This year, the industry giants stopped fighting, and "growth" became an important word they frequently mentioned.The start-up wind gradually died down, and more than 300 companies ended up with a scrawl.Life is tough for capital, too. In the first 11 months of 2019, the overall financing deal size of the venture capital circle was only 43% of that of 2018.

By Zhen Xiangqing

As the big three relying on the rise of China Mobile Limited's Internet dividend, "TMD" (byte beat, Meituan, DiDi Global Inc.) will take a completely different path in 2019.

Byte jump is still in a "radical" state, with a new high of investment in 2019, ranking first among the three companies, and all-round development in social networking, search, education, games and other fields, pointing directly to the core business of Tencent and Baidu, Inc.. Even in the search field, said, "go to the first place to do it."

Byte jump is still in a "radical" state, with a new high of investment in 2019, ranking first among the three companies, and all-round development in social networking, search, education, games and other fields, pointing directly to the core business of Tencent and Baidu, Inc.. Even in the search field, said, "go to the first place to do it."

Meituan, who has been criticized for losses for many years, began to shrink the front, focusing on profits, and his market capitalization continued to hit new highs, becoming the third largest listed Internet company after BABA and Tencent.

DiDi Global Inc., who once spent a lot of money on cultivating the market, is slightly quiet. after the hitchhiking incident, it is busy saving the company's image and making up lessons for the hidden dangers brought about by its rapid expansion in the past.

The title "TMD" first became popular in 2015. At that time, DiDi Global Inc. and Meituan, who were good at fighting, were both valued at more than $15 billion, while Jinri Toutiao was valued at far less than $10 billion.

But now, the pattern began to change, and the once backward byte beat surpassed DiDi Global Inc. to rank second in the global unicorn valuation.

As of June 30, 2019, byte jump was valued at $71.7 billion, far exceeding DiDi Global Inc. 's $51.6 billion, according to the 2019 Hurun Global Unicorn list released by Hurun Research Institute. After Meituan went public, his market capitalization hit rock bottom at the end of that year, about US $32.6 billion. After making a profit in 2019, Meituan's market capitalization continued to hit new highs, currently about 76.9 billion US dollars, second only to BABA and Tencent among China's listed Internet companies.

Shen Nanpeng, head of Sequoia Capital, who also invested in "TMD," once told the media that which of the three "TMD" families has more stamina depends on whether they look at five years, ten years or 20 years later. Although the future is unpredictable, by observing the change of "TMD", which was once defined as the second camp of the Internet, we may be able to get a glimpse of the changes that are quietly taking place in the Internet landscape in China.

A radical byte beat:"do whatever you can make money."

Compared with Meituan's rapid contraction of the front and focus on profits after listing, byte beat is still expanding investment and attacking everywhere.

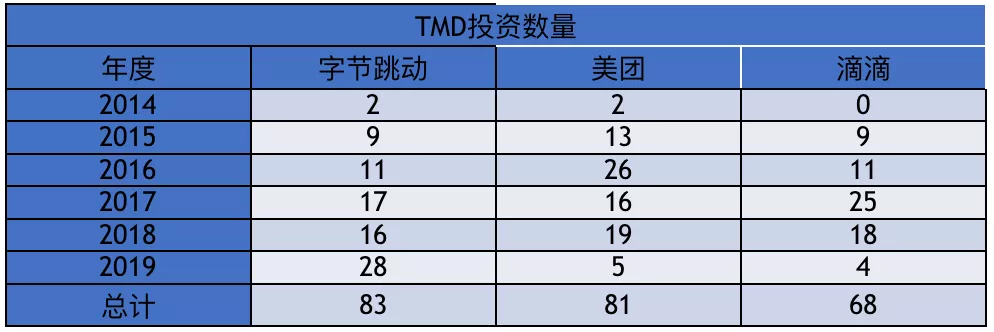

No matter compared with previous years, or compared with DiDi Global Inc. and Meituan, 2019 is the most aggressive year for byte jump investment. According to CVSource, there were 28 investments in 2019, an increase of 12 over 2018, involving education, games and other fields. Meituan and DiDi Global Inc., by contrast, saw a serious decline in investment in 2019 compared with 2018, five and four times respectively.

