Benzinga's options scanner has just identified more than 8 option transactions on Trade Desk (NASDAQ:TTD), with a cumulative value of $328,214. Concurrently, our algorithms picked up 2 puts, worth a total of 74,631.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $80.0 and $155.0 for Trade Desk, spanning the last three months.

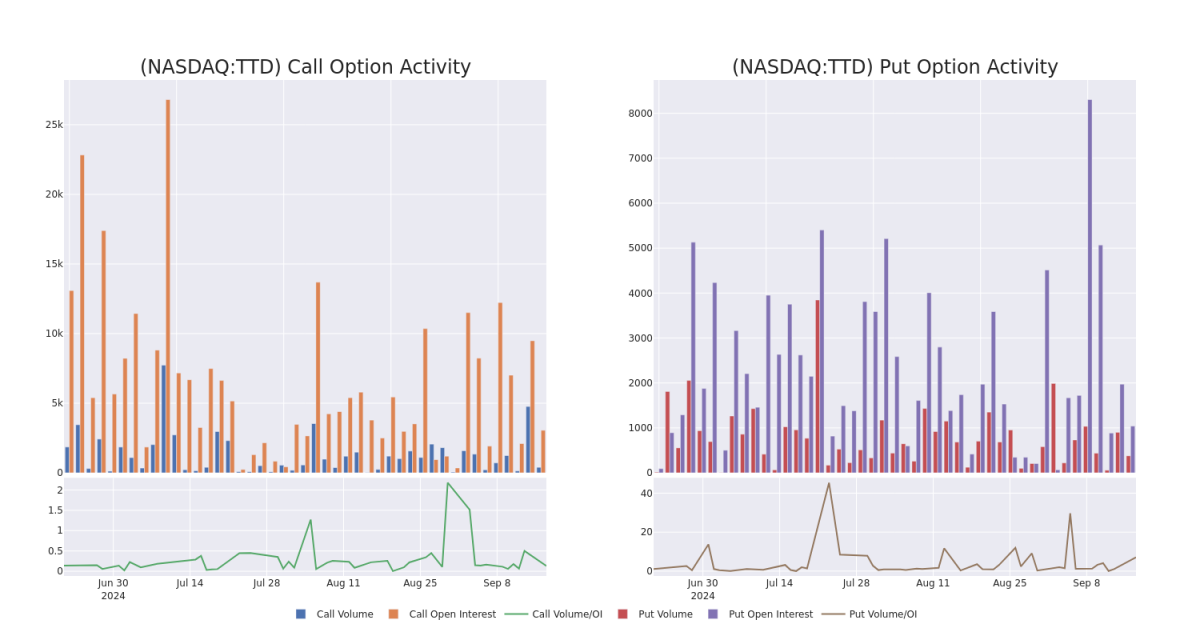

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Trade Desk's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Trade Desk's substantial trades, within a strike price spectrum from $80.0 to $155.0 over the preceding 30 days.

Trade Desk 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TTD | CALL | TRADE | BULLISH | 09/20/24 | $17.25 | $15.85 | $17.25 | $90.00 | $86.2K | 1.2K | 50 |

| TTD | CALL | TRADE | BULLISH | 12/20/24 | $12.05 | $11.9 | $12.05 | $105.00 | $60.2K | 1.0K | 52 |

| TTD | CALL | TRADE | BEARISH | 09/19/25 | $38.15 | $37.75 | $37.75 | $80.00 | $52.8K | 0 | 14 |

| TTD | CALL | TRADE | BULLISH | 12/20/24 | $31.0 | $30.65 | $30.95 | $80.00 | $43.3K | 77 | 14 |

| TTD | PUT | TRADE | BULLISH | 09/19/25 | $45.6 | $45.5 | $45.5 | $150.00 | $40.9K | 0 | 10 |

About Trade Desk

The Trade Desk provides a self-service platform that helps advertisers and ad agencies programmatically find and purchase digital ad inventory (display, video, audio, and social) on different devices like computers, smartphones, and connected TVs. It utilizes data to optimize the performance of ad impressions purchased. The firm's platform is referred to as a demand-side platform in the digital ad industry. The firm generates its revenue from fees based on a percentage of what its clients spend on advertising.

The Trade Desk provides a self-service platform that helps advertisers and ad agencies programmatically find and purchase digital ad inventory (display, video, audio, and social) on different devices like computers, smartphones, and connected TVs. It utilizes data to optimize the performance of ad impressions purchased. The firm's platform is referred to as a demand-side platform in the digital ad industry. The firm generates its revenue from fees based on a percentage of what its clients spend on advertising.

After a thorough review of the options trading surrounding Trade Desk, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Trade Desk's Current Market Status

- With a volume of 915,504, the price of TTD is up 2.4% at $108.39.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 50 days.

Professional Analyst Ratings for Trade Desk

5 market experts have recently issued ratings for this stock, with a consensus target price of $119.0.

- An analyst from B of A Securities downgraded its action to Buy with a price target of $135.

- An analyst from Wedbush has decided to maintain their Outperform rating on Trade Desk, which currently sits at a price target of $115.

- Reflecting concerns, an analyst from Needham lowers its rating to Buy with a new price target of $115.

- Maintaining their stance, an analyst from Loop Capital continues to hold a Buy rating for Trade Desk, targeting a price of $120.

- In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Neutral, setting a price target of $110.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.