On the evening of the 6th, US stocks opened slightly higher. The number of non-farm employment in the United States increased by 0.142 million in August, lower than expected, which cleared the way for the Federal Reserve's interest rate cut in September.

As of the time of writing, the three major indexes showed mixed performance. $Dow Jones Industrial Average (.DJI.US)$ Up 0.45%,$Nasdaq Composite Index (.IXIC.US)$ Down 0.27%, $S&P 500 Index (.SPX.US)$ Up 0.08%.

On Friday, the US stock market welcomed the highly anticipated labor market data.

According to the US Department of Labor's Bureau of Labor Statistics, the number of non-farm payrolls in the US increased by 0.142 million in August, which was lower than the average forecast of 0.161 million by analysts surveyed by Dow Jones. At the same time, the data for the previous two months have been revised downward. The unemployment rate edged down to 4.2%, the first decline in five months, reflecting a reversal of the temporary layoffs by companies. Average hourly earnings increased by 0.4%.

According to the US Department of Labor's Bureau of Labor Statistics, the number of non-farm payrolls in the US increased by 0.142 million in August, which was lower than the average forecast of 0.161 million by analysts surveyed by Dow Jones. At the same time, the data for the previous two months have been revised downward. The unemployment rate edged down to 4.2%, the first decline in five months, reflecting a reversal of the temporary layoffs by companies. Average hourly earnings increased by 0.4%.

The growth in non-farm payrolls is mainly driven by employment in the healthcare and social assistance sectors. The construction and government sectors also saw job growth. The diffusion index, which measures the breadth of employment growth, increased.

The labor force participation rate in August remained at 62.7%, but the employment participation rate for the 25-54 age group saw a slight decline for the first time since March.

The non-farm payroll jobs created in the US in August were slightly below expectations, and the data for July was revised downward, reflecting a slowdown in the labor market and also clearing the way for the Federal Reserve to cut interest rates later this month.

The non-farm payroll report has sparked debate about the magnitude of the interest rate cut.

The latest non-farm payroll report did not eliminate the uncertainty among Fed officials about whether they will cut interest rates by a more traditional 25 basis points or by a larger 50 basis points, which is likely to intensify the current debate about how much the Fed should cut rates.

The August non-farm payroll data has raised concerns in the market that the Federal Reserve's aggressive interest rate policy is causing a greater slowdown in economic activity than previously expected, fueling speculation that the Fed's next meeting will result in a larger rate cut.

The yield on U.S. Treasury bonds has fallen as market participants expect Fed officials to cut interest rates by 50 basis points at the upcoming meeting to guard against the possibility of continued weakness in employment. S&P 500 futures continue to decline, and the U.S. dollar is experiencing a wider drop.

U.S. Treasury bonds have risen and yields have fallen, with the previously released U.S. employment report being mixed. This has strengthened the traders' bets that the Fed may cut interest rates significantly this month.

The two-year U.S. Treasury bond yield, which is more sensitive to the Fed's policy outlook, briefly fell by 11 basis points to 3.63%. The August employment report released by the U.S. government showed lower-than-expected non-farm payroll growth, but the data for the previous months were revised lower and the unemployment rate decreased.

Swap traders have slightly increased the possibility of a 50 basis point rate cut by the Fed this month. It is widely expected that the Fed will initiate its first rate cut in over four years at this meeting. The market price reflects a probability of a significant rate cut this month, which has increased from around 36% before the data release to around 50%. For the whole of 2024, the current implied rate cut in the swap contract is about 115 basis points, higher than the 108 basis points earlier on Friday.

Analyst Cameron Crise stated that the employment data initially appeared in line with consensus on the surface, despite some revisions to the previous figures. The unemployment rate dropped to 4.2%, in line with the median forecast, but indicating a reversal of the recent upward trend, which provides some relief, especially since the number of employed individuals in households increased by 0.168 million, close to the increase in non-farm employment (0.142 million people) while the participation rate remained unchanged.

Crise pointed out that it should be noted that the data for the previous months was revised downward by 0.086 million, so from this perspective, this report appears somewhat weak. This is unlikely to be a decisive factor for a 25 or 50 basis point rate cut, so Fed Governor Williams' speech in a few hours will be the key.

Robert Pavlik, Senior Portfolio Manager at Dakota Wealth, stated that the August unemployment rate is in line with expectations, lower than the previous report, but upon closer examination of the numbers, it is found that the number of new jobs added has decreased compared to expectations and the previous data has been revised downward, which actually indicates a slowdown in the economy.

Robert Pavlik said, "I don't think this is a sign of an economic collapse, but it is a sign of a slowdown. I think this means a 25 basis point rate cut in September, rather than a larger rate cut."

Federal Reserve officials say that cutting interest rates now is appropriate.

