The gross margin has dropped to 4.5%. Can't Flashback Technology handle the volume of the mobile phone recycling market?

Over the past ten years, China's mobile phone shipments have been at the top of the world. According to Frost & Sullivan data, in 2023, China's mobile phone shipments were 0.289 billion units, an increase of 6.3% over the previous year. In the future, China's new mobile phone shipments are expected to grow at a CAGR of about 3.4% between 2023 and 2028, reaching around 0.341 billion units in 2028.

It is worth noting that the consumption upgrade of new mobile phones will drive a rise in consumer demand to dispose of old or unused mobile phones, thereby increasing the used consumer electronics trading market and mobile phone recycling market in China. In terms of trade-in recycled mobile phones, the market size in China increased from 4 billion yuan (RMB, same below) in 2019 to 14.2 billion yuan in 2023, with a compound annual growth rate of about 37.3%, and is expected to further increase to about 56.5 billion yuan in 2028.

In this context, mobile phone recycling service provider Flashback Technology Co., Ltd. (hereinafter referred to as Flashback Technology) submitted a listing application to the main board of the Hong Kong Stock Exchange on September 17, and Qingke Capital is its sole sponsor.

In this context, mobile phone recycling service provider Flashback Technology Co., Ltd. (hereinafter referred to as Flashback Technology) submitted a listing application to the main board of the Hong Kong Stock Exchange on September 17, and Qingke Capital is its sole sponsor.

China's third-largest mobile phone recycling service provider

According to the prospectus, Flashback Technology is a Chinese company engaged in providing aftermarket trading services for consumer electronics products, focusing on the mobile phone recycling service market. According to Frost & Sullivan, in terms of total recycling transactions from the consumer side in 2023, the company is the largest mobile phone recycling service provider in China and the third largest mobile phone recycling service provider in China, with market shares of about 7.4% and 1.4% respectively. According to Frost & Sullivan, in 2023, the company was also the third-largest mobile phone recycling service provider in China based on mobile phone sales collected from consumers.

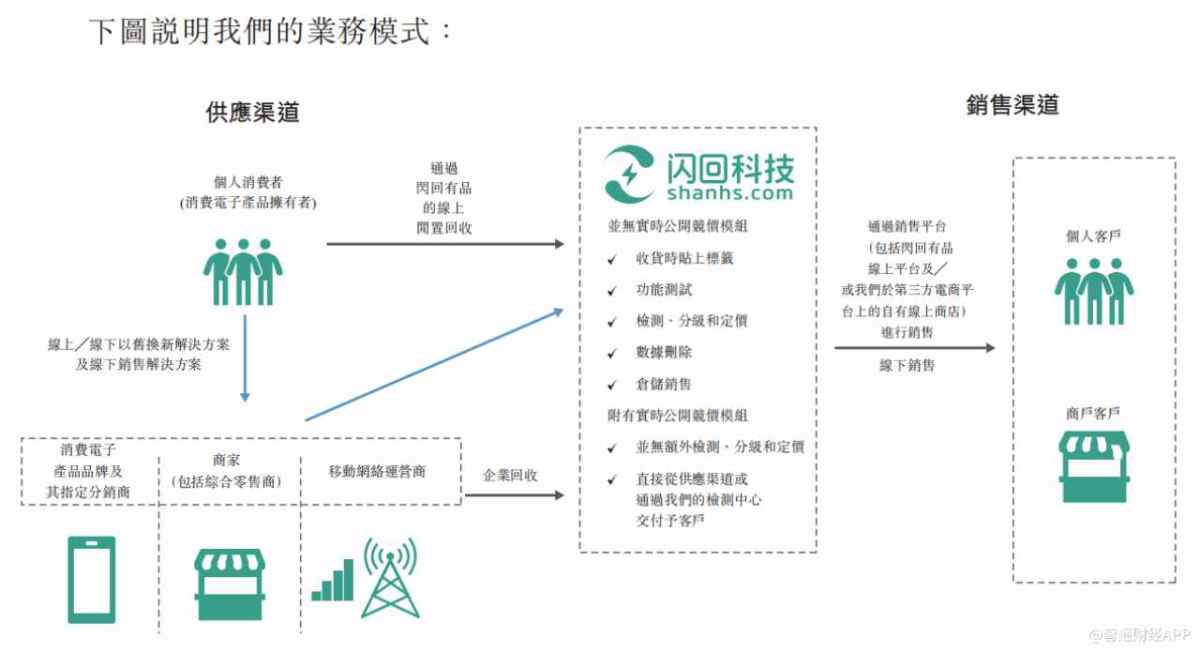

Flashback Technology mainly obtains the supply of used consumer electronics products through trade-in transactions carried out at offline and/or online stores of upstream procurement partners using the recycling system Flash Recycling. Individual consumers (that is, end suppliers) buy new consumer electronics products at a discount by trading in their used consumer electronics products as part of payment. The company's testing and operation center then processes the purchased used consumer electronics products using proprietary testing, grading and pricing technology, and efficiently sells the relevant electronic products to various buyers in the second-hand consumer electronics market, mainly through the company's online platform flashback products and its own online stores operated on multiple third-party e-commerce platforms.

