Deep-pocketed investors have adopted a bearish approach towards Procter & Gamble (NYSE:PG), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in PG usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 14 extraordinary options activities for Procter & Gamble. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 28% leaning bullish and 64% bearish. Among these notable options, 3 are puts, totaling $151,047, and 11 are calls, amounting to $1,659,550.

What's The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $155.0 to $195.0 for Procter & Gamble during the past quarter.

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $155.0 to $195.0 for Procter & Gamble during the past quarter.

Analyzing Volume & Open Interest

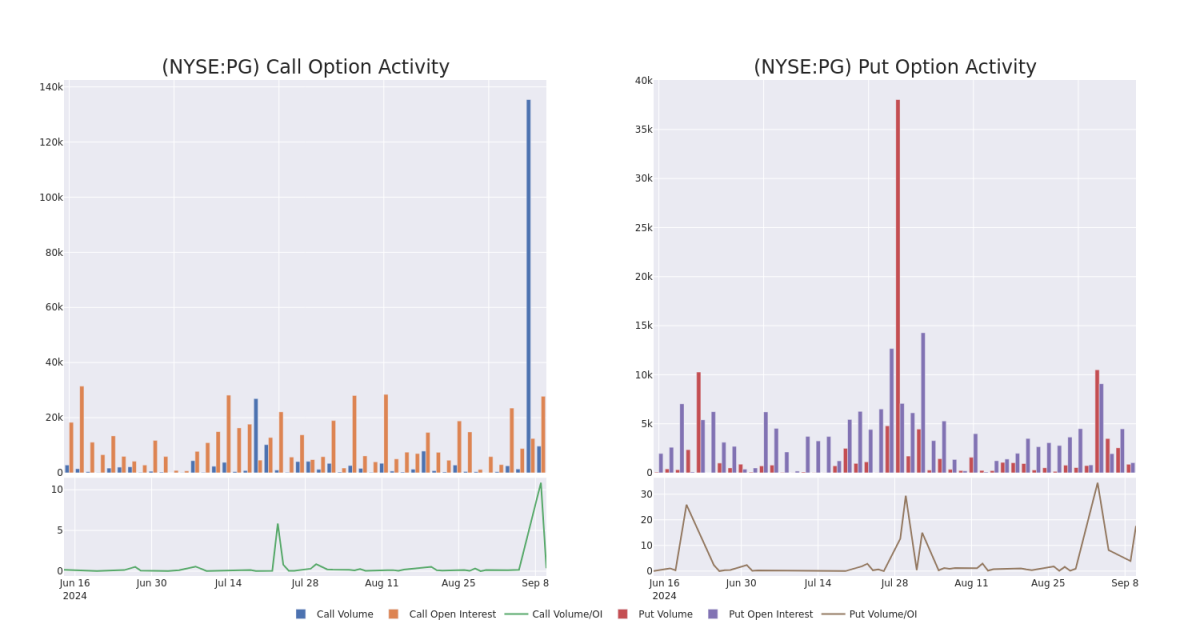

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Procter & Gamble's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Procter & Gamble's whale activity within a strike price range from $155.0 to $195.0 in the last 30 days.

Procter & Gamble Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PG | CALL | SWEEP | BEARISH | 12/20/24 | $6.65 | $6.6 | $6.6 | $175.00 | $431.1K | 2.3K | 673 |

| PG | CALL | TRADE | BEARISH | 01/17/25 | $11.05 | $10.9 | $10.9 | $170.00 | $341.1K | 6.2K | 342 |

| PG | CALL | TRADE | BULLISH | 09/20/24 | $10.3 | $9.8 | $10.3 | $165.00 | $322.3K | 3.5K | 316 |

| PG | CALL | TRADE | BEARISH | 09/20/24 | $5.35 | $5.3 | $5.3 | $170.00 | $206.7K | 8.5K | 632 |

| PG | PUT | SWEEP | BULLISH | 10/18/24 | $1.21 | $1.2 | $1.21 | $165.00 | $86.9K | 3.3K | 757 |

About Procter & Gamble

Since its founding in 1837, Procter & Gamble has become one of the world's largest consumer product manufacturers, generating more than $80 billion in annual sales. It operates with a lineup of leading brands, including more than 20 that generate north of $1 billion each in annual global sales, such as Tide laundry detergent, Charmin toilet paper, Pantene shampoo, and Pampers diapers. Sales outside its home turf represent more than half of the firm's consolidated total.

Current Position of Procter & Gamble

- With a volume of 2,571,277, the price of PG is down -1.77% at $174.64.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 35 days.

Professional Analyst Ratings for Procter & Gamble

1 market experts have recently issued ratings for this stock, with a consensus target price of $190.0.

- An analyst from DZ Bank upgraded its action to Buy with a price target of $190.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Procter & Gamble options trades with real-time alerts from Benzinga Pro.