Whales with a lot of money to spend have taken a noticeably bearish stance on United Rentals.

Looking at options history for United Rentals (NYSE:URI) we detected 10 trades.

If we consider the specifics of each trade, it is accurate to state that 10% of the investors opened trades with bullish expectations and 50% with bearish.

From the overall spotted trades, 3 are puts, for a total amount of $113,231 and 7, calls, for a total amount of $202,876.

From the overall spotted trades, 3 are puts, for a total amount of $113,231 and 7, calls, for a total amount of $202,876.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $450.0 to $740.0 for United Rentals over the recent three months.

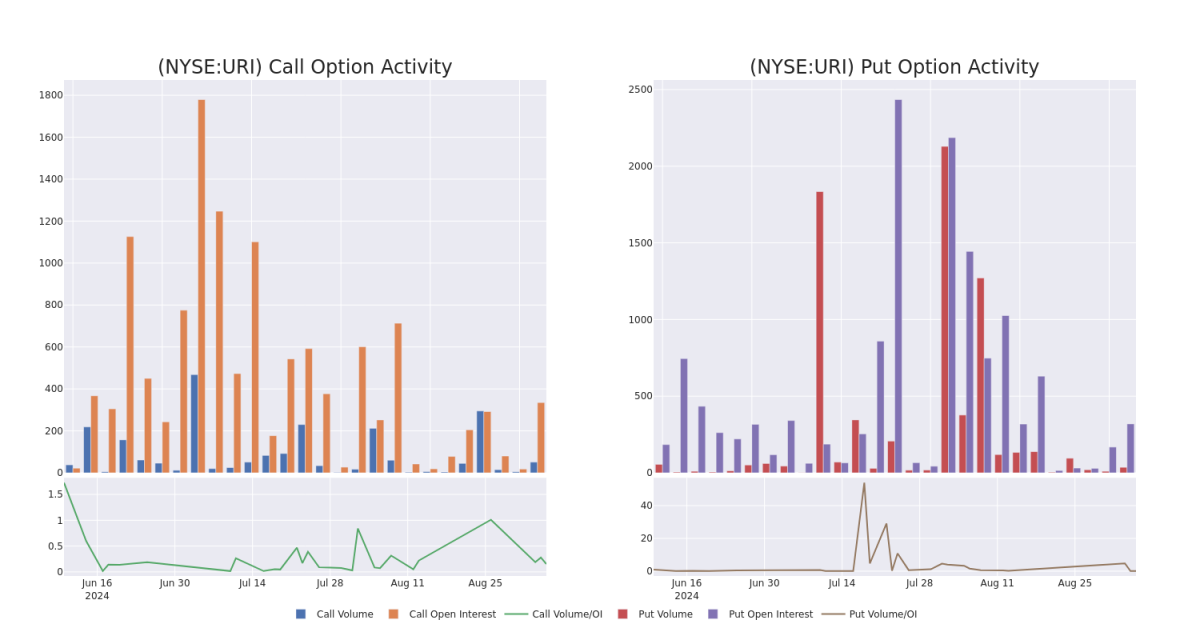

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in United Rentals's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to United Rentals's substantial trades, within a strike price spectrum from $450.0 to $740.0 over the preceding 30 days.

United Rentals Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| URI | PUT | SWEEP | BEARISH | 09/20/24 | $39.8 | $37.8 | $39.8 | $720.00 | $47.7K | 254 | 12 |

| URI | PUT | TRADE | BEARISH | 01/17/25 | $64.9 | $63.5 | $64.9 | $700.00 | $38.9K | 65 | 0 |

| URI | CALL | SWEEP | BEARISH | 12/20/24 | $74.0 | $68.5 | $70.0 | $670.00 | $35.0K | 21 | 5 |

| URI | CALL | TRADE | BULLISH | 10/18/24 | $28.0 | $27.1 | $28.0 | $710.00 | $30.8K | 12 | 11 |

| URI | CALL | TRADE | NEUTRAL | 12/20/24 | $62.0 | $59.7 | $60.73 | $690.00 | $30.3K | 83 | 7 |

About United Rentals

United Rentals is the world's largest equipment rental company. It principally operates in the United States and Canada, where it commands approximately 15% share in a highly fragmented market. It serves three end markets: general industrial, commercial construction, and residential construction. Like its peers, United Rentals historically has provided its customers with equipment that was intermittently used, such as aerial equipment and portable generators. As the company has grown organically and through hundreds of acquisitions since it went public in 1997, its catalog (fleet size of $21 billion) now includes a range of specialty equipment and other items that can be rented for indefinite periods.

After a thorough review of the options trading surrounding United Rentals, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is United Rentals Standing Right Now?

- Trading volume stands at 315,559, with URI's price down by -0.44%, positioned at $697.52.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 48 days.

What Analysts Are Saying About United Rentals

In the last month, 1 experts released ratings on this stock with an average target price of $795.0.

- An analyst from Evercore ISI Group has decided to maintain their Outperform rating on United Rentals, which currently sits at a price target of $795.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.