With its strong position in the mobile phone recycling service market in China and its understanding of the needs and preferences of buyers in the second-hand consumer electronics market, Flashback Technology also participates in corporate recycling and offline sales to process consumer electronics products in batches to meet the business needs of upstream business partners and customers. Furthermore, the company provides value-added and after-sales services to participants in the upstream and downstream value chains.

The Zhitong Finance App learned that Flashback Technology has established and developed two core corporate brands, namely “Flash Recycling” and “Flash Back Products”. “Flash Recycling” is the company's main brand that carries out offline recycling business and recycles used consumer electronics products from individual consumers through upstream procurement partners. “Flashback Products” is the main brand of used consumer electronics products purchased by the company to customers on its own online platforms and/or its own online stores on third-party e-commerce platforms.

Sales expenses were high, and the loss was nearly 0.3 billion in three and a half years

In terms of performance, in 2021, 2022, 2023, and 2024, for the six months ended June 30, Flashback Technology achieved revenue of approximately 0.75 billion yuan, 0.919 billion yuan, 1.158 billion yuan, and 0.577 billion yuan, respectively. Losses during the same period were 48.708 million yuan, 99.084 million yuan, 98.268 million yuan, and 40.126 million yuan, respectively.

According to the prospectus, losses for the year ended December 31, 2021, 2022, and 2023 were mainly due to the general increase in the company's sales costs from about 0.688 billion yuan as of 2021 to about 1.08 billion yuan as of 2023. The increase in sales costs is mainly due to the increase in the company's procurement volume due to continuous business growth, and the establishment of new strategic partnerships with more mainstream consumer electronics brands to expand supply channels; new models of mobile phones are constantly being updated and upgraded, resulting in higher procurement costs than older mobile phones; and increased competition in the mobile phone recycling service market, and the company's overall procurement costs have increased.

Flashback Technology pointed out that the company has incurred and will continue to incur significant costs in purchasing used consumer electronics products, and that failure to resell such used electronic products in a timely manner, or to manage the company's working capital and cash flow, or to obtain additional financing in the future may have a significant adverse impact on the company's business, operating performance and financial situation

The Zhitong Finance App notes that high sales costs have put pressure on Flashback Technology's gross margin. In the first half of 2024, the company's overall gross margin was 4.5%, down 2.3 percentage points from the previous year; among them, the gross margin for selling used mobile phones was 3.8%, down 3.3 percentage points from the previous year.

China's mobile phone recycling market is expected to grow steadily

In this context, in order to improve profitability, Flashback Technology needs to continue to expand its business scale to a large extent in order to reduce marginal costs. The company stated in its prospectus that it plans to use part of the IPO to further strengthen strategic cooperation with the company's upstream procurement partners to continue to consolidate the current market position of offline mobile phone recycling services in China and expand the company's trading services to Hong Kong and other Southeast Asian countries.

According to Frost & Sullivan's report, China's mobile phone recycling market still has plenty of room for development. In terms of trade-in recycled mobile phones, the Chinese market rapidly increased from 4 billion yuan in 2019 to 14.2 billion yuan in 2023, with a compound annual growth rate of about 37.3%, and is expected to further increase to about 56.5 billion yuan in 2028. As far as the transaction volume of recycled mobile phones from idle is concerned, the statistics increased from about 18.8 billion yuan in 2019 to about 48.7 billion yuan in 2023, and is expected to further increase to about 132.9 billion yuan in 2028.

Divided by channel breakdown by transaction volume, offline channels are still the main channel for recycling trade-in phones, accounting for about 77% of the total market size in 2023. The offline amount increased from about 3.3 billion yuan in 2019 to about 10.8 billion yuan in 2023, with a CAGR of about 34.5%. In the future, as the trend of mobile phone recycling through offline channels continues to increase, the market is expected to maintain an upward trend, reaching about 42.7 billion yuan by 2028, with a compound annual growth rate of about 31.6% from 2023 to 2028.

It should be noted that while the mobile phone recycling market is expanding, competition in the industry also tends to heat up. According to the Frost & Sullivan report, based on the total transaction value of mobile phone devices, the five major market participants accounted for 16.4% of the market share of China's offline trade-in mobile phone recycling market in 2023, indicating that industry competition is far from winning or losing.

Flashback Technology stated in its prospectus that the company's revenue growth rate declined by about 11.3% in the first half of 2024. The decline is mainly due to China's increasingly competitive market environment and challenging macroeconomic conditions. The number of used phones that the company has recycled and subsequently sold has declined.

Flashback Technology also said that the severe macroeconomic environment and fierce competition in the industry where the company operates may limit the company's supply, lead to an increase in operating costs and capital expenses, and lead to a decline in revenue and gross margin. Failure to compete with existing and potential competitors may have a significant impact on the company's business, operating performance, and financial position.

在此背景下,手机回收服务商闪回科技有限公司(下称:闪回科技),于9月17日向港交所主板提交上市申请,清科资本为其独家保荐人。

在此背景下,手机回收服务商闪回科技有限公司(下称:闪回科技),于9月17日向港交所主板提交上市申请,清科资本为其独家保荐人。