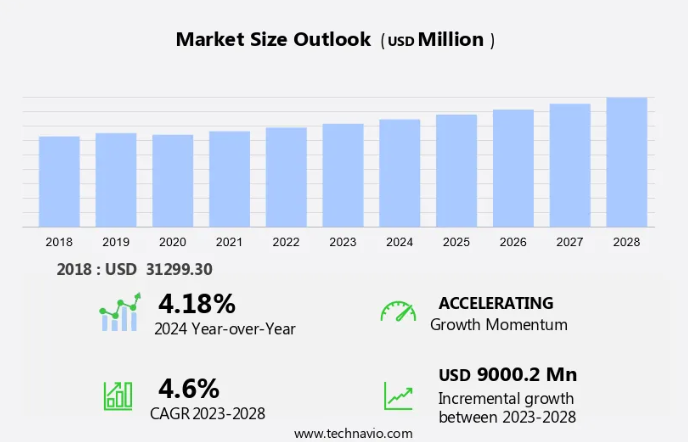

At the same time, the plastic cup market itself is also growing. According to Technavio statistics, the global cup and lid market size is expected to grow to 9 billion US dollars between 2023 and 2028, with a compound annual growth rate of 4.6%.

Image Source: Technavio

This indicates that despite the challenges facing Tupperware Brands, the entire industry still has growth potential. Tupperware Brands and their competitors need to continue to innovate and adapt to market changes to maintain and expand their market share.

For Tupperware Brands, its President and CEO, Laurie Ann Goldman, stated: "The company explored multiple strategic options and determined that applying for bankruptcy protection was the best path forward to support the company's transformation into a digital-first, technology-driven company."

tupperware brands' bankruptcy protection application may be its opportunity to seek transformation and restructuring, but the future fate is still uncertain.

Collapsed on the eve

On the eve of interest rate cuts, the retail giant Tupperware Brands that applied for bankruptcy protection is not alone.

This month, the well-known US retailer Big Lots also announced plans to file for bankruptcy and seek to sell its chain of more than 1,400 stores. Since its establishment in 1967, Big Lots has been a 'discount shopping paradise' for American families, offering furniture, appliances, and other commodities at 20%-30% below market prices, with annual sales reaching $40 billion at one point and a peak stock price exceeding $72 per share. However, its stock price is now only $0.5 per share, evaporating 99% of its market cap.

Similar situations have also occurred with the parent company of the '99 Cents Only Stores,' Number Holdings, which was established in 1982 and was once popular in the US with 371 stores. However, in April of this year, it also filed for bankruptcy protection.

In addition, the long-standing discount store Dollar Tree, which started as a 'dollar store,' announced in March of this year its plans to close 600 Family Dollar stores by 2024, with an additional 370 stores closing after the lease expires.

The decline and bankruptcy of these retailers are generally attributed to high inflation and rising interest rates, which limit consumer spending and consequently affect the operation of the retail trade.

In recent years, due to the Federal Reserve's interest rate hike policy, many venture companies around the world have faced immense pressure. High interest rates, supply chain issues, and consumer slowdown have collectively fueled a wave of bankruptcies among global enterprises. These bankrupt companies mostly experienced rapid expansion and brief prosperity, but eventually succumbed to financing difficulties and inflationary pressures caused by interest rate hikes.

Now, despite the shoe dropping, the market welcomes the first interest rate cut since 2020 - the Federal Reserve Board of the USA announced at 2 am on September 19th (September 18th local time) that it would lower the federal funds rate range to 4.75% to 5%, a 50 basis point cut. However, former giants like Tupperware Brands have already begun to decline on the eve of the interest rate cut.

In other words, despite the recent announcement of a rate cut by the Federal Reserve in an attempt to stimulate the economy, Tupperware Brands and many other companies have already suffered severe impacts before this.

实际上,自1946年推出首款塑料密封保鲜盒以来,特百惠已成为厨具和家居用品的知名品牌,在全球拥有70多家分公司和多个国家的制造基地。

实际上,自1946年推出首款塑料密封保鲜盒以来,特百惠已成为厨具和家居用品的知名品牌,在全球拥有70多家分公司和多个国家的制造基地。