What key signals did the Fed release during this globally watched rate cut night? Aside from the decision to cut rates by 50 basis points, what other key details should we not overlook? We have summarized the "key points" of 9 interest rate meetings for our readers.

On September 19th, Beijing time, at 2 am, the Fed announced a cut in the federal funds rate target range to 4.75%-5.00%, marking the first rate cut since March 16, 2020, with a 50 basis point reduction. The long-awaited policy shift has finally arrived.

After the Fed announced the rate cut decision, the three major US stock indexes initially rose, but quickly gave up their gains and turned into declines. At the close, the Dow fell 103 points, a decrease of 0.25%, while the Nasdaq Composite Index and the S&P 500 Index both fell by about 0.3%. US Treasury yields narrowed after earlier gains.

So, during this globally watched rate cut night, what key signals did the Fed release? Aside from the decision to cut rates by 50 basis points, what other key details should people not overlook? Below, we summarize the "key points" of the 9 interest rate meetings for our readers:

So, during this globally watched rate cut night, what key signals did the Fed release? Aside from the decision to cut rates by 50 basis points, what other key details should people not overlook? Below, we summarize the "key points" of the 9 interest rate meetings for our readers:

1. A 50 basis point rate cut

Prior to the September Fed interest rate meeting, market participants had been speculating on whether the Fed would cut rates by 25 or 50 basis points. In the end, the Fed voted to cut rates by 50 basis points, making it the first rate cut since 2020 with a bolder move. This long-awaited change comes after a two-year battle by the central bank to combat inflation.

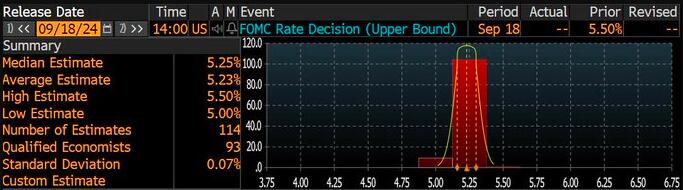

Prior to this, the Fed had held steady for eight consecutive meetings (since July last year), keeping its policy rate at the high level since 2001. This rate cut by the Fed is in line with the pricing in the interest rate market before the meeting, but undoubtedly defied the predictions of many investment bank analysts. As we mentioned in our outlook yesterday, out of the 114 institutional economists surveyed by Bloomberg, only 9 successfully predicted that the Fed would cut rates by 50 basis points tonight, while the vast majority (105) believed that the Fed would only cut rates by 25 basis points...

In its monetary policy statement, the Fed stated that, given the progress of inflation and the balance of risks, the committee decided to lower the federal funds rate target range by 50 basis points to 4.75% - 5%. When considering any further adjustment to the federal funds rate target range, the committee will carefully assess future data, evolving outlooks, and risk balances.

Federal Reserve Chairman Powell also stated at the post-meeting press conference that the Fed's current goal is to maintain inflation cooling while ensuring that the unemployment rate does not rise. Investors should consider a substantial 50 basis point rate cut as a"firm commitment" by the Fed to achieve these goals.

In response, Chris Larkin, a strategist at Morgan Stanley-owned platform E*Trade, said the market got what it wanted - the Fed's first move was a large interest rate cut."The Fed is known for not being too hasty, so if people think the Fed is acting too slowly, especially when economic data continues to weaken, it might be disappointing. But they did it today."

For Krishna Guha, Head of Global Policy and Central Bank Strategy at Evercore ISI, the Fed's big move provides some assurance for a soft landing and should be especially beneficial for risk assets that are adaptable to the cycle, such as small caps, cyclical stocks, commodities, and currency.

② Dissenting vote appears.

Although the Fed made a 50 basis point rate cut decision on Wednesday, there is clearly some dissent within the institution. The Fed's statement showed that Bowman became the first board member to cast a dissenting vote on interest rate decisions since 2005 - she advocated a slight rate cut to start a loose cycle at Wednesday's policy meeting.

As a hawkish figure within the Fed, Bowman believes that this should be a more standard 25 basis point rate cut. In fact, she has long been cautious about slowing inflation and said in a speech on August 20 that price increases are still above the Fed's 2 percent target. She then pointed out that federal funds rates should be gradually lowered.

There has been little dissent in the Fed's decisions in recent years, making the internal "harmony" during Powell's tenure as chairman. The last time there was disagreement over a Fed decision was from a regional Fed president (rather than a board member closer to the center of power) - Esther George, the president of the Kansas City Fed, voted against the decision at the meeting in June 2022 and called for a slight rate hike.

It is worth mentioning that, as we mentioned in yesterday's preview, there may be some controversy within the Fed about whether to cut rates by 25 basis points or 50 basis points. An interesting point is that until the end of last week, investors expected the Fed to cut rates by only 25 basis points, as few officials publicly called for a larger rate cut. But within the current Fed, Chairman Powell may be a "dove" who wants to implement looser policies with greater force. The recent releases from Fed media and the shift in market expectations may well be the result of fierce internal debate within the Fed.

