Deep-pocketed investors have adopted a bullish approach towards ASML Holding (NASDAQ:ASML), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in ASML usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 15 extraordinary options activities for ASML Holding. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 60% leaning bullish and 26% bearish. Among these notable options, 4 are puts, totaling $182,150, and 11 are calls, amounting to $711,501.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $650.0 to $880.0 for ASML Holding during the past quarter.

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $650.0 to $880.0 for ASML Holding during the past quarter.

Insights into Volume & Open Interest

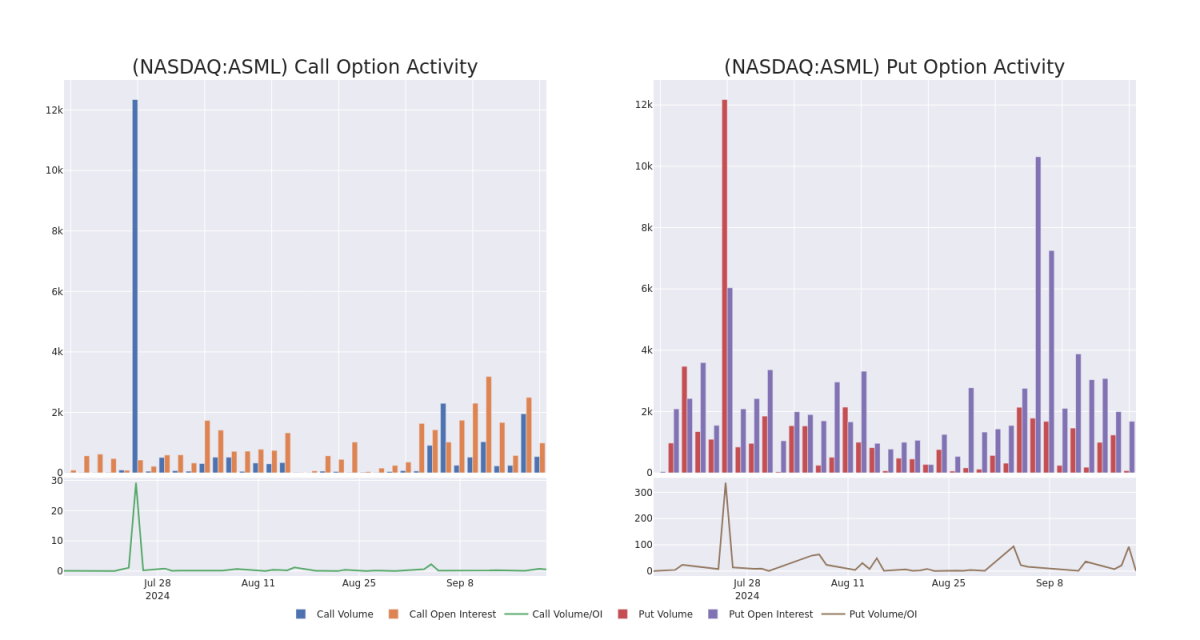

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for ASML Holding's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of ASML Holding's whale activity within a strike price range from $650.0 to $880.0 in the last 30 days.

ASML Holding 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ASML | CALL | SWEEP | BEARISH | 10/18/24 | $19.1 | $19.0 | $19.0 | $850.00 | $321.1K | 653 | 202 |

| ASML | PUT | TRADE | BULLISH | 10/18/24 | $43.2 | $42.6 | $42.6 | $810.00 | $68.1K | 155 | 36 |

| ASML | PUT | TRADE | BULLISH | 09/20/24 | $24.5 | $22.6 | $22.6 | $830.00 | $58.7K | 764 | 29 |

| ASML | CALL | TRADE | BULLISH | 02/21/25 | $55.5 | $54.5 | $55.1 | $880.00 | $55.1K | 43 | 10 |

| ASML | CALL | TRADE | NEUTRAL | 12/20/24 | $53.3 | $52.4 | $52.92 | $830.00 | $52.9K | 10 | 10 |

About ASML Holding

ASML is the leader in photolithography systems used in the manufacturing of semiconductors. Photolithography is the process in which a light source is used to expose circuit patterns from a photo mask onto a semiconductor wafer. The latest technological advances in this segment allow chipmakers to continually increase the number of transistors on the same area of silicon, with lithography historically representing a high portion of the cost of making cutting-edge chips. ASML outsources the manufacturing of most of its parts, acting like an assembler. ASML's main clients are TSMC, Samsung, and Intel.

In light of the recent options history for ASML Holding, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of ASML Holding

- With a volume of 668,596, the price of ASML is down -3.77% at $796.92.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 26 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for ASML Holding with Benzinga Pro for real-time alerts.