Before and after the unlocking of the shares held by the two core investors, there may be more speculative funds participating in the speculation, causing further amplification of the stock's volatility...

Less than a hundred days after its listing, kingfarproperty, the "number one property stock in Shaanxi", has already experienced the taste of sharp rises and falls in stock prices.

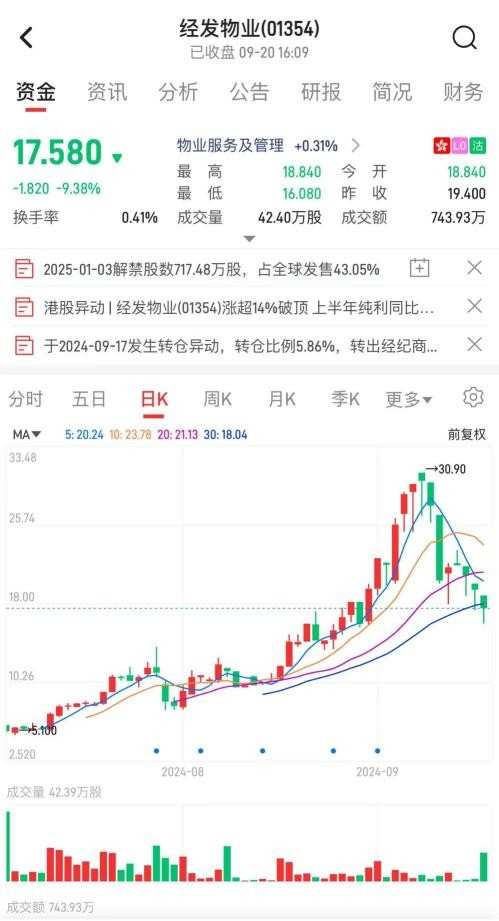

On September 20, kingfarproperty opened low and continued to trend downward, falling as much as 17.11% intraday. By the end of the day, kingfarproperty closed at HK$17.58, a decrease of 9.38%. It is worth mentioning that this is already the fourth time in the past seven trading days that kingfarproperty has recorded a decline of over 5%. Especially on September 12, the stock experienced a "Black Thursday", with a staggering 26.58% single-day drop.

However, if we turn back the clock, the stock price trend of kingfarproperty would present a different picture. After listing on July 3, the stock price of kingfarproperty once fell below the IPO price of HK$7.5 and dropped to a new low of HK$5.1 on July 5. But thereafter, kingfarproperty turned upwards, embarking on a sharp rise over the next two months. The stock reached HK$30.9 on September 10, a 3.12-fold increase from the IPO price, and a more than 5-fold increase from the lowest point.

However, if we turn back the clock, the stock price trend of kingfarproperty would present a different picture. After listing on July 3, the stock price of kingfarproperty once fell below the IPO price of HK$7.5 and dropped to a new low of HK$5.1 on July 5. But thereafter, kingfarproperty turned upwards, embarking on a sharp rise over the next two months. The stock reached HK$30.9 on September 10, a 3.12-fold increase from the IPO price, and a more than 5-fold increase from the lowest point.

From breaking below IPO price right after listing, to tripling in just two months, and now the stock price being halved over the past seven trading days, the stock price trend of kingfarproperty can be described as unpredictable.

Behind this strange trend, there may be both objective factors favorable for stock price speculation such as kingfarproperty having a relatively small market cap, limited total tradable shares, and highly concentrated ownership; as well as the possibility of artificially driving up the stock price early in the lock-up period, which might allow those cornerstone investors who assisted significantly before the listing to make a clean exit in the future.

Public information shows that before the listing of Kingfar Property, the shareholder structure included Xi'an Economic and Technological Development Zone Commission holding 7.5% through EDA Group and 67.5% through eda group hldgs. During the IPO, Kingfar Property globally offered a total of 16.6668 million H shares, accounting for 25% of the total shares after the issuance.

During the process of seeking IPO, Kingfar Property introduced 3 cornerstone investors, namely Xi'an Tianbo Diagnostic Technology Co., Ltd. (referred to as "Tianbo Diagnostic"), Xi'an Dingzhun Education Technology Co., Ltd. (referred to as "Dingzhun Education"), THE REYNOLD LEMKINS GROUP (ASIA) LIMITED (referred to as "Reynold Lemkins Group"), with a total shareholding of 10.76%.