Of course, Powell reiterated at the post-meeting press conference that today's significant rate cut decision, despite one dissenting vote, also "received broad support from Fed officials after repeated discussions. There are various opinions, and in fact, there is also a lot of consensus."

KPMG's chief economist Swank said in an interview on Thursday that Powell, despite the opposition of the board, was willing to make a significant rate cut, indicating "how much he hopes for a half percentage point rate cut." Swank pointed out that getting other committee members to agree to the rate cut was a "huge victory" for Powell.

The secret of the dot plot: 50-100.

In the highly anticipated rate forecast "dot plot" of the FOMC, there are two key numbers that investors should focus on at the moment: the Fed is expected to cut rates by another 50 basis points this year, and an additional 100 basis points next year.

The latest dot plot for September shows that 19 policymakers expect the median end-of-2024 Fed rate to be between 4.25% and 4.5%. This means that overall, they believe there will be an additional 50 basis points of cumulative rate cuts by the end of the year on top of the current level.

The median forecast also shows that 19 policymakers believe the end-of-2025 rate will be between 3.25% and 3.5%, meaning a cumulative 100 basis points of rate cuts in 2025; a 50-basis-point cut in 2026, and a long-term maintenance between 2.75% and 3%.

The latest rate forecast from the dot plot, compared to June, has clearly shifted downward. However, it should be noted that even though the Fed's rate outlook has become more dovish, overall it is still somewhat more hawkish than the current rate market expectations.

After the Fed decision, traders in the rate market now expect the Fed to cut rates to 4.10% by the end of this year, a total decrease of 75 basis points (there will be at least one more 50 basis points cut in November and December). By the end of next year, rates are expected to fall to 2.917% (below 3%).

The Fed is "regretting"

Did the Fed regret not cutting rates earlier in July? The answer from Fed Chairman Powell last night is: a little bit!

Fed Chairman Powell said at the press conference that if the Fed had seen the non-farm payroll report released a few days after the July decision, it might have cut rates for the first time at the July interest rate meeting. However, Powell denied that the Fed waited too long to cut rates, seeing the rate cut as a 're-adjustment' of Fed policy, and not as a lag behind the interest rate curve.

Powell said: 'If we had received the July employment report before the meeting, would we have cut rates? We probably would have. We did not make that decision at the time.'

Earlier, the US Department of Labor's non-farm employment report for July showed weakness in the US labor market, with the unemployment rate rising to 4.3%, triggering a recession warning signal from the 'SAM rule'. Prior to the Fed's July interest rate meeting, some former Fed veterans had actually called for a rate cut at that meeting, but after much hesitation, the Fed ultimately took no action.

The Fed's move to cut rates by 50 basis points at once is clearly intended to make up for the failure to act in July.

Nathan Thooft, a senior portfolio manager at Manulife Investment Management, said: 'The dot plot did not show a further 50 basis point rate cut, further confirming that the current change is just a beginning, and it is proactive, not a trend. This may also indicate that they regret not starting with a 25 basis point rate cut at the last meeting.'

Do not assume that the 50 basis point rate cut is a 'new pace'

It seems to echo the point we mentioned earlier, and Powell also emphasized in the press conference that there is no commitment to take similar measures (50 basis point rate cut) at every future meeting.

Powell pointed out, "Adjusting our policy stance will help maintain strong economic and labor markets, and will continue to promote further progress on inflation as we transition to a more neutral stance. We haven't chosen a predetermined path. We will continue to make decisions meeting after meeting."

Powell said that although the Fed cut rates by 50 basis points this time, investors should not expect future rate cuts to continue at this magnitude. "We've been waiting, and I think that patience has paid off. We believe that inflation will continue to move towards below 2%, so I think that's why we took this strong action today," said Jerome Powell, Chairman of the Fed. "I don't think anyone should look at this and say, 'Oh, this is a new rhythm.'"

Ryan Sweet, chief U.S. economist at Oxford Economics, said, "The Fed doesn't like to admit policy mistakes, but the initial decision to cut rates significantly may not continue. The decision in September was a preemptive move aimed at increasing the likelihood of a 'soft landing' by the central bank."

"We expect the Fed to cut rates by 25 basis points at each of the next few meetings to make policy adjustments to the now more normalized economic conditions. The Fed still relies on data, and if the economy deteriorates faster than expected, policymakers will accelerate the pace of rate cuts," wrote PIMCO economist Tiffany Wilding in a report.

Unemployment rate of 4.4%

In the Fed's latest Summary of Economic Projections, the Fed's forecast for the unemployment rate in the next two years has clearly been a focus of attention among many industry insiders - Fed officials expect the U.S. unemployment rate to remain at 4.4% by the end of this year and next year, and then decline.

