Goldman Sachs expects that Brent crude oil will recover to $77 per barrel in the fourth quarter of this year, as the market's overly pessimistic sentiment towards oil demand improves and the OECD inventory remains slightly below normal levels, providing some support for oil prices. However, over time, the market's pessimistic expectations for supply and demand balance are gradually increasing, putting further pressure on oil prices next year.

Renowned energy analyst John Kemp recently warned that many institutional investors, including hedge funds, are more pessimistic about oil prices than ever before, as there are signs indicating that the growth engines of the world's major economies are stalling. Investors also concluded that OPEC+ has no choice but to further limit production to support oil prices.

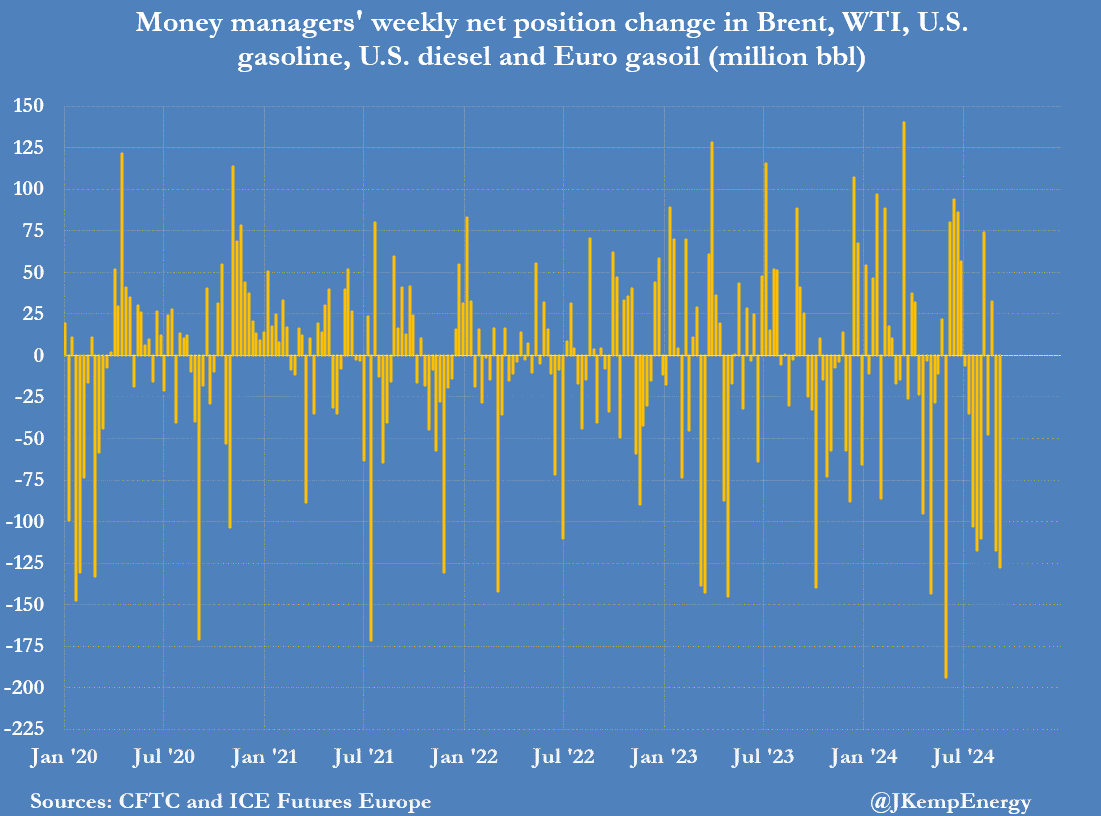

As of September 10, within 7 days, hedge funds and other fund managers have sold the equivalent of 0.128 billion barrels of oil in six of the most important futures and options contracts. Fund managers have been selling oil in eight of the past ten weeks, and their aggregate holdings have decreased by a total of 0.558 billion barrels since early July.