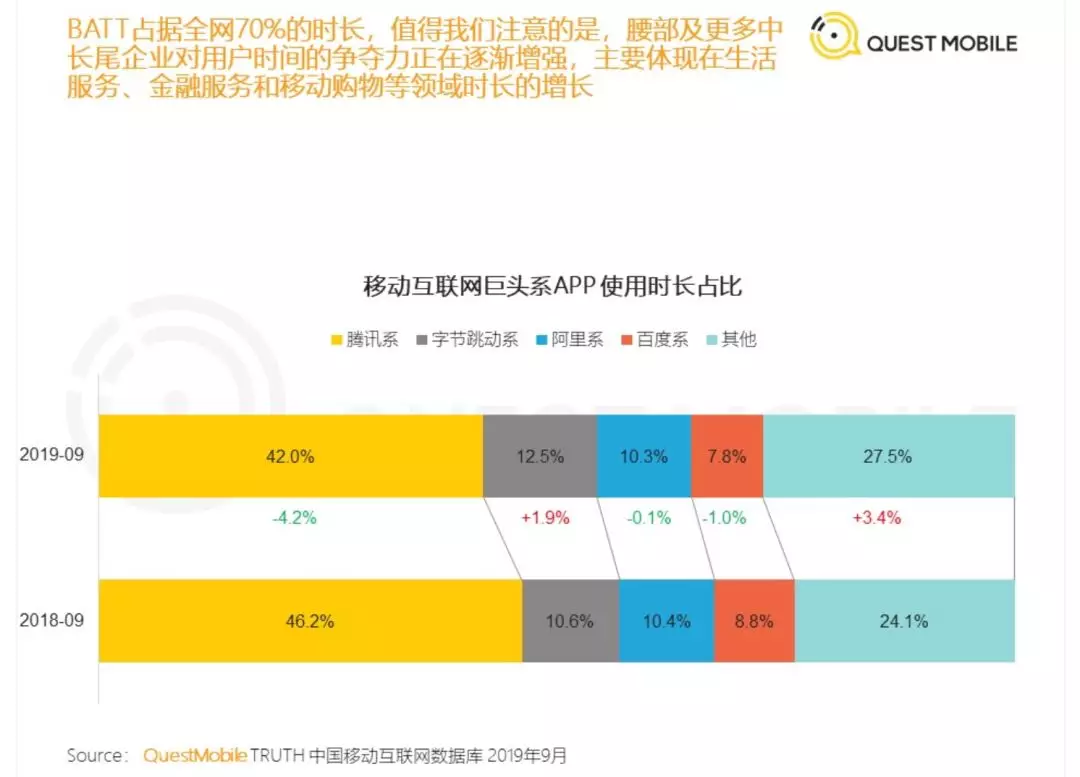

From its own business point of view, Byte Jump already has two popular styles APP "Douyin" and "Jinri Toutiao". At present, in addition to Tencent, the byte jump system APP occupies the longest user time, and is still growing. According to the QuestMobile report, as of September 2019, the proportion of byte-beating APP usage has increased to 12.5%.

However, due to the continuous decline in the growth rate of mobile Internet users and the limited room for future growth, each attack with byte beat is equivalent to seizing the territory of other Internet companies, especially giants.

In July 2019, Zhang Yiming suggested that Jinri Toutiao, the byte-beating main product, was struggling through a growth bottleneck of 180 million DAU, and that without the expansion of search scenarios and high-quality content, Jinri Toutiao might have only 40 million DAU left.

To this end, byte jump online "headline search". Zhu Wenjia, the new CEO of Jinri Toutiao, said bluntly about the competition, "since you must aim at the first thing to do, you must aim at the second." "in order to complete the search layout, byte jump also acquired the interactive encyclopedia wholly-owned in August 2019, in order to mark Baidu, Inc. encyclopedia.

In order to achieve growth, the byte jump, known as the APP factory, is also hoping to produce the next popular style. When Chen Lin, the former CEO of Jinri Toutiao, was transferred to lead the innovation business in 2019, 36Kr Holdings quoted people familiar with the matter as saying that his goal was to "produce the third DAU over 100 million products for byte jump."

Under the management of Chen Lin, he has social, educational and other new businesses. Byte Jump successively launched social products such as multi-flash and chat in 2019, but the craze for the release of new products failed to achieve the rapid and spontaneous growth of users. Data from Qimai show that Duoflash fell off the cliff after reaching a peak of downloads around 450000 when it was just released, and the current number of downloads remains at about 20, 000 a day, while the situation is even worse, with only about 500 downloads per day.

For the education business, the byte jump is very determined. After testing online English in 2018, byte Jump launched K12 online school products through the acquisition of Qingbei online School in 2019. English and K12 are the most competitive areas in the education industry, and this is where the core business of China's two education giants New Oriental Education & Technology Group Hehao's future lies. Byte Jump will face direct competition with the two traditional education giants and online education companies such as vipkid and Yuanfudao.

