Whales with a lot of money to spend have taken a noticeably bearish stance on Booking Holdings.

Looking at options history for Booking Holdings (NASDAQ:BKNG) we detected 57 trades.

If we consider the specifics of each trade, it is accurate to state that 33% of the investors opened trades with bullish expectations and 40% with bearish.

From the overall spotted trades, 17 are puts, for a total amount of $786,100 and 40, calls, for a total amount of $3,658,791.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $2000.0 to $4900.0 for Booking Holdings over the recent three months.

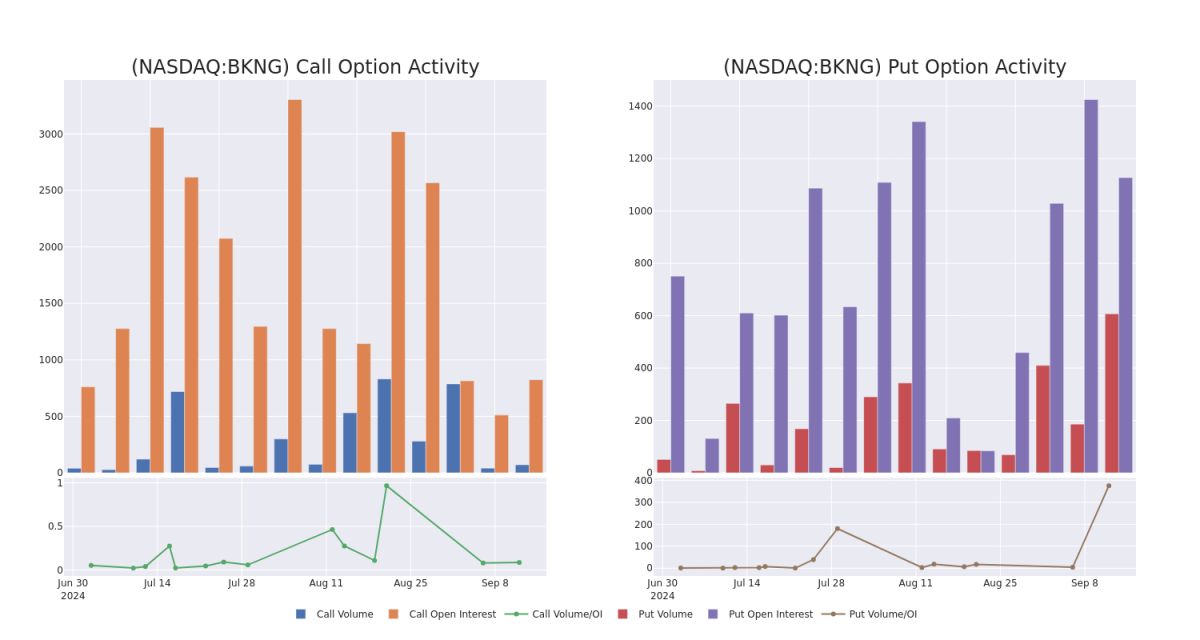

Analyzing Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Booking Holdings's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Booking Holdings's whale activity within a strike price range from $2000.0 to $4900.0 in the last 30 days.

Booking Holdings 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BKNG | CALL | SWEEP | NEUTRAL | 09/27/24 | $129.9 | $122.6 | $126.15 | $3955.00 | $252.3K | 0 | 20 |

| BKNG | CALL | SWEEP | BEARISH | 09/27/24 | $130.1 | $119.2 | $123.1 | $3955.00 | $246.0K | 0 | 20 |

| BKNG | CALL | TRADE | BEARISH | 01/17/25 | $2077.9 | $2074.6 | $2074.6 | $2000.00 | $207.4K | 297 | 20 |

| BKNG | CALL | TRADE | BEARISH | 01/17/25 | $2072.5 | $2066.6 | $2066.6 | $2000.00 | $206.6K | 297 | 11 |

| BKNG | CALL | TRADE | BULLISH | 01/17/25 | $2061.8 | $2052.8 | $2061.8 | $2000.00 | $206.1K | 297 | 22 |

About Booking Holdings

Booking is the world's largest online travel agency by sales, offering booking and payment services for hotel and alternative accommodation rooms, airline tickets, rental cars, restaurant reservations, cruises, experiences, and other vacation packages. The company operates several branded travel booking sites, including Booking.com, Agoda, OpenTable, and Rentalcars.com, and has expanded into travel media with the acquisitions of Kayak and Momondo. Transaction fees for online bookings account for the bulk of revenue and profits.

Having examined the options trading patterns of Booking Holdings, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Booking Holdings Standing Right Now?

- Trading volume stands at 115,632, with BKNG's price up by 1.33%, positioned at $4031.86.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 44 days.

What The Experts Say On Booking Holdings

In the last month, 4 experts released ratings on this stock with an average target price of $4022.5.

- Consistent in their evaluation, an analyst from Morgan Stanley keeps a Equal-Weight rating on Booking Holdings with a target price of $4200.

- An analyst from Jefferies downgraded its action to Hold with a price target of $4200.

- An analyst from Truist Securities downgraded its action to Hold with a price target of $4100.

- An analyst from Cantor Fitzgerald has revised its rating downward to Neutral, adjusting the price target to $3590.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Booking Holdings with Benzinga Pro for real-time alerts.