Other reports also show that the job market is losing momentum. While layoffs are still generally restrained, many companies have delayed expansion plans due to high borrowing costs and uncertainty before the November presidential elections.

A survey by the Federal Reserve released this Wednesday on regional businesses shows that employers have become more selective in their hiring in recent weeks. Some companies have shortened work hours and kept vacant positions unfilled.

After the release of non-farm payroll data, John Williams, president of the New York Federal Reserve, said on Friday that given the progress made in reducing inflation and cooling the job market, it is appropriate for the Federal Reserve to cut interest rates now.

Williams said that the Federal Reserve has made "significant progress" in achieving its dual goals of maintaining price stability and full employment, and the risks associated with achieving these goals have reached a "balance". He expressed more confidence that inflation is progressing towards the central bank's target of 2% and added that the labor market is unlikely to be a source of future price pressures.

Williams did not comment on the possible magnitude of the first interest rate cut.

While Williams did not discuss the magnitude of the first interest rate cut, he said that "officials can shift policies to a neutral setting over time, depending on the evolution of data, outlook, and the risks to achieving our objectives."

Nick Timiraos, a well-known financial journalist known as the "Fed whisperer," said, "Williams' prepared remarks did not lay any foundation for a 50-basis-point rate cut. He said that over time, policy can shift to a more neutral stance."

Fed officials have recently hinted that a rate cut in mid-September is almost certain. Officials are satisfied with the slowdown in inflation recovery, and an unexpected setback earlier this year delayed their rate cut plans. But some are now more concerned about maintaining rates at their highest level in 20 years, as the labor market may be slowing down too much.

Therefore, the focus of the debate at the Fed's meeting on September 17-18 is whether to start with a more traditional 25 basis point rate cut or a larger 50 basis point cut to prevent the unwanted softness in the labor market.

Focus stocks

Most growth tech stocks fell, with Broadcom down over 9%, Nvidia and Tesla down nearly 2%.

China concept stocks were mixed, with Nio up nearly 4%, PDD Holdings up nearly 1%, and Li Auto Inc down more than 1%.

$Broadcom (AVGO.US)$ Williams fell more than 9% after the results, with Q3 semiconductor business revenue growth slowing and Q4 revenue guidance below expectations.

$Apple (AAPL.US)$ Rising nearly 1%, Apple completed the latest update of WeChat before the launch of iPhone 16, which also dispelled the previous speculation of "iPhone 16 not compatible with WeChat, choose between iPhone and WeChat."

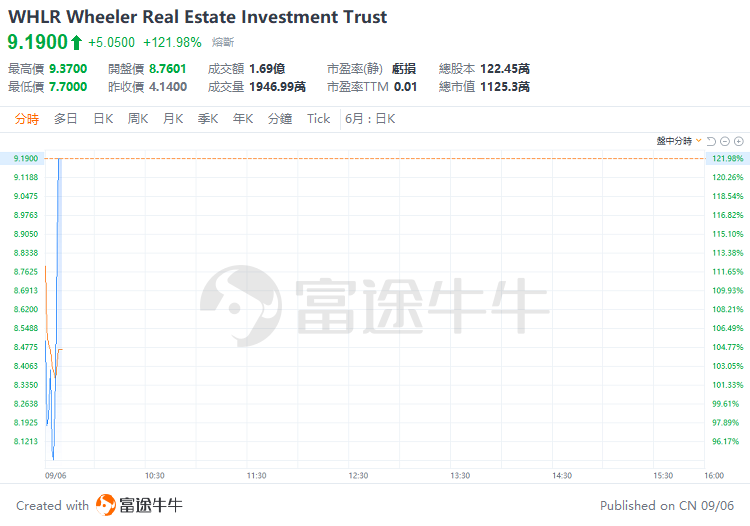

$Wheeler Real Estate Investment Trust Inc (WHLR.US)$ Rising over 120%, the stock price was halted. On the news front, Wheeler announced that the court dismissed a class-action lawsuit against the company, which was related to the company's acquisition of Cedar Realty Trust Inc. in August 2022.

Editor/new

美国劳工部劳工统计局报告称,美国8月非农就业人数增加14.2万,低于接受道琼斯调查的分析师平均预测的16.1万。与此同时,之前两个月的数据被向下修正。失业率微降至4.2%,是5个月以来首次下降,反映出企业临时裁员的形势出现逆转。平均时薪增长0.4%。

美国劳工部劳工统计局报告称,美国8月非农就业人数增加14.2万,低于接受道琼斯调查的分析师平均预测的16.1万。与此同时,之前两个月的数据被向下修正。失业率微降至4.2%,是5个月以来首次下降,反映出企业临时裁员的形势出现逆转。平均时薪增长0.4%。