At present, byte jump has yet to launch a product that has an influence in the education industry, its online English product gogokid has faced layoffs, and the head of Qingbei online school left in October 2019. But this has failed to dampen byte-beating's enthusiasm for education, which acquired part of Smartisan's patent rights in 2019 and plans to release a K12 education hardware product in 2020.

Byte-beating gaming ambitions are also on display in 2019. Game live broadcast, agent distribution has been unable to meet its appetite, byte beat in 2019 to the road to self-research games. To this end, it has acquired two game companies, and set up a team of 100 people, and began to develop their own games-based Oasis project (Oasis Project). According to Caijing, the self-developed game belongs to the strategy department, and the project is also known as "hold back the big move" internally.

Like Tencent, the byte beat with 700 million traffic is not satisfied with only the third-party diversion, but to complete the commercial closed loop, in addition to advertising, education, games and other scenes. A byte-beating insider told Touzhong that "do whatever you can make money" because "there is a lot of traffic now, and the only channel for cash is advertising." "

Meituan, who shrinks the front:Finally make a profit

"2019 may be the worst year in the past decade, but it will be the best year in the next decade. "Wang Xing's saying in Fanfou has been widely quoted. But in the case of Meituan, on the contrary, 2019 was Meituan's best year in the past decade-Meituan made an overall profit for the first time in the second quarter of 2019.

Benefiting from the performance, Meituan walked out of a smile curve in the secondary market. On the last trading day of 2019, Meituan closed at HK $101.9 per share, 1.32 times the closing price of HK $43.9 per share on the last trading day of 2018. At present, Meituan has a market capitalization of about HK $600 billion, second only to BABA and Tencent.

Recalling the listing in 2018, Meituan said frankly in the prospectus, "We have incurred losses since our establishment, and we may continue to incur large losses in the future." Meituan lost 10.5 billion yuan in 2015, 5.8 billion yuan in 2016 and 19 billion yuan in 2017. An adjusted loss of 8.5 billion yuan in 2018.

2019 will be the turning point for Meituan. In the second quarter, Meituan made an adjusted net profit of 1.5 billion yuan, making an overall profit for the first time. In the third quarter, the adjusted net profit was 1.9 billion yuan, the second consecutive quarter of profit.

"on the one hand, Meituan's profit is also the result of BABA's ineffective fighting in local life services. An Internet analyst who follows Meituan once told China.com. The analyst believes that Meituan's commission rate (note: commission ratio) has increased rapidly, and the stop-loss has become a regular one, reflecting BABA's loss of industry pricing power in the attack on the business.

Indeed, in the field of takeout, Meituan has occupied an absolute advantage and has pricing qualifications in the industry. According to the Trustdata report, in 2019, the share of Meituan takeout business continued to rise to 65.8 percent, while the Alibaba echelon ele.me + ele.me Xuan (note: the original Baidu, Inc. takeout, has been acquired by ele.me) continued to decline to 32.2 percent, the takeout sector basically took shape at 2:1.

The flip side of profit is that in 2019, Meituan will no longer attack everywhere, but shrink the front. A Meituan employee told China Investment Network that Meituan opened too many business lines before the listing and cut a lot after listing in order to save costs.

The flip side of profit is that in 2019, Meituan will no longer attack everywhere, but shrink the front. A Meituan employee told China Investment Network that Meituan opened too many business lines before the listing and cut a lot after listing in order to save costs.

At present, Meituan's innovative business mainly includes sharing bicycles, online car-hailing, catering management system, fresh retail. In terms of online car-hailing, Meituan adopted an aggregation model with less investment; in terms of fresh retail, Meituan's baby elephant fresh and Meituan bought vegetables, which did not show combat effectiveness compared with box horse Xiansheng and super species.

Meituan's strategic focus has shifted from C to B. At the beginning of 2019, Meituan announced that Meituan will focus on the B end in 2019, investing 11 billion yuan, and the focus of Meituan's 10000 employees will also shift from consumers to businesses. For example, the large-scale operation of catering supply chain platform fast donkey purchase; the launch of "steamed bread direct employment" blue-collar recruitment platform to help merchants solve the recruitment problem of blue-collar workers.

Wang Xing once said in an interview with Caijing, "in the long run, if Meituan only makes a very shallow connection, it is worthless." So we are making deeper connections in all vertical industries, and we are now providing ERP systems to catering bosses, and we will go to B and go deeper. "

Anxious DiDi Global Inc.:Reshape the image

DiDi Global Inc. is the only Internet upstart who has a hard time among the three small giants of TMD.

