This week, the enthusiasm for the technology stocks, cryptos, and junk bond markets has once again heated up, boosting the confidence of fund managers, as they expect policy makers to rarelly lower interest rates by half a percentage point.

Market participants widely expect Federal Reserve Chairman Jerome Powell to take decisive monetary policy action, which traders are closely monitoring and initiating a new round of bets, hoping for a soft landing of the economy. This week, the enthusiasm for the technology stocks, cryptos, and junk bond markets has once again heated up, boosting the confidence of fund managers, as they expect policy makers to rarelly lower interest rates by half a percentage point. $NASDAQ 100 Index (.NDX.US)$ After a significant decline in the previous week, the market has shown a reversal trend by rising for five consecutive days this week, resulting in a cumulative increase of nearly 6%.

This is the latest turn in the recent market narrative. After almost yielding to expectations of an economic recession, stock traders are starting to believe that growth is sustainable, especially with the anticipated arrival of loose monetary policy. Some optimistic investors even see an ideal investment environment: an active Federal Reserve, likely to inject vigor into the still expanding economy through substantial rate cuts.

Pria Misra, portfolio manager at JPMorgan Asset Management, said, 'For the stock market, the best scenario is a strong economy with lower interest rates. A 50 basis point cut is good news, as it shows that the Fed doesn't want to fall behind the situation.'

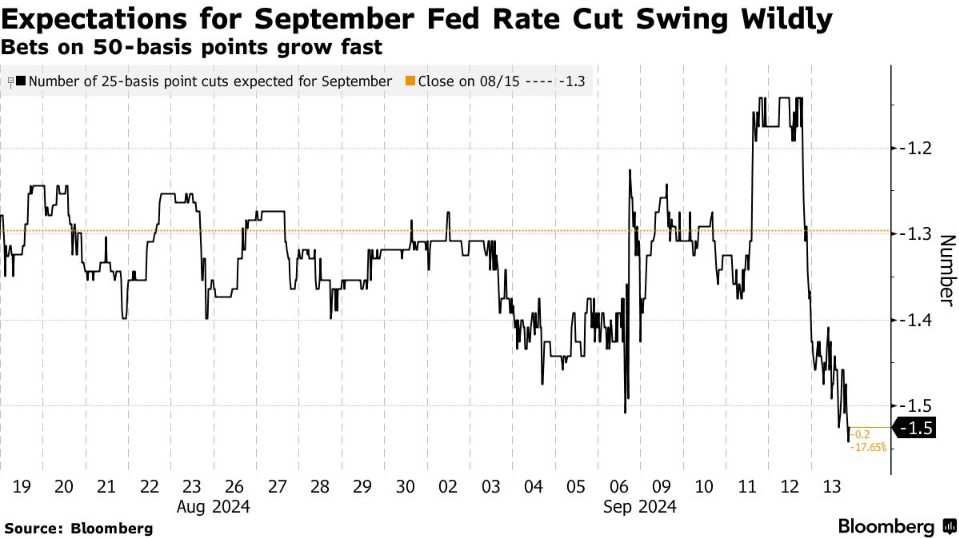

On Friday, the futures market once again bet heavily on a significant cut in benchmark interest rates, while just a few days ago, the market thought the possibility of a rate cut was unlikely. This shift has driven the strong rise of stocks that are considered beneficiaries, including cheap stocks, small companies, and high dividend companies, while the USD exchange rate has fallen.

Before the Fed meeting on September 17-18, there was increasing debate about the magnitude of the first rate cut. The pricing in the futures market indicated a 43% chance of a 50 basis point cut, up from 25% a few days ago, but down from the probability of nearly 60% a week ago.

Currently, the interest rate futures market predicts that by the end of this year, there is the highest probability of a 100 basis point rate cut, and a further 150 basis point rate cut is expected in 2025. The September Summary of Economic Projections is expected to imply more accommodative policies than in June, mainly in response to the deterioration of the labor market. In June, officials' median forecast showed that the unemployment rate would reach 4% by the end of this year. The unemployment rate in July was already 4.3% and slightly fell to 4.2% in August.

The S&P 500 index rose 4% in five trading days, marking the best single-week performance since November and is now less than 50 points away from the historical high set in July. The junk bond market also saw a rise as a major exchange-traded fund ended its two-week decline.

However, this week saw record highs for gold prices and a 15-month low for 10-year US Treasury yields, both of which can be interpreted as signals of economic deterioration. Despite better-than-expected consumer price data and a relatively healthy labor market, this suggests that monetary policy should proceed cautiously. Former New York Fed President William Dudley, JPMorgan's Michael Feroli, and other economists believe that the Fed should further cut rates to avoid falling behind the situation.

Feroli wrote in Friday's report: "We believe what the Fed should do next week is clear: cut the policy interest rates by 50 basis points to adjust to the evolving risk balance."

Raphael Thuin, head of capital markets strategy at Tikehau Capital, stated that the Fed is walking a delicate line. "The Fed may disrupt the markets by cutting rates by 50 basis points to address economic weakness, possibly causing volatility before the end of the year," he said. "On the other hand, if the 50 basis point rate cut is in response to favorable inflation data and central bank officials also provide reassuring communication, it may boost risk assets."

Regardless of how policymakers act, Doug Ramsey, Chief Investment Officer at Leuthold Group, doubts the sustainability of the stock market celebration. He pointed out that the unique characteristics of the current rise in risk assets may indicate a short lifespan, including valuations that have never been reset due to a comprehensive economic downturn.

Leuthold's data shows that out of the past 12 bull markets, only 4 started outside of an economic recession, and on average lasted only half as long as other bull markets. He wrote in a report: "Bull markets lacking the traditional 'father image' of a recession often have shorter lifespans than genetically superior bull markets, with the S&P 500 index rising only a third as much as the latter." "If the current bull market's performance matches the average performance of the previous four most cyclical bull markets, it will last until May 2025, with the S&P 500 index reaching a peak of 5,852 points - about 8% higher than the closing price on September 6th. Not very good."

Hedge funds are also cautious, with brokers from Morgan Stanley's team stating that hedge funds have reduced their net stock exposure to the lowest level since the end of last year. EPFR Global data compiled by Bank of America shows that overall, market positioning has become more cautious, with U.S. stock funds experiencing their largest weekly outflow since April.

Doubters also point out that the pace of interest rate changes reflected in federal funds futures - exceeding two percentage points over the next 12 months - is rarely seen outside of an economic recession. James St. Aubin, Chief Investment Officer of Ocean Park Asset Management, said: "With the S&P index near historical highs and narrow credit spreads, the Fed's massive interest rate cuts to start the easing cycle seem to only happen when the Fed knows something others do not." "I believe a 50 basis point rate cut could have more harm than good on market sentiment. If necessary, there is still a lot of room for further rate cuts in the future. We just haven't reached that stage yet."

Editor/new