This article comes from Sina Hong Kong stocks, and part of the content is comprehensive from magnesium engraved real estate.

On January 6th, Hong Kong businessman Joseph Lau recently made a new move, losing 1.6 billion of his shares in Evergrande in 2019 and reducing its floating profit from 6.6 billion to 5 billion at the end of 2019. Chinese property owners, especially Gan Bichang, can't help but wonder: how did Hong Kong tycoon Joseph Lau become a big fan of Evergrande? What does the organization think of the increasing ownership of Evergrande by Chinese property owners? What happened to Joseph Lau and his Chinese property owners behind the growing ownership of Evergrande?

In 2019, Evergrande has a loss of 1.6 billion and a dividend of 1.8 billion.

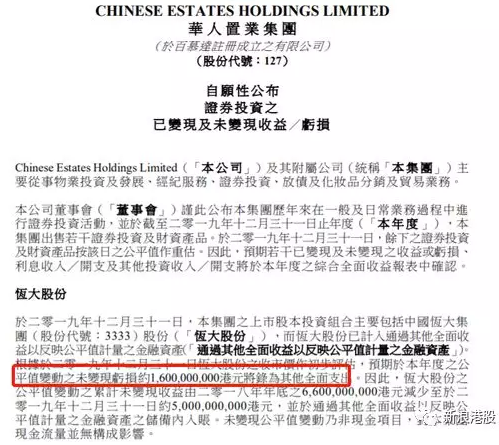

On January 3, the Chinese Real Estate Group announced that the unrealised loss on the change in the fair value of its holdings of Evergrande shares this year is expected to be about HK $1.6 billion, which will be recorded as other comprehensive expenses. After a 1.6 billion loss on its investment in Evergrande in 2019, the accumulated unrealised income of Chinese property buyers through changes in the fair value of their holdings in Evergrande decreased from HK $6.6 billion at the end of 2018 to about HK $5 billion at the end of 2019.

After the announcement, Chinese property fell 0.63% last Friday and fell 1.75% today. The latest offer is HK $6.18, with a market capitalization of HK $11.8 billion.

After the announcement, Chinese property fell 0.63% last Friday and fell 1.75% today. The latest offer is HK $6.18, with a market capitalization of HK $11.8 billion.

It is worth noting that Chinese property buyers have repeatedly bought shares of Evergrande Group through the open market since April 2017. the floating profit in 2017 is nearly 10 billion Hong Kong dollars, and the profit is only 5 billion a few days ago, which is half the level of floating earnings in 2017.

Although the market value of Evergrande's stake in Joseph Lau has shrunk by 1.6 billion, Evergrande's arrogant handout of red envelopes is about to be accounted for. The total distributable profits of Evergrande shareholders in 2018 were as high as 37.4 billion yuan, with a total dividend of 18.7 billion yuan according to the 50% distribution ratio. According to statistics from Sina Hong Kong stocks, Joseph Lau and Chen Kaiyun will receive a "big red envelope" of about 1.672 billion yuan, which is HK $265 million more than a floating loss of HK $1.6 billion.

How did Joseph Lau become a big fan of Evergrande?

The relationship between Chinese property and Evergrande can be traced back to at least 2009. The Chinese invested in Evergrande IPO, and then began to help each other with real money.

However, the preference of Chinese property buyers for Evergrande may come more from the recognition of Xu Jiayin's personal ability by the Liu Luanxiong family. Liu Luanxiong Xu Jiayin is 7 years old, but this does not affect their mutual attraction under the same magnetic field, and has been shown in all aspects during Lau Luanxiong's illness.

In 2016, Liu Luanxiong had a kidney transplant due to kidney failure. After the operation, he was extremely thin. Gamby never left his body and took care of him with an open mind. Liu's physical and mental condition gradually recovered. The following year, in December, Joseph Lau formally married Chen Kaiyun (Gamby) and righted her to become Mrs Liu. Surprisingly, shortly after marriage, Gamby became pregnant for the third time and gave birth to a daughter at the age of 38, which shows that Luanxiong Lau is getting better.

