The most oversold stocks in the consumer staples sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

Farmmi Inc (NASDAQ:FAMI)

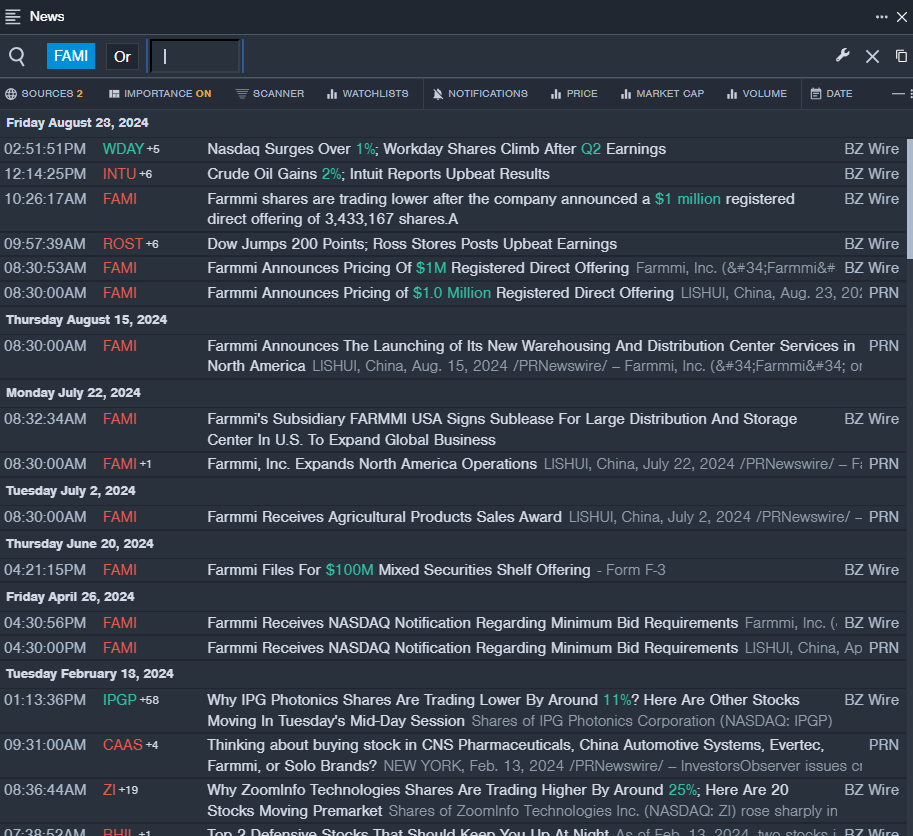

- On Aug. 23, Farmmi announced a $1 million registered direct offering of 3,433,167 shares. A. The company's stock fell around 61% over the past month and has a 52-week low of $0.17.

- RSI Value: 29.98

- FAMI Price Action: Shares of Farmmi fell 5.1% to close at $0.22 on Tuesday.

- Benzinga Pro's real-time newsfeed alerted to latest FAMI news.

elf Beauty Inc (NYSE:ELF)

- On Sept. 16, Piper Sandler analyst Korinne Wolfmeyer maintained e.l.f. Beauty with an Overweight and lowered the price target from $260 to $162. The company's stock fell around 30% over the past month. It has a 52-week low of $88.47.

- RSI Value: 28.33

- ELF Price Action: Shares of elf Beauty fell 0.7% to close at $112.43 on Tuesday.

- Benzinga Pro's charting tool helped identify the trend in ELF stock.

- Cramer: Hewlett Packard Is A 'Very Inexpensive' Stock, Likes This Big Tech Stock