The interest rate cut decision that the Federal Reserve may make this week is expected to lead to a rise in the yen, which may unsettle emerging market investors and bring to mind the global turmoil in August.

The Fed's possible interest rate cut this week may lead to a strengthening of the Japanese yen, which could unsettle emerging market investors and bring back memories of the global turmoil in August.

Last month, the yen rose due to the Bank of Japan's interest rate hike, severely impacting arbitrage trading in emerging markets and causing the Nikkei 225 index to experience its worst decline since 1987. Coupled with a significant drop in US non-farm payroll employment, Wall Street's favorite volatility indicator soared, and US technology stocks experienced their worst decline since 2008.

There are similarities this time as well. Investors have different opinions on whether the Fed will start its easing policy with a standard 25 basis points cut or a larger cut. A half basis point cut could raise doubts about the health of the US economy and trigger a sell-off of emerging Asian assets. It could also strengthen the yen and prompt investors to unwind risk asset arbitrage positions based on yen funding.

There are similarities this time as well. Investors have different opinions on whether the Fed will start its easing policy with a standard 25 basis points cut or a larger cut. A half basis point cut could raise doubts about the health of the US economy and trigger a sell-off of emerging Asian assets. It could also strengthen the yen and prompt investors to unwind risk asset arbitrage positions based on yen funding.

On the other hand, a quarter basis point cut could benefit the stock market, with smaller Southeast Asian markets potentially being the major beneficiaries.

The market is focused on the yen.

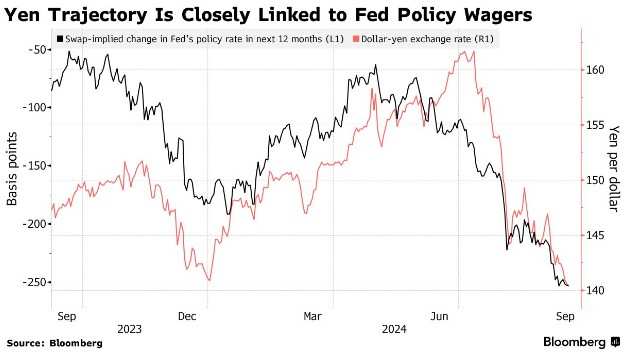

The movement of the yen is closely related to expectations of a Fed rate cut. On Monday, as speculation grew about a half percentage point rate cut, the yen jumped to the 140 level against the dollar, reaching its highest level this year.

This has caused panic among Japanese investors, as further rate cuts by the Federal Reserve could further push up the yen exchange rate and hurt the profits of the country's exporters. Traders, hedge funds, and institutions still vividly remember the sharp rise in the yen after the Bank of Japan's interest rate hike last month, which triggered a global sell-off.

Following the announcement of the Federal Reserve's interest rate decision, investors' attention will turn to the Bank of Japan's meeting on Friday. Although most economists expect no change in policy, investors will still focus on any hints of a possible rate hike in December.

Betting on smaller markets.

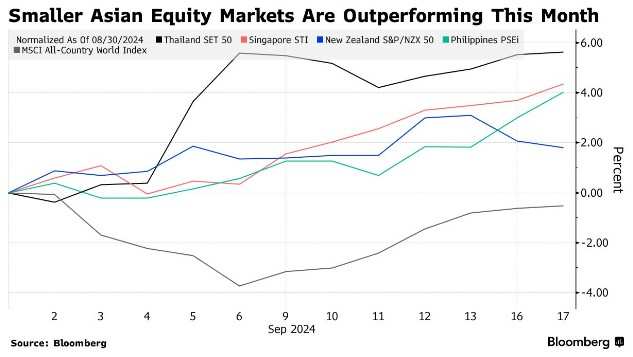

Smaller Southeast Asian markets have become the preferred choice for fund managers to position themselves against the shift in Federal Reserve policy. Four out of the top five Asian stock market benchmark indices have performed best in this region, with Thailand leading the way.

Over the past two months, fund managers have increased their holdings of sovereign bonds in Thailand, Indonesia, and Malaysia. For the past three months, they have been net buyers of Indonesian, Malaysian, and Philippine stocks. These inflows have made Southeast Asian currencies the top performing currencies in emerging markets this quarter.

India has become a pillar of the emerging markets.

The possibility of a rate cut by the Federal Reserve of the USA may lead to a reduction in borrowing costs for the Reserve Bank of India. This prospect has attracted foreign investors to buy local stocks, pushing major stock indices to reach a historical high on Tuesday.

Sumeet Rohra, a fund manager at Smartsun Capital Pte. based in Singapore, said, "The rate cut by the Federal Reserve will have a positive impact on valuations and may trigger India's own rate-cutting cycle in a lagging manner." He added that India's economic growth rate will help attract more capital inflows.

After the rate cut by the Federal Reserve, the increasing proportion of India in the allocation of emerging markets may also be boosted. This country, often referred to as the "next China", has become a favorite of investors due to its strong economic growth, growing middle class, and thriving manufacturing industry.

India's position in emerging markets is increasing.

The outlook for the Australian bond market is worrying.

However, not all Asian markets will benefit from the Federal Reserve's policy. Momentum indicators show that the rise in Australian bonds is starting to appear excessive, with yields on policy-sensitive three-year and ten-year bonds reaching their lowest level since June earlier this week. Bond investors will also closely monitor local employment data in August, which will be released hours after the announcement of the Federal Reserve's policy decision.

National Australia Bank Limited Sponsored ADR (NAB) stated that, given the strong correlation between Australian government bonds and US government bonds, whether the rebound can continue will depend on whether the Federal Reserve is gentle enough to meet expectations of a terminal interest rate of around 2.75%. Sydney-based senior fixed income strategist Kenneth Crandton said that employment data may also prompt the market to lower expectations for interest rate cuts by the Reserve Bank of Australia in the next six months.

"Compared to the expectations of the Reserve Bank of Australia, short-term Australian Commonwealth Government Bonds (ACGB) are clearly too loose," he said. "I don't think long-term ACGB has any value either."

Editor/Rocky

这次也有相似之处。投资者对美联储将以标准的 25 个基点还是更大幅度的降息来启动宽松政策意见不一。降息半个基点可能会引发人们对美国经济健康状况的怀疑,从而引发对新兴亚洲资产的抛售。这也可能推动日元走强,促使投资者平仓以日元为融资基础的风险资产套利头寸。

这次也有相似之处。投资者对美联储将以标准的 25 个基点还是更大幅度的降息来启动宽松政策意见不一。降息半个基点可能会引发人们对美国经济健康状况的怀疑,从而引发对新兴亚洲资产的抛售。这也可能推动日元走强,促使投资者平仓以日元为融资基础的风险资产套利头寸。