Deep-pocketed investors have adopted a bearish approach towards Affirm Holdings (NASDAQ:AFRM), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in AFRM usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 24 extraordinary options activities for Affirm Holdings. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 29% leaning bullish and 54% bearish. Among these notable options, 12 are puts, totaling $792,968, and 12 are calls, amounting to $700,397.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $20.0 and $60.0 for Affirm Holdings, spanning the last three months.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $20.0 and $60.0 for Affirm Holdings, spanning the last three months.

Insights into Volume & Open Interest

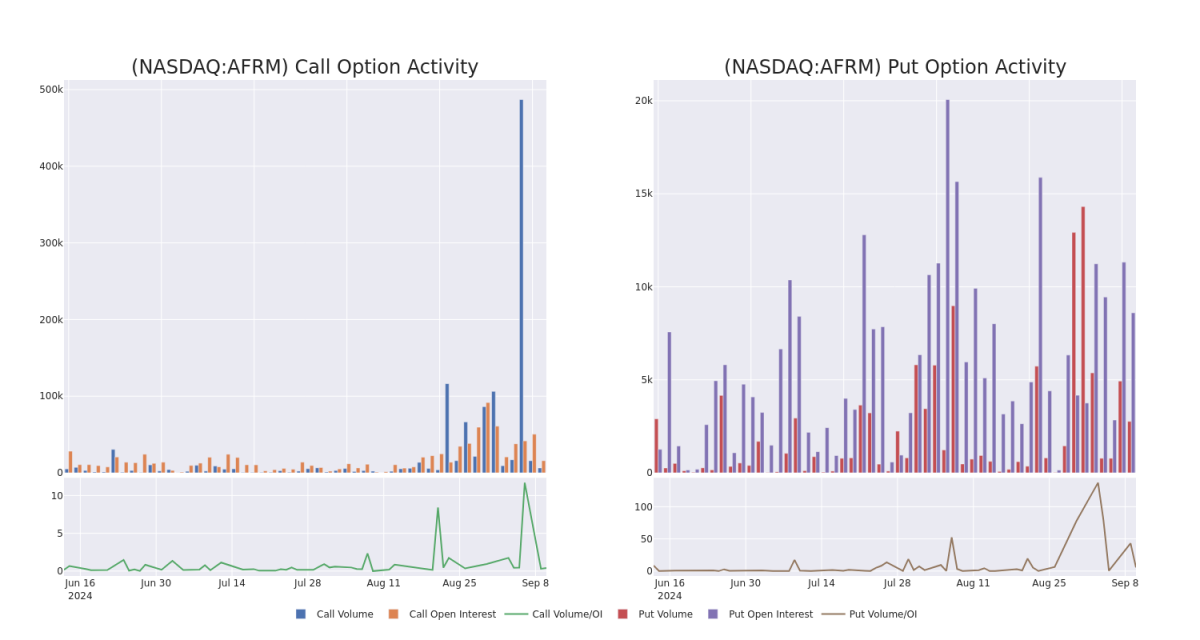

In terms of liquidity and interest, the mean open interest for Affirm Holdings options trades today is 1161.29 with a total volume of 9,000.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Affirm Holdings's big money trades within a strike price range of $20.0 to $60.0 over the last 30 days.

Affirm Holdings 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AFRM | CALL | SWEEP | BULLISH | 09/20/24 | $2.5 | $2.42 | $2.5 | $35.00 | $289.7K | 5.7K | 14 |

| AFRM | PUT | SWEEP | BULLISH | 03/21/25 | $4.95 | $4.85 | $4.85 | $32.50 | $127.5K | 813 | 37 |

| AFRM | PUT | SWEEP | BEARISH | 01/16/26 | $2.93 | $2.91 | $2.93 | $20.00 | $111.6K | 2.0K | 1.5K |

| AFRM | PUT | SWEEP | BEARISH | 02/21/25 | $3.45 | $3.35 | $3.45 | $30.00 | $111.4K | 317 | 484 |

| AFRM | PUT | SWEEP | BEARISH | 02/21/25 | $7.35 | $7.25 | $7.3 | $37.50 | $90.5K | 392 | 124 |

About Affirm Holdings

Affirm Holdings Inc offers a platform for digital and mobile-first commerce. It comprises a point-of-sale payment solution for consumers, merchant commerce solutions, and a consumer-focused app. The firm generates its revenue from merchant networks, and through virtual card networks among others. Geographically, it generates a majority share of its revenue from the United States.

Having examined the options trading patterns of Affirm Holdings, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Affirm Holdings

- Currently trading with a volume of 3,382,389, the AFRM's price is down by -4.06%, now at $36.62.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 57 days.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Affirm Holdings with Benzinga Pro for real-time alerts.