Financial giants have made a conspicuous bullish move on Deere. Our analysis of options history for Deere (NYSE:DE) revealed 32 unusual trades.

Delving into the details, we found 56% of traders were bullish, while 34% showed bearish tendencies. Out of all the trades we spotted, 29 were puts, with a value of $1,287,729, and 3 were calls, valued at $706,047.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $380.0 and $430.0 for Deere, spanning the last three months.

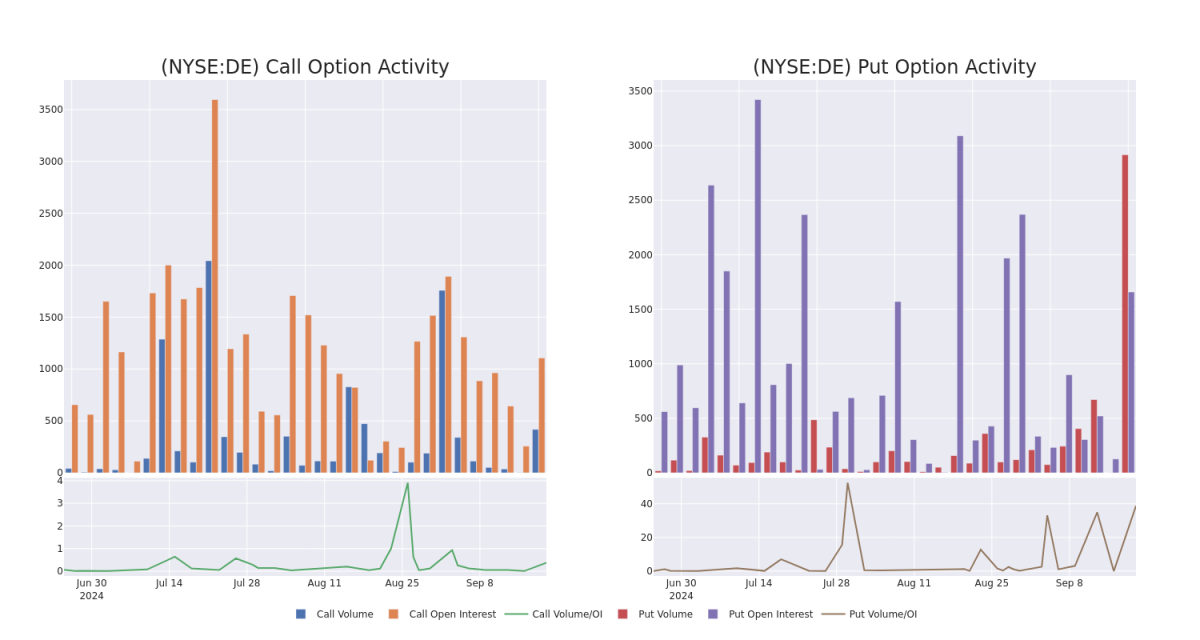

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Deere options trades today is 251.36 with a total volume of 3,334.00.

In terms of liquidity and interest, the mean open interest for Deere options trades today is 251.36 with a total volume of 3,334.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Deere's big money trades within a strike price range of $380.0 to $430.0 over the last 30 days.

Deere Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DE | CALL | TRADE | BULLISH | 03/21/25 | $21.3 | $20.35 | $21.25 | $430.00 | $637.5K | 401 | 305 |

| DE | PUT | SWEEP | NEUTRAL | 10/18/24 | $6.6 | $6.5 | $6.5 | $400.00 | $181.5K | 215 | 540 |

| DE | PUT | SWEEP | BULLISH | 10/18/24 | $4.3 | $4.0 | $4.05 | $390.00 | $82.2K | 729 | 322 |

| DE | PUT | SWEEP | BULLISH | 01/16/26 | $38.75 | $37.65 | $38.2 | $400.00 | $76.4K | 117 | 101 |

| DE | PUT | TRADE | BULLISH | 01/16/26 | $38.65 | $38.0 | $38.0 | $400.00 | $76.0K | 117 | 121 |

About Deere

Deere is the world's leading manufacturer of agricultural equipment, producing some of the most recognizable machines in the heavy machinery industry in their green and yellow livery. The company is divided into four reportable segments: production and precision agriculture, small agriculture and turf, construction and forestry, and John Deere Capital. Its products are available through an extensive dealer network, which includes over 2,000 dealer locations in North America and approximately 3,700 locations globally. John Deere Capital provides retail financing for machinery to its customers, in addition to wholesale financing for dealers, which increases the likelihood of Deere product sales.

Where Is Deere Standing Right Now?

- Currently trading with a volume of 585,017, the DE's price is down by -0.4%, now at $408.1.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 61 days.

What The Experts Say On Deere

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $425.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from Morgan Stanley persists with their Overweight rating on Deere, maintaining a target price of $425.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Deere with Benzinga Pro for real-time alerts.