Although this latest forecast has been revised upwards significantly from June, it is important to note that the U.S. unemployment rate has already been at 4.3% and 4.2% over the past two months, which is still a relatively optimistic forecast. In the past, during economic downturns and recessions, once the unemployment rate rises, it tends to continue to rise.

In fact, in this Federal Reserve decision, people can see the Fed's attention to the labor market.

For example, in the Federal Reserve's monetary policy statement, the Fed changed the balance of risks to achieving employment and inflation goals from 'sustained trend' to 'roughly balanced', and added the expression 'firm commitment to support maximum employment'.

Powell also stated after the meeting that the US labor market is currently 'very close' to maximum employment, but reiterated that the Fed is aware of signs of a slowdown in job growth. He pointed out that it is clear that the number of job additions has decreased in the past few months, which is worth paying attention to. The Fed's current goals are to maintain price stability and ensure that the unemployment rate does not rise.

⑦ The risk of an economic recession will not 'rise'.

Regarding the Federal Reserve's decision to cut interest rates by 50 basis points, a concern for market participants beforehand was whether such a significant rate cut implied that the Fed had seen some unknown danger signals in the current US economic sector? Otherwise, the first rate cut in a Fed easing cycle usually does not unfold to such an extent...

And in his latest speech last night, Powell still tried to reassure people.

Powell said, 'After a large rate cut, the risk of an economic recession does not rise. I don't currently see any signs that the possibility of an economic recession has increased. I don't see it,' he continued, 'You will see the economy growing at a stable pace. You will see inflation declining. You will see the labor market still at a very stable level. So, I don't see it now (an economic recession).'

Kristina Hooper, Chief Global Market Strategist at Invesco, said, 'Powell clearly stated that today's decision is not a crisis rate cut, but rather the normalization of monetary policy from a very strict level of constraint. Given the Fed's assurances, I expect risk assets to perform well in the coming weeks - unless future economic data shows further weakness.'

"Although there is doubt about the economic necessity of a 50 basis point rate cut, the market should also celebrate today's rate cut - and will continue to celebrate in the coming months," said Seema Shah, Chief Global Strategist at Principal Asset Management. , "The Fed will do everything in its power to avoid a hard landing. Where is the recession?"

It will not return to the era of ultra-low interest rates.

Regarding the future long-term interest rate environment, Powell predicted last night that the era of cheap funds will not reappear.

He said:"By intuition, most people would say that we probably won't return to that (ultra-low interest rate) era, when sovereign debt and long-term bonds worth trillions of dollars were traded at negative interest rates. Personally, I feel we won't return to that state."

Powell believes that the neutral interest rate may be much higher than at that time, although he does not yet know how high the neutral interest rate will be.

Of course, it is clear that market participants are not entirely convinced of Powell's above statement at the moment. From the dot plot, the Fed's latest forecast for the median federal funds rate in the long term is 2.9%, up from 2.8% in June. However, the current pricing of the interest rate market actually expects the Fed to reach this level by the end of next year. As for whether the Fed's rate cut cycle will end next, perhaps no one can guarantee it at the moment.

A rate cut does not preclude a balance sheet reduction.

The Fed's rate cut indicates that market liquidity will gradually return to a more relaxed environment. Interestingly, despite the rate cut, the Fed still does not intend to end the balance sheet reduction immediately.

Federal Reserve Chairman Powell said on Wednesday that the strong liquidity in the financial system will allow the Fed to continue to shrink its balance sheet while starting to cut interest rates. Powell said: "Bank reserves remain ample and it is expected to continue for a period of time."

Powell spoke about the so-called Quantitative Tightening (QT) process. This means that the Fed will withdraw the liquidity added through bond purchases during the pandemic, which has so far reduced its total holdings from a peak of $9 trillion in the summer of 2022 to the current $7.2 trillion. Earlier this year, the Fed slowed down the pace of QT, currently allowing up to $60 billion of U.S. Treasury and mortgage-backed securities (MBS) to expire each month.

Some analysts had previously speculated that if the Fed decided to cut interest rates by 50 basis points, it might accelerate the end of the QT policy in order to better coordinate the tools in the Fed's monetary policy toolbox. However, Powell pointed out at a press conference that most of the reduction in the balance sheet had not affected the bank reserves held at the Fed, and that cash had mainly been withdrawn from the reverse repurchase tools. The current situation indicates that even if the federal funds rate declines, "we will not consider completely stopping the reduction of the balance sheet".

A survey conducted by the Fed in July showed that market participants expected QT to end in the spring of next year. Fed officials have repeatedly stated that they are unsure when QT will end, and will monitor market clues to determine if liquidity is excessively tight.

Editor / jayden