Deep-pocketed investors have adopted a bearish approach towards Caterpillar (NYSE:CAT), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in CAT usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 10 extraordinary options activities for Caterpillar. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 20% leaning bullish and 70% bearish. Among these notable options, 2 are puts, totaling $61,620, and 8 are calls, amounting to $408,314.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $300.0 to $360.0 for Caterpillar during the past quarter.

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $300.0 to $360.0 for Caterpillar during the past quarter.

Volume & Open Interest Development

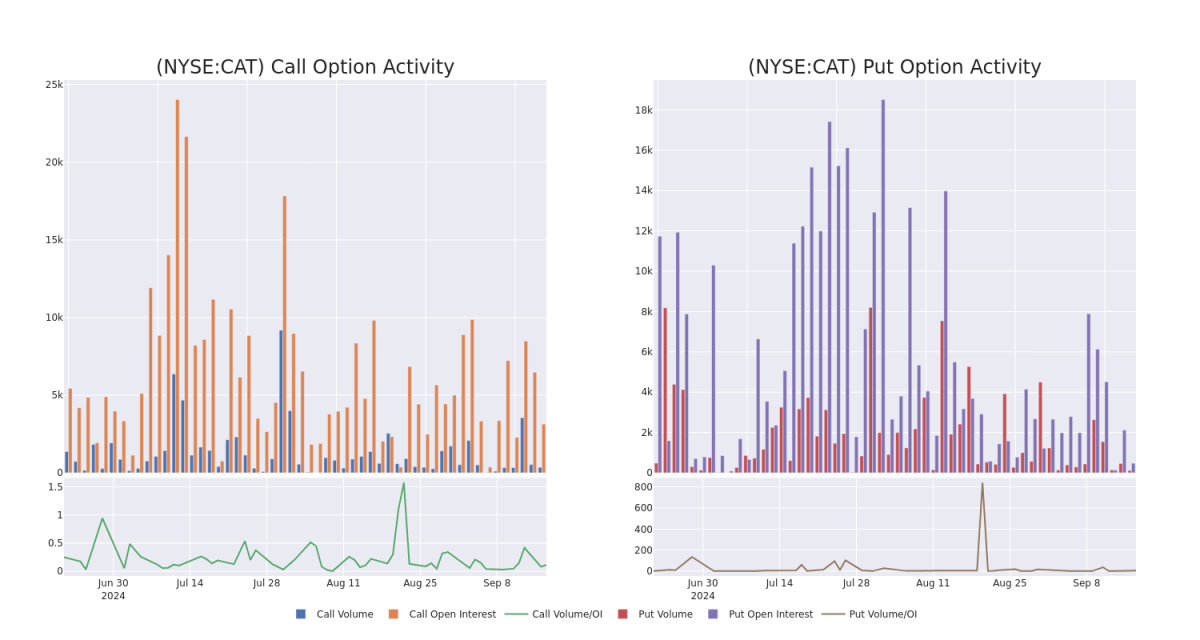

In today's trading context, the average open interest for options of Caterpillar stands at 936.38, with a total volume reaching 677.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Caterpillar, situated within the strike price corridor from $300.0 to $360.0, throughout the last 30 days.

Caterpillar Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CAT | CALL | SWEEP | BEARISH | 09/20/24 | $14.7 | $13.35 | $14.4 | $340.00 | $105.3K | 1.9K | 180 |

| CAT | CALL | SWEEP | BEARISH | 10/18/24 | $7.9 | $7.5 | $7.65 | $360.00 | $62.4K | 1.0K | 143 |

| CAT | CALL | TRADE | BULLISH | 10/04/24 | $11.45 | $11.2 | $11.45 | $350.00 | $46.9K | 143 | 1 |

| CAT | CALL | TRADE | BEARISH | 10/18/24 | $21.45 | $20.8 | $20.8 | $340.00 | $45.7K | 633 | 42 |

| CAT | CALL | SWEEP | NEUTRAL | 01/17/25 | $62.15 | $60.0 | $61.2 | $300.00 | $42.8K | 1.8K | 1 |

About Caterpillar

Caterpillar is the top manufacturer of heavy equipment, power solutions, and locomotives. It is currently the world's largest manufacturer of heavy equipment. The company is divided into four reportable segments: construction industries, resource industries, energy and transportation, and Cat Financial. Its products are available through a dealer network that covers the globe with about 2,700 branches maintained by 160 dealers. Cat Financial provides retail financing for machinery and engines to its customers, in addition to wholesale financing for dealers, which increases the likelihood of Caterpillar product sales.

Having examined the options trading patterns of Caterpillar, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Caterpillar

- With a volume of 156,645, the price of CAT is down -0.29% at $352.68.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 41 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.