Bank of America strategist stated that the stock market may trade sideways and fluctuate before clear signs of weakness or strength in US employment data are shown.

A team led by Michael Hartnett stated that there are several market factors supporting both bullish and put claims. While optimists argue that technology and semiconductor stocks - including this year's leader nvidia - have rebounded from key technical levels, pessimists warn that 'nothing good will happen' when bond yields and bank stocks both decline.

In a report, Hartnett wrote that a clear direction in employment will 'eliminate autumn uncertainty', after non-farm payrolls increased by 0.142 million in August, below analysts' expectations. 'Before that, risks will rotate rather than rupture or retreat'.

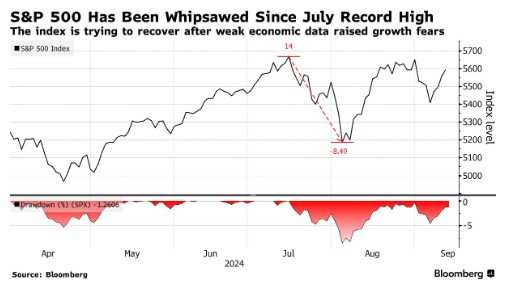

Since mid-July, the US stock market has been fluctuating due to concerns about an economic recession caused by weak employment data. This has also led investors to speculate on the extent of potential rate cuts by the Fed in the coming months.

Derivative data shows that traders are currently expecting a reduction of over 100 basis points by the end of 2024, with a 25 basis point cut expected next week.

While the S&P 500 index rose last year, Hartnett remained bearish on the stock market, stating a preference for bonds in 2024.

The next employment report from the US Department of Labor will be released on October 4th. Hartnett has indicated that he still favors bonds and gold. For stock investors, he recommends investing in resource stocks and real estate investment trusts, among other bond-sensitive industries.

Editor/Lambor