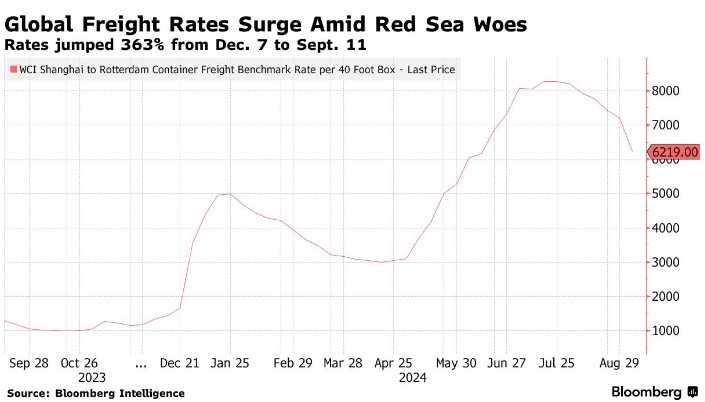

The Red Sea crisis has led to a sharp rise in freight prices in Asia, boosting the performance of shipping companies, while companies that rely on exports have suffered higher logistics costs.

According to the performance of Asian enterprises in the first half of the year, the chain reaction of the Red Sea crisis will continue to bring a high cost to enterprises that produce and export goods, while companies engaged in freight transportation will benefit from higher freight rates. According to institutions, as of mid-July, in order to avoid the risk of attack in the Red Sea, container ships have reduced the traffic volume on narrow channels by about 70% since December last year. This has increased transportation time and costs.

The earnings of Chinese shipping companies, including China Shipping Holdings, have increased due to the increase in revenue from their container shipping business, while Orient Overseas International Ltd. states that its performance on the trans-Pacific trade route has been better due to supply chain tension and rising freight rates. On the other hand, companies such as Miniso (MNSO.US) are being impacted by the rising logistics costs. Dixon Technologies said that the increase in freight rates has affected profit margins. Indian motorcycle manufacturer TVS Motor Co. said that exports are facing longer transportation times.

Bloomberg analysts Lee A. Klaskow and Kenneth Loh said, "The container shipping industry and its connected supply chains have once again been hit, this time by the prolonged crisis in the Red Sea. The recent result is a surge in container freight rates and shipping company earnings."

Bloomberg analysts Lee A. Klaskow and Kenneth Loh said, "The container shipping industry and its connected supply chains have once again been hit, this time by the prolonged crisis in the Red Sea. The recent result is a surge in container freight rates and shipping company earnings."

Houthi rebels control parts of northwestern Yemen and have been attacking ships with drones and missiles since mid-November. The Houthi rebels claim that they are attacking ships associated with Israel and the West in solidarity with Palestine during the ongoing Gaza war. More and more merchant ships are choosing longer routes to bypass the region.

Bloomberg analysts said, "We believe that once the supply chain normalizes, freight rates will return below breakeven levels due to the structural challenges facing the industry. The expanding supply-demand gap could weigh on the prospects of container freight rates and shipping company earnings."

The impact on port operators is mixed. Adani Ports and Special Economic Zone Ltd., India's largest port operator, has seen overall throughput growth, while the container throughput of Gujarat Pipavav Port Ltd. has declined due to smuggling.

Other beneficiaries include companies in the air cargo industry as businesses seek alternative ways to extend transportation times. This has helped Singapore Airlines increase its cargo load factor by 5.9 percentage points year-on-year in the April-June quarter; the airline noted that strong e-commerce traffic and increased demand for air cargo driven by the Red Sea crisis. Cathay Pacific also said that freight volume increased by about 10% from January to June this year; the airline and HSBC analysts expect demand to remain at healthy levels by the end of this year.

Soren Toft, CEO of the world's largest container shipping company, Maersk Line, believes that the Red Sea crisis will not end in the short term. Toft said, 'I believe there will be no solution in the short term' to ensure safe passage in the region.

彭博分析师Lee A . Klaskow和Kenneth Loh表示:“集装箱班轮业及其连接的供应链再次受到打击,这次是受到红海旷日持久的危机的打击。近期的结果是集装箱运价和班轮公司收益飙升。”

彭博分析师Lee A . Klaskow和Kenneth Loh表示:“集装箱班轮业及其连接的供应链再次受到打击,这次是受到红海旷日持久的危机的打击。近期的结果是集装箱运价和班轮公司收益飙升。”