As of the closing on September 20, although Kingfar Property's total market cap reached 1.172 billion Hong Kong dollars, the free float market value was only 0.293 billion Hong Kong dollars. Excluding the aforementioned major shareholders, the combined shareholding percentage of the remaining public shareholders was less than 15%. It is evident that Kingfar Property has a low free float market value and a high ownership concentration. During the extreme fluctuations of the company, the trading volume and turnover ratio of Kingfar Property always remained at a relatively low level. For example, on September 20, the trading volume was only 7.439 million Hong Kong dollars, with a turnover ratio of less than 3%, yet the final closing price drop approached 10%. This is similar to cases of significant price volatility caused by high ownership concentration in the Hong Kong stock market.

Furthermore, the identities and lock-up release dates of the three cornerstone investors who assisted Kingfar Property in a successful IPO are also worth investors' attention.

In terms of background, both Tianbo Diagnostic and Dingzhun Education can be considered as "fellow townsmen" of Kingfar Property, as these companies are all from Xi'an, Shaanxi. Tianbo Diagnostic, established in 2014, located in Xi'an Economic and Technological Development Zone, is an IVD industry service provider dedicated to providing comprehensive solutions for medical laboratories, with Meng Wujun as the controlling shareholder; Dingzhun Education, established in 2017, registered in Xi'an Economic and Technological Development Zone, with Ding Huaming as the largest shareholder.

Compared to the two companies mentioned above, the other major cornerstone investor of Kingfar Property, Reynold Lemkins Group, may be relatively more familiar to investors. According to public information, Reynold Lemkins Group is a typical single-family office with a history of over 30 years. Since 2024 alone, Reynold Lemkins Group has participated in multiple Hong Kong IPO projects. In addition to Kingfar Property, Reynold Lemkins Group is also a cornerstone investor in companies such as EdiCloud eda group hldgs and TDI technology.

According to relevant announcements, Tianbo Diagnostic subscribed for 4.3911 million shares of Kingfar Property, Dingzhun Education subscribed for 1.4637 million shares, while Reynold Lemkins Group subscribed for 1.32 million shares. Interestingly, despite being cornerstone investors, the lock-up release dates for the shares held by the three institutions are staggered. The lock-up period for the two "fellow townsmen" of Kingfar Property is both until July 2, 2025, while Reynold Lemkins Group's shares are allowed to be unlocked half a year earlier, on January 3 of the following year. If Kingfar Property's stock price remains high at that time, whether the profit-rich Reynold Lemkins Group will exit first is obviously worth watching.

Looking back at the fundamentals of Kingfarproperty, at least in terms of paper data, the company is currently in a hot upward trend. In the first six months of this year, Kingfarproperty achieved revenue of 0.463 billion yuan (RMB, same below), and a net income of 31.003 million yuan, with year-on-year increases of 18.57% and 22.95% respectively. Both core financial data have seen high growth, which is quite prominent in the property industry that is still in a period of adjustment.

However, behind the seemingly impressive data, it is worth investors exploring how high the growth potential of Kingfarproperty really is. On the one hand, Kingfarproperty's business operations are highly concentrated in the city of Xi'an, which means that if the company cannot make significant breakthroughs outside Xi'an, the company's growth "ceiling" will be low; on the other hand, at this stage, Kingfarproperty's business still relies heavily on the related party, Xi'an Economic and Technological Development Zone Management Committee. While it is good to have strong backing, Kingfarproperty ultimately needs to develop more new customers to expand its growth space.

Looking ahead, considering the very low market cap and high concentration of shares of Kingfarproperty, the future stock price trend of Kingfarproperty is expected to be anything but flat. Especially as time goes on, with the unblocking of shares held by two cornerstone investors, there may be more speculative funds participating in the speculation. At that time, the volatility of the stock may further increase, and retail investors need to be cautious of the investment risks.

但若将时钟往回拨,经发物业的股价运行态势则又会是另外一幅景象。7月3日上市后,经发物业股价曾一度跌破发行价7.5港元,并于7月5日盘中触及5.1港元创下股价新低。但在此之后经发物业便拐头向上,接下来两个月里该股以凌厉升势接连上冲,最终在9月10日达到了30.9港元,较发行价上涨了3.12倍,相较股价低点涨幅更是超过了5倍。

但若将时钟往回拨,经发物业的股价运行态势则又会是另外一幅景象。7月3日上市后,经发物业股价曾一度跌破发行价7.5港元,并于7月5日盘中触及5.1港元创下股价新低。但在此之后经发物业便拐头向上,接下来两个月里该股以凌厉升势接连上冲,最终在9月10日达到了30.9港元,较发行价上涨了3.12倍,相较股价低点涨幅更是超过了5倍。