Financial giants have made a conspicuous bullish move on Exxon Mobil. Our analysis of options history for Exxon Mobil (NYSE:XOM) revealed 15 unusual trades.

Delving into the details, we found 53% of traders were bullish, while 33% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $228,805, and 9 were calls, valued at $519,889.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $90.0 to $125.0 for Exxon Mobil during the past quarter.

Analyzing Volume & Open Interest

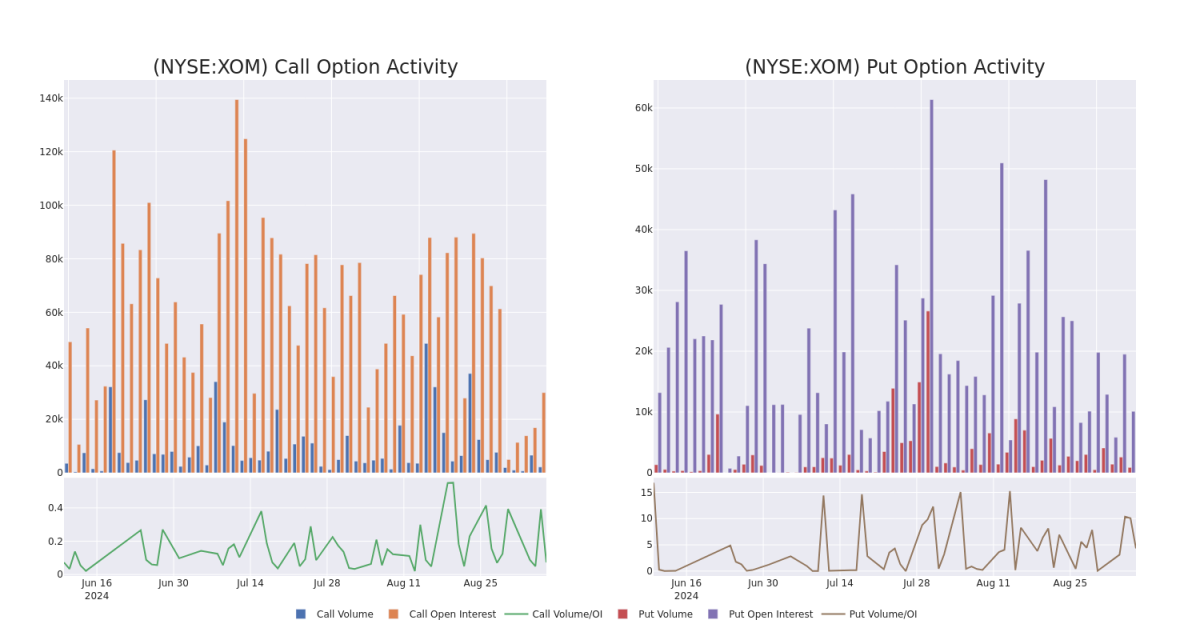

In terms of liquidity and interest, the mean open interest for Exxon Mobil options trades today is 3340.42 with a total volume of 3,072.00.

In terms of liquidity and interest, the mean open interest for Exxon Mobil options trades today is 3340.42 with a total volume of 3,072.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Exxon Mobil's big money trades within a strike price range of $90.0 to $125.0 over the last 30 days.

Exxon Mobil Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| XOM | CALL | TRADE | BEARISH | 01/17/25 | $4.0 | $3.95 | $3.95 | $120.00 | $165.5K | 15.3K | 420 |

| XOM | CALL | SWEEP | BULLISH | 10/18/24 | $2.76 | $2.74 | $2.76 | $115.00 | $82.3K | 4.7K | 717 |

| XOM | CALL | SWEEP | BULLISH | 10/18/24 | $3.2 | $3.1 | $3.2 | $115.00 | $76.8K | 4.7K | 391 |

| XOM | CALL | SWEEP | BEARISH | 01/16/26 | $27.75 | $27.5 | $27.61 | $90.00 | $55.2K | 900 | 21 |

| XOM | PUT | SWEEP | BULLISH | 02/21/25 | $10.35 | $10.25 | $10.25 | $120.00 | $53.3K | 16 | 53 |

About Exxon Mobil

ExxonMobil is an integrated oil and gas company that explores for, produces, and refines oil around the world. In 2023, it produced 2.4 million barrels of liquids and 7.7 billion cubic feet of natural gas per day. At the end of 2023, reserves were 16.9 billion barrels of oil equivalent, 66% of which were liquids. The company is one of the world's largest refiners with a total global refining capacity of 4.5 million barrels of oil per day and is one of the world's largest manufacturers of commodity and specialty chemicals.

Where Is Exxon Mobil Standing Right Now?

- With a volume of 2,525,232, the price of XOM is down -0.6% at $112.49.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 49 days.

What The Experts Say On Exxon Mobil

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $157.0.

- Consistent in their evaluation, an analyst from UBS keeps a Buy rating on Exxon Mobil with a target price of $157.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Exxon Mobil with Benzinga Pro for real-time alerts.