Financial giants have made a conspicuous bearish move on Applied Mat. Our analysis of options history for Applied Mat (NASDAQ:AMAT) revealed 23 unusual trades.

Delving into the details, we found 34% of traders were bullish, while 65% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $231,435, and 20 were calls, valued at $2,281,061.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $150.0 to $260.0 for Applied Mat over the last 3 months.

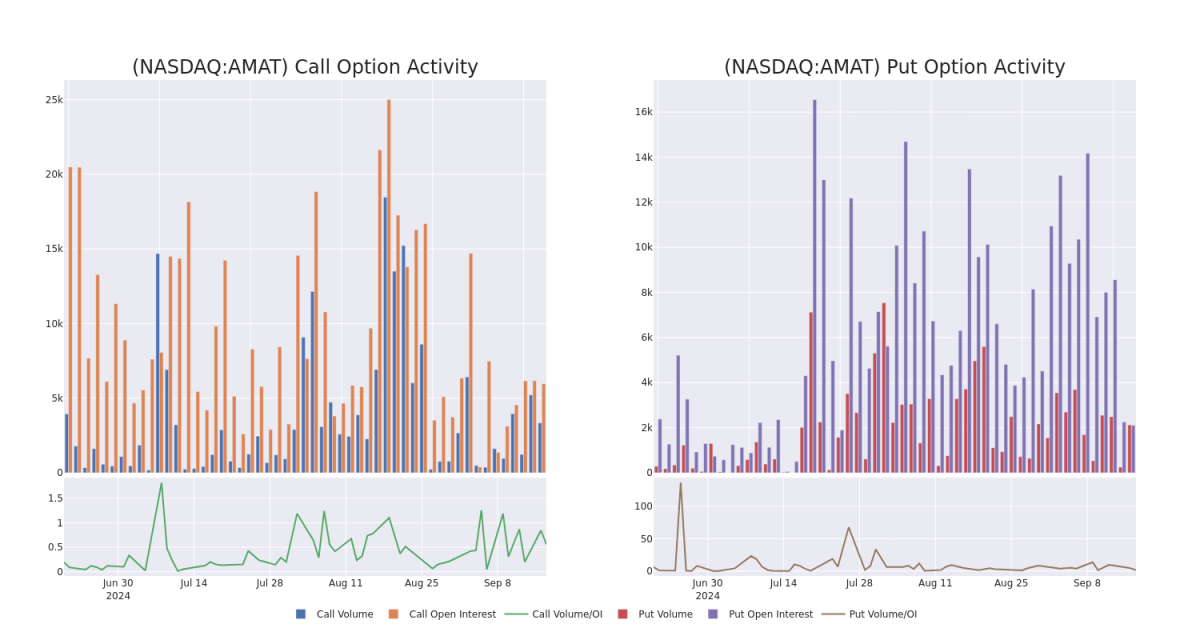

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Applied Mat's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Applied Mat's whale trades within a strike price range from $150.0 to $260.0 in the last 30 days.

Applied Mat Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMAT | CALL | TRADE | BULLISH | 10/18/24 | $8.2 | $7.95 | $8.19 | $190.00 | $818.9K | 1.2K | 130 |

| AMAT | CALL | TRADE | BULLISH | 06/20/25 | $52.6 | $52.35 | $52.6 | $150.00 | $263.0K | 228 | 50 |

| AMAT | CALL | SWEEP | BULLISH | 09/27/24 | $4.35 | $4.3 | $4.35 | $190.00 | $217.5K | 232 | 1.1K |

| AMAT | CALL | SWEEP | BEARISH | 11/15/24 | $9.3 | $9.1 | $9.1 | $200.00 | $182.0K | 1.0K | 201 |

| AMAT | PUT | SWEEP | BEARISH | 09/20/24 | $1.54 | $1.31 | $1.54 | $185.00 | $107.6K | 1.5K | 1.4K |

About Applied Mat

Applied Materials is the largest semiconductor wafer fabrication equipment, or WFE, manufacturer in the world. Applied Materials has a broad portfolio spanning nearly every corner of the WFE ecosystem. Specifically, Applied Materials holds a market share leadership position in deposition, which entails the layering of new materials on semiconductor wafers. It is more exposed to general-purpose logic chips made at integrated device manufacturers and foundries. It counts the largest chipmakers in the world as customers, including TSMC, Intel, and Samsung.

Where Is Applied Mat Standing Right Now?

- Currently trading with a volume of 2,810,644, the AMAT's price is up by 0.04%, now at $187.65.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 58 days.

Professional Analyst Ratings for Applied Mat

3 market experts have recently issued ratings for this stock, with a consensus target price of $204.0.

- Consistent in their evaluation, an analyst from UBS keeps a Neutral rating on Applied Mat with a target price of $210.

- An analyst from Citigroup persists with their Buy rating on Applied Mat, maintaining a target price of $217.

- Maintaining their stance, an analyst from Morgan Stanley continues to hold a Equal-Weight rating for Applied Mat, targeting a price of $185.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.