Financial giants have made a conspicuous bearish move on T-Mobile US. Our analysis of options history for T-Mobile US (NASDAQ:TMUS) revealed 8 unusual trades.

Delving into the details, we found 37% of traders were bullish, while 50% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $206,440, and 3 were calls, valued at $140,497.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $170.0 and $230.0 for T-Mobile US, spanning the last three months.

Analyzing Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for T-Mobile US's options for a given strike price.

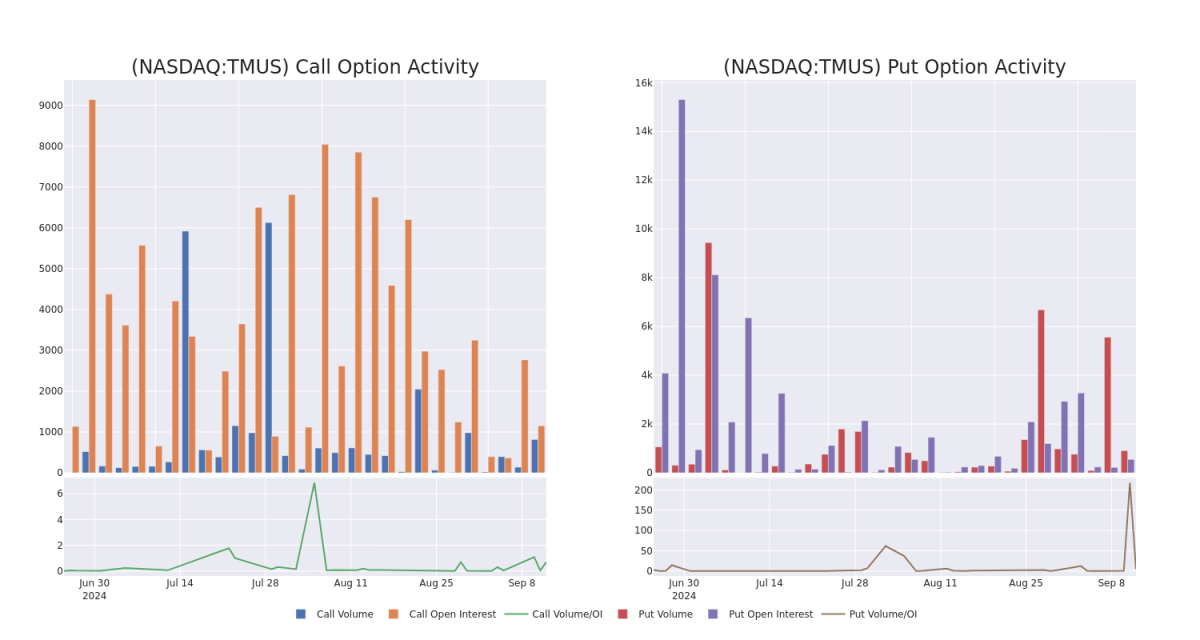

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of T-Mobile US's whale activity within a strike price range from $170.0 to $230.0 in the last 30 days.

T-Mobile US Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TMUS | CALL | SWEEP | BEARISH | 03/21/25 | $5.35 | $4.65 | $4.65 | $230.00 | $72.2K | 227 | 588 |

| TMUS | PUT | TRADE | BEARISH | 06/20/25 | $13.35 | $12.9 | $13.35 | $200.00 | $64.0K | 330 | 235 |

| TMUS | PUT | SWEEP | BULLISH | 03/21/25 | $3.35 | $3.3 | $3.3 | $170.00 | $47.5K | 101 | 250 |

| TMUS | CALL | SWEEP | NEUTRAL | 03/21/25 | $4.65 | $4.6 | $4.65 | $230.00 | $41.1K | 227 | 588 |

| TMUS | PUT | SWEEP | BEARISH | 11/15/24 | $7.1 | $7.05 | $7.1 | $200.00 | $36.9K | 119 | 160 |

About T-Mobile US

Deutsche Telekom merged its T-Mobile USA unit with prepaid specialist MetroPCS in 2013, and that firm merged with Sprint in 2020, creating the second-largest wireless carrier in the us T-Mobile now serves 77 million postpaid and 21 million prepaid phone customers, equal to around 30% of the us retail wireless market. The firm entered the fixed-wireless broadband market aggressively in 2021 and now serves more than 5 million residential and business customers. In addition, T-Mobile provides wholesale services to resellers.

Having examined the options trading patterns of T-Mobile US, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

T-Mobile US's Current Market Status

- With a trading volume of 1,710,178, the price of TMUS is up by 1.7%, reaching $201.92.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 41 days from now.

What Analysts Are Saying About T-Mobile US

1 market experts have recently issued ratings for this stock, with a consensus target price of $230.0.

- Consistent in their evaluation, an analyst from Wells Fargo keeps a Overweight rating on T-Mobile US with a target price of $230.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for T-Mobile US with Benzinga Pro for real-time alerts.