BT Brands, Inc. (NASDAQ:BTBD) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 19% over that time.

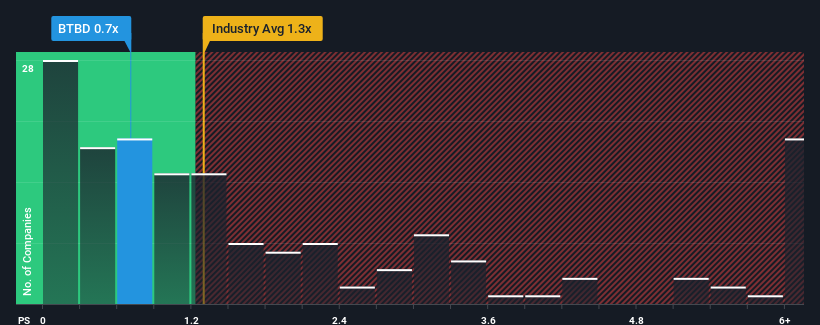

Even after such a large jump in price, it would still be understandable if you think BT Brands is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.7x, considering almost half the companies in the United States' Hospitality industry have P/S ratios above 1.3x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

How BT Brands Has Been Performing

It looks like revenue growth has deserted BT Brands recently, which is not something to boast about. It might be that many expect the uninspiring revenue performance to worsen, which has repressed the P/S. If not, then existing shareholders may be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for BT Brands, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, BT Brands would need to produce sluggish growth that's trailing the industry.

In order to justify its P/S ratio, BT Brands would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. However, a few strong years before that means that it was still able to grow revenue by an impressive 63% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 13% shows it's noticeably more attractive.

With this information, we find it odd that BT Brands is trading at a P/S lower than the industry. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What We Can Learn From BT Brands' P/S?

The latest share price surge wasn't enough to lift BT Brands' P/S close to the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of BT Brands revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 3 warning signs for BT Brands (of which 1 can't be ignored!) you should know about.

If you're unsure about the strength of BT Brands' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.