After that, Joseph Lau allocated more than 50% and more than 24% of the shares to his wife Chen Kaiyun and his eldest son Liu Mingwei on health grounds. Chen Kaiyun not only received more than 11.3 billion yuan in shares, but also was appointed executive director of Chinese real estate. Her fortune soared to more than 54.7 billion Hong Kong dollars, making her the richest woman in Hong Kong in 2017.

It is reported that Chen Kaiyun, 37, officially married Joseph Lau in November 2016, becoming the second wife of the Hong Kong tycoon. Mr Lau then gave a HK $1.05 billion Wan Chai real estate project to Gamby. The biggest one came in January 2017, when Mr. Lau gave his wife Gamby a private shopping mall in Tsim Sha Tsui called The One, which was valued at about 18 billion Hong Kong dollars (16 billion yuan).

After receiving a large fortune from Joseph Lau, Gamby is conservatively estimated to be worth about 40 billion Hong Kong dollars (34.7 billion yuan), surpassing the HK $37.2 billion (about 32.2 billion yuan) of Zhu Li Yuehua, the richest woman in Hong Kong and known as the "shell queen" president of Golden Li Fung in 2016. become the youngest woman in Hong Kong.

Liu Luanxiong gradually transferred a lot of wealth to Gamby, which not only liked him, but also related to his poor health in recent years. After giving The One to Gamby, Luanxiong Lau said in an interview that he was not in good health in recent years, so he wanted to prepare Gamby for the worst, so he recently distributed a lot of property to Liu Mingwei, Gamby and her children so that she could rely on in the future.

As early as the end of 2016, Joseph Lau is said to have set aside HK $10 billion in cash to be divided equally among Gamby and his eldest son Liu Mingwei before the kidney transplant, indicating that if anyone wants to challenge his will, it will be used in a property lawsuit.

As Mr Lau arranges household chores, his once-glorious real estate business is also fading out, especially in the mainland. In 2015, Chinese property buyers sold four mainland projects to Evergrande twice, with a total value of about HK $8.25 billion, and the Wantong Tower in Wan Chai, Hong Kong, was sold to Evergrande for HK $12.5 billion in November of the same year.

After several asset movements, the performance of Chinese home ownership has changed from the gradual decline in the past few years to an improvement in 2016. According to the report, revenue rose 100.7 per cent in the first half of 2016 from a year earlier, while gross profit rose 76.69 per cent year-on-year to HK $1.356 billion. However, in 2018, the company achieved HK $843 million in revenue, down 44.4 per cent from a year earlier, while profits attributable to shareholders fell 72.6 per cent to 1.015 billion yuan.

It was from this time that Luanxiong Lau and his wife became "die-hard fans" of Evergrande.

Increasing its holdings in Evergrande on the one hand and selling its assets on the other.

Joseph Lau, one of the four richest people in Hong Kong, frequently sold mainland assets while betting "half of the country" on Evergrande, and it was Xu Jiayin who took the offer.

Resell mainland assets to Evergrande, and then buy a large number of Evergrande shares. This capital movement may be in line with the mantra of Joseph Lau that "if you have money together, it is difficult to do it together".

Joseph Lau was also one of the first Hong Kong businessmen to enter the mainland for real estate development. As early as 1987, when he did not know what the villa was in the mainland, he cooperated with Poly and invested in Beijing's first high-end foreign-related apartment and villa Lijing Garden.

After Hong Kong's return to the motherland, Joseph Lau began to invest in mainland real estate on a large scale, with projects in more than a dozen cities, with a cumulative investment of more than 20 billion yuan.

However, since 2015, Joseph Lau has been selling his assets. Most of the recipients are Xu Jiayin, chairman of Evergrande Group. Only three landmark office buildings in Hong Kong sold in 2015, namely, the Wantong Building in the United States, the commercial and residential project in Chengdu and the Yulong Tianfeng project in Chongqing, have cashed in HK $20.75 billion.

Today, the sellable properties of Chinese homes in the mainland have been sold out, with only one property in the Hilton Hotel in Beijing, the Oriental International Building in Beijing, the Luohu Commercial City in Shenzhen and the four Seasons apartment in Beijing, according to the official website.