After the hitchhiking accident, DiDi Global Inc. was more likely to "correct his name" in 2019, making up lessons for the safety risks brought about by rapid expansion in the past.

The impact of the security incident on DiDi Global Inc. is obvious. According to Aurora Mobile Limited and big data, DiDi Global Inc. 's average monthly travel DAU fell from about 16 million in August to 11.057 million in December, and nearly 5 million in four months. The security incident even led to a sharp decline in the entire travel market. Bain Research once predicted that the total value of transactions in China's travel market would reach $72 billion by 2020, but according to the latest forecast, that figure will moderate to $60 billion in 2021.

Safety has become the focus of DiDi Global Inc. in 2019. Slogans and videos are everywhere in DiDi Global Inc. 's headquarters building, and even the words "all in is safe wholeheartedly" are affixed to the door panels on the inside of the bathroom, according to AI Finance.

In order to get closer with users, DiDi Global Inc. founder Cheng Wei became active in Weibo Corp, posting 42 posts on Weibo Corp in 2019. The last time Cheng Wei released Weibo Corp intensively, it was when DiDi Global Inc. expanded at a high speed in 2014.

Liu Qing, president of DiDi Global Inc., not only became active in Weibo Corp, but also made her debut in variety shows. In September, DiDi Global Inc. jointly launched the self-made talk show "spit Didi" with a group of employees to respond to complaints. In December, DiDi Global Inc., as a joint producer, launched the talent variety show "Let's go, Shifu!" The contestants in the program are all drivers from DiDi Global Inc., tick-tock and other travel platforms.

While DiDi Global Inc. makes concessions to safety and is busy making up lessons, a new round of challenges will begin again.

In 2019, Gao de, Meituan and other converged travel platforms came to the fore, and part of DiDi Global Inc. 's orders were intercepted. Some industry insiders analyzed that Gao de and Meituan, as aggregation platforms, have natural advantages, and the irreplaceability of the map is there, while Meituan already has the ability to aggregate all traffic and life scenes.

"this will be a challenge for DiDi Global Inc., because before DiDi Global Inc. is my biggest, I have many cars, then after the emergence of this platform, what is DiDi Global Inc. 's advantage left? "

Bain Consulting has released "2018 China's New Travel Market Research", DiDi Global Inc. still dominates the market, accounting for 90% of the transaction volume, but it is hard to say that these are DiDi Global Inc. users. 60% of the orders are not from DiDi Global Inc. 's own APP, they may come from Wechat, Alipay, Amap, Trip.com and other places.

Transport capacity is the problem that DiDi Global Inc. urgently needs to solve at present. After "ALL IN safety", DiDi Global Inc. released data in July, showing that a total of about 300000 drivers were cleared. The Information quoted people familiar with the matter as saying that DiDi Global Inc. can only meet 70% of his required capacity. In Beijing and Shanghai, the problem of insufficient capacity is particularly serious. During the peak period in the core of Beijing, it almost always takes more than 10 minutes to take a taxi.

In order to make up for the lack of transport capacity, DiDi Global Inc. launched the third-party service provider "ride-hailing in seconds" and launched an open platform for ride-hailing, reaching agreements with Guangzhou Automobile, Dongfeng, FAW and other car companies to connect the third-party service providers run by the car companies into the DiDi Global Inc. ride-hailing open platform.

In December 2019, the ride returned 16 months after it went offline. Unlike in the past as a profitable product, the new version of ride is now more important for DiDi Global Inc. to supplement its capacity. In addition, DiDi Global Inc. also focused on the ride-sharing business last year, with the slogan "90% discount" to alleviate the problem of insufficient transport capacity.

A fact that can not be ignored is that DiDi Global Inc. 's valuation has shrunk. At its peak, DiDi Global Inc. was valued at $56 billion in a $4 billion round of financing at the end of 2019, but DiDi Global Inc. was valued at $51.6 billion as of June 30, 2019, according to the Hurun Global Unicorn list released by Hurun Research Institute. On that basis, DiDi Global Inc. 's valuation is now $4.4 billion lower than it was at the end of 2017.

This may not be good news for DiDi Global Inc..

Edit / Sylvie

字节跳动依然处于「激进」状态,2019年投资数量创出新高,位列三家公司第一,并在社交、搜索、教育、游戏等领域全面发展,直指腾讯和百度的核心业务,甚至在搜索领域,称「要奔着第一名去做」。

字节跳动依然处于「激进」状态,2019年投资数量创出新高,位列三家公司第一,并在社交、搜索、教育、游戏等领域全面发展,直指腾讯和百度的核心业务,甚至在搜索领域,称「要奔着第一名去做」。