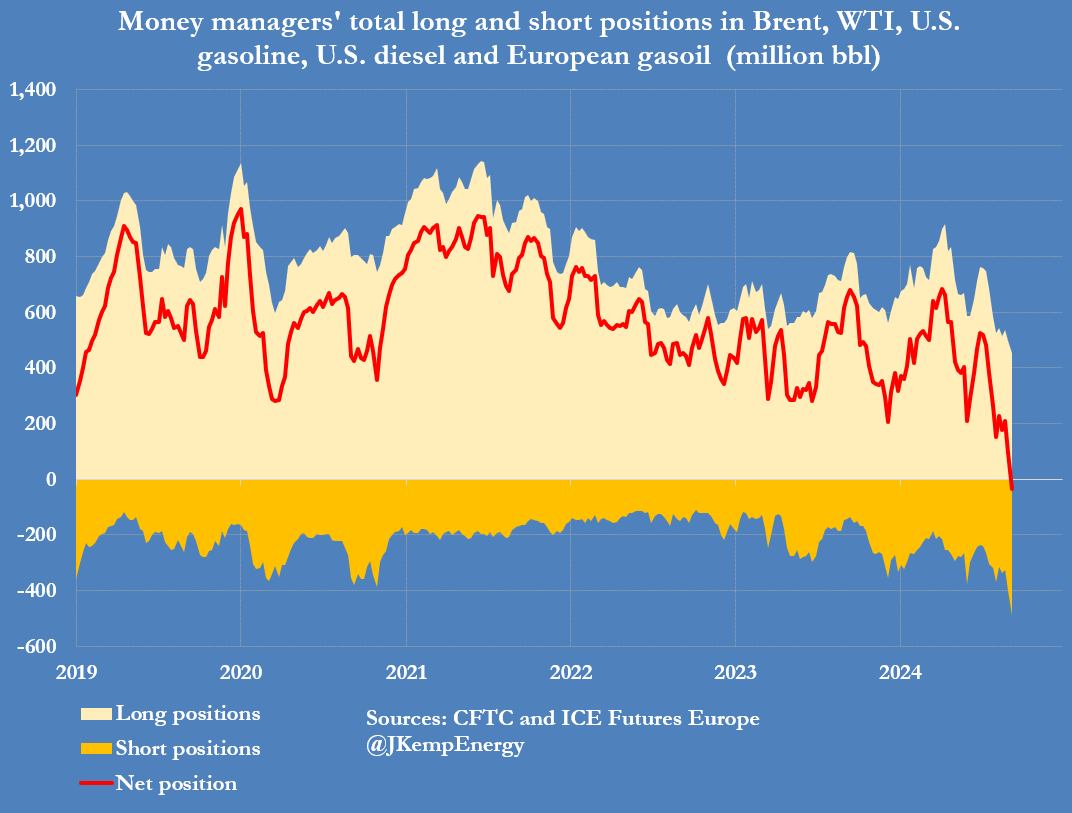

As of now, the fund's crude oil holdings have dropped for the first time from a net long position of 0.524 billion barrels on July 2 to a net short position of 34 million barrels.

As of now, the fund's crude oil holdings have dropped for the first time from a net long position of 0.524 billion barrels on July 2 to a net short position of 34 million barrels.

With hedge funds continuing to sell, Brent crude oil briefly fell below $70, with a 10% drop in the past month.

Looking ahead, Goldman Sachs pointed out in a report released earlier that despite the possibility of a short-term rebound in oil prices, the crude oil market may face more challenges in the long run.

Goldman Sachs analysts Callum Bruce, Daan Struyven, and Yulia Zhestkova Grigsby pointed out in the report that the initial decline in oil prices was triggered by the drop in forward prices, consistent with the strong production performance of U.S. shale oil producers in the second quarter of 2024. However, over time, the market's pessimistic expectations of supply and demand balance have gradually increased, putting further pressure on oil prices next year.

Next year, will there be a serious oversupply? The market has already priced it in.

According to the report, due to the worsening global growth expectations and the spread of economic recession panic, the market's oil demand expectations for the next six months have decreased by nearly 1 million barrels per day.

Goldman Sachs has reduced its global growth expectations by 1 percentage point and raised its expectations for global economic recession by 25 percentage points accordingly. At the same time, Goldman Sachs has raised the possibility of the United States entering a recession in the next year by 5 percentage points to 20%. Goldman Sachs believes that compared to the stock and bond markets, the oil market has a larger reevaluation of the downside risks to growth.

The stock market still prices in robust and continuous growth. We estimate that the probability of an economic recession within the 12 months implied by the bond market, measured by the likelihood of the December SOFR rate being priced below 2%, has increased by 15 percentage points.

The report points out that a seemingly reasonable explanation is that the oil market has become more forward-looking and has priced in a severe supply glut for 2025. Goldman Sachs writes:

Oil prices typically reflect expectations two quarters ahead of the spot market. When inventories are above average levels, prices reflect future expectations more. When inventories are below average levels, prices need to reflect the risk of recent inventory shortages.

When the oil market has been in a low inventory state for a period of time and begins to transition into a state of ample supply, where inventories exceed normal or historical average levels, market concerns about future supply shortages decrease.

This transition affects market evaluations of oil prices, particularly the spread between spot contracts and forward contracts, at which point the convenience yield of holding physical oil decreases.

"Shortsighted" bull market and "farsighted" bear market.

According to Goldman Sachs' basic assumption, Brent crude oil is expected to recover to $77 per barrel in the fourth quarter of this year, because the market's excessively pessimistic sentiment regarding oil demand has improved, market pricing and valuation have recovered somewhat, and OECD inventory is slightly below normal levels, providing some support to oil prices.

We maintain a more optimistic attitude towards global oil demand, especially outside of Asia, and expect the overly pessimistic demand concerns to fade away.

Although we forecast an excess of 0.7 million barrels per day in 2025, we expect the increase in inventory in emerging markets and strategic petroleum reserves (SPR) to keep OECD inventory below normal levels.

This has been confirmed in the high-frequency basic data on global oil inventory over the past 8 weeks. Our global oil inventory tracking shows that the substantial reduction in oil inventory over the past 8 weeks has exceeded 1 million barrels per day.

The report also cautions that if the market continues to underestimate current oil prices, it may hinder the recovery of valuations. If the current underestimation continues to be at the 25th percentile in history, then Brent oil in the fourth quarter may stall near $72 per barrel, $5 lower than Goldman Sachs' basic assumption.

Editor/Somer