Currently, there is a huge divergence in the market regarding whether the Federal Reserve will cut interest rates by 25 basis points or 50 basis points on September 18. This week, some Wall Street senior investors have suggested that the Federal Reserve could make a significant 50 basis point rate cut next week without alarming the market.

It is widely expected that Federal Reserve policymakers will lower interest rates at the meeting on September 17-18, but the extent of the rate cut remains uncertain. Last week, disappointing employment data sparked concerns about a slowdown in the labor market and briefly shifted market expectations towards a larger rate cut. However, this week, the expectation of a 50 basis point rate cut has begun to fade.

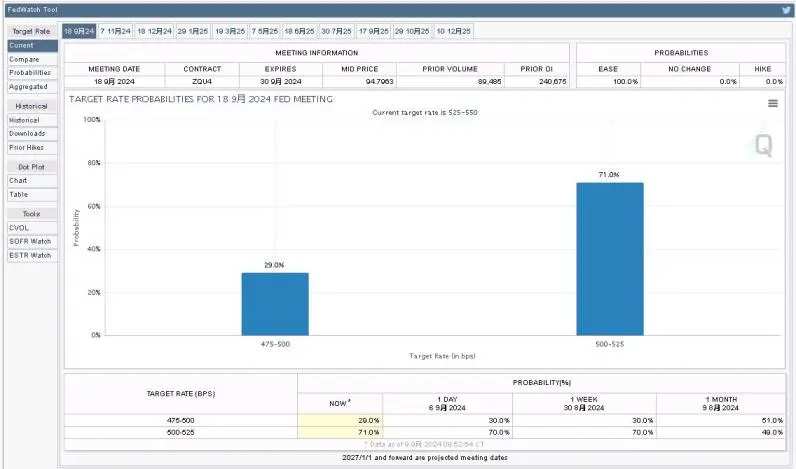

CME Group's FedWatch Tool shows that the current market expects a 29% probability of a 50 basis point rate cut by the Fed in September, and a 71% probability of a 25 basis point rate cut.

Michael Yoshikami, CEO of Destination Wealth Management, said on Monday that a larger rate cut would indicate that the central bank is prepared to take action, but would not signal deeper concerns about a broader recession.

Michael Yoshikami, CEO of Destination Wealth Management, said on Monday that a larger rate cut would indicate that the central bank is prepared to take action, but would not signal deeper concerns about a broader recession.

Michael Yoshikami told the media, "I wouldn't be surprised if the Fed cuts rates by 50 basis points directly." He added, "On one hand, this would be seen as a very positive signal, indicating that the Fed is taking necessary steps to support job growth. I believe the Fed is ready to act preemptively at this point."

Michael Yoshikami's comments echo those made by Nobel laureate Joseph Stiglitz last Friday. Stiglitz said that the Fed should cut rates by 50 basis points at the next meeting, and believed that the Fed had gone "too far, too fast" in its previous policy tightening.

Michael Yoshikami acknowledges that a larger interest rate cut may exacerbate people's concerns about an impending recession, but he insists that this viewpoint is exaggerated and points out that unemployment rates and interest rates are still historically low, and corporate profits have been strong. He further explains that the recent market sell-off is based on the "huge profits" accumulated last month. Despite the volatility earlier this month, all major indices rose in August, and September is traditionally a period of sluggish trading.

Thanos Papasavvas, the founder and chief investment officer of ABP Invest, expressed concern over the potential economic recession. The research firm recently adjusted the probability of a U.S. economic recession from a 'mild' 25% in June to a 'relatively manageable' 30%. However, Thanos Papasavvas still maintains that the fundamental components of the economy, namely manufacturing and unemployment rates, are 'resilient' and he is not worried about the U.S. economy entering a recession.

These views contrast sharply with those of other market observers, such as economist George Lagarias, who stated to the media last week that a significant interest rate cut could be 'very dangerous'.

George Lagarias said, 'I don't think there is a sense of urgency for a 50-basis-point rate cut. A 50-basis-point rate cut might send the wrong message to the markets and the economy. It could signal a sense of urgency, but it could also become a self-fulfilling prophecy.'

Editor/Emily

Destination Wealth Management首席执行官Michael Yoshikami周一表示,更大幅度的降息将表明央行已经准备采取行动,但不会发出对更广泛衰退的更深层次担忧的信号。

Destination Wealth Management首席执行官Michael Yoshikami周一表示,更大幅度的降息将表明央行已经准备采取行动,但不会发出对更广泛衰退的更深层次担忧的信号。