On the other hand, Luanxiong Lau and Mr. and Mrs. Gamby have greatly increased their holdings in Evergrande shares. In April 2017, Chinese Real Estate sold Shengjing Bank's shares and bought China Evergrande Group's shares at a price of 6.9 billion Hong Kong dollars. According to Chioce, Joseph Lau and his wife Chen Kaiyun have increased their holdings of Evergrande shares since July 19, 2017, with the total number of shares rising from 658 million to 1.173 billion shares and their shareholding ratio from 5.02 per cent to 9 per cent.

In 2017, as Evergrande's share price continued to rise, Xu Jiayin repeatedly topped the rich list, and Evergrande shares rose 458 per cent from HK $4.585 to HK $25.582 at the end of 2017. With the explosive growth of Evergrande's share price, Joseph Lau and Gamby hold shares in Evergrande with a floating profit of well over HK $10 billion. Evergrande's share price fell in 2018, and Chinese home buyers lost another 3.7 billion in their positions and 1.6 billion in 2019. However, he still made a net profit of 5 billion Hong Kong dollars a few days ago.

In addition to increasing their holdings of Evergrande shares, the couple also hold Evergrande bonds. According to a spokesman for Chinese real estate, Luen Lau and Chen Kaiyun currently hold Evergrande bonds with a total face value of US $1 billion, covering different maturity and coupon rates. In this regard, Lau Luen-hsiung and Chen Kaiyun, major shareholders of Chinese real estate, said through a spokesman that the couple had full confidence in Evergrande.

What is the impact of Chinese ownership of Evergrande on its own performance?

As of mid-2019, Chinese real estate owned 6.54% of Evergrande shares and held 857.5 million shares, while Gamby personally owned 316 million shares. Gamby and Joseph Lau together own 8.94% of Evergrande, or about 1.173 billion shares, with a market value of HK $25.4 billion and a float of HK $5 billion.

As of mid-2019, the income of Chinese home buyers was 270 million Hong Kong dollars, down 51.79 percent from the same period last year; the gross profit was 255 million Hong Kong dollars, down 43.44 percent from the same period last year; and the profit attributable to the owners of the company for the period was 845 million Hong Kong dollars, compared with a loss of 364 million Hong Kong dollars in the same period last year.

According to a notice issued by Chinese Real Estate, Chinese Real Estate sells a number of securities investments and financial products, mainly including bonds, and the net realised gain from the sale is expected to be about HK $183.5 million, which will be recognized in this year's profit and loss.

As for the preliminary assessment of the remaining securities investments and treasury products based on estimated quotations, the estimated net unrealised gain of approximately HK $1 billion in changes in fair value for the year will be recognised in profit or loss for the year.

If you add in Evergrande's dividend, the profit of Chinese home buyers in 2019 is still very gratifying.

In response, Wen Jie, a strategist at Everbright Sun Hung Kai, said that China Home has changed from a company with stable recurrent rental income to an investment holding company, and its profit performance is restricted by the value of securities assets. Unless they are optimistic about the performance of their securities assets (such as Evergrande), it is recommended that retail investors should carefully consider the investment risks. Under the current accounting level, the performance of Chinese home ownership will rise and fall greatly, although it does not affect its basic factors, but the book fair value has changed, but it will lead to stock price fluctuations.

Yan Zhaojun, an analyst at Sino-Thai International Strategy, said that Huazhai had earlier stated that it was a long-term holder of Evergrande and that the stock price fluctuations on its books did not have much impact. Huazhai bought a large stake in Evergrande at a low price a few years ago, and although it has increased its holdings at high levels in recent years, it is believed that the cumulative return is still substantial, mainly because Evergrande has paid generous dividends over the past few years, which is enough to offset some of the decline in the share price. On the other hand, Huazhai also invested a large number of high-interest internal housing bonds in 17-19, including Evergrande and Kaisa. The Group also pointed out in the latest announcement that the unrealised return on the bonds reached HK $1 billion.

Edit / Iris

消息公布后,华人置业上周五跌0.63%,今日再度跌1.75%,最新报价6.18港元,市值118亿港元。

消息公布后,华人置业上周五跌0.63%,今日再度跌1.75%,最新报价6.18港元,市值118亿港元。