On September 2nd, heart Wei Medical (6609.HK), the pioneer of neurointerventional medical devices in China, which is listed in Hong Kong, held its 2024 midterm earnings conference, providing a detailed explanation of the company's midterm business performance.

The following are the key points of Heart Wei Medical's 2024 midterm business performance:

Steady revenue growth, approaching the breakeven point

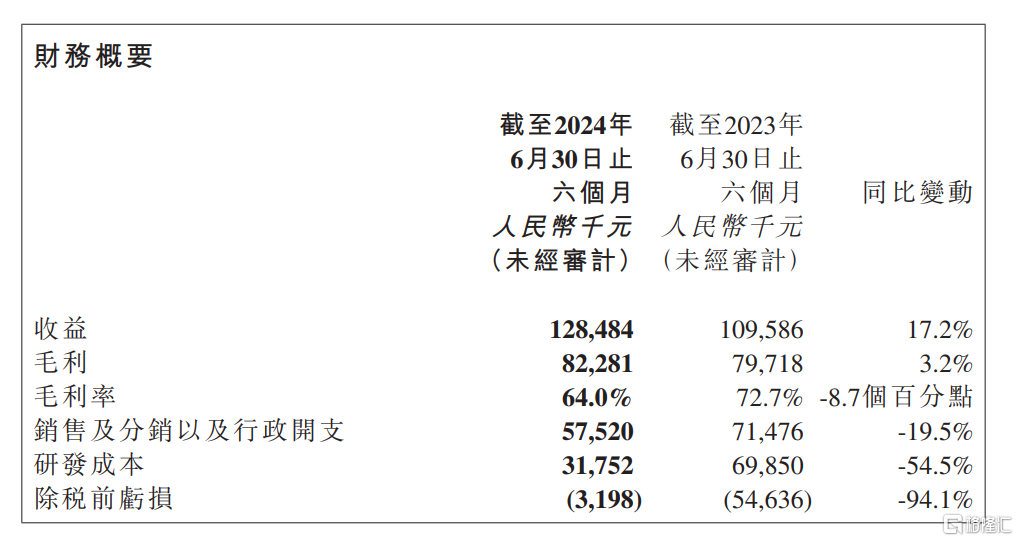

From the perspective of core financial indicators, in the first half of the year, the company achieved revenue of 0.128 billion yuan, a year-on-year growth of 17.24%, demonstrating a steady growth trend. This reflects the company's strong market adaptability and business resilience in the face of complex and volatile financial market environment, as well as multiple challenges such as centralized procurement policies, laying a solid foundation for the company's continued development in the industry.

From the perspective of core financial indicators, in the first half of the year, the company achieved revenue of 0.128 billion yuan, a year-on-year growth of 17.24%, demonstrating a steady growth trend. This reflects the company's strong market adaptability and business resilience in the face of complex and volatile financial market environment, as well as multiple challenges such as centralized procurement policies, laying a solid foundation for the company's continued development in the industry.

In terms of profit, the company's pre-tax losses in the first half of the year further narrowed to 3.2 million yuan, a year-on-year decrease of 94.1%. The significant improvement in financial performance indicates that the company's turning point to profitability is approaching, ushering in a new chapter of profitability. This undoubtedly further boosts investors' confidence in the market.

The growth driver for the company's revenue in the first half of the year mainly came from acute ischemic stroke (AIS) thrombectomy devices, intracranial arterial stenosis treatment devices, and innovative pathway devices. At the same time, thanks to the approval of multiple product registrations by the local regulatory authority, the company's overseas revenue has also been effectively increased, marking a solid step forward in the company's global layout.

In terms of core business strategy, Heart Wei Medical is undergoing a major transformation from homogeneous pathway products to user solutions centered around therapeutic products. This strategic adjustment not only provides strong support for the company's product sales growth, but also demonstrates its strategic vision of deep cultivation, pursuit of differentiated competition in the field of neurointervention.

Since the end of last year, in order to better adapt to the rapidly changing market environment, the company has continuously promoted the transformation and upgrading of the neurointerventional business to differentiated treatment devices. Specifically, neurointerventional treatment devices such as clot retrieval brackets, suction catheters, dilation balloons, embolization protection systems, and spring coils contributed 35.6% of the sales revenue, reaching 45.8 million yuan. At the same time, the sales of neurointerventional pathway devices and other products also achieved a year-on-year growth of 42.1%, with revenue reaching 82.7 million yuan, further consolidating the company's leading position in the industry.

Improving operational efficiency and enriching the R&D pipeline create room for growth.

In terms of cost reduction and efficiency improvement, Xinwei Medical has also achieved significant results. Despite the price adjustment pressure brought by the centralized procurement policy, the company has maintained a good trend of cost control, efficiency improvement, and efficient operation since the second half of last year.

Data shows that the sales and management expense ratio of the company decreased by 20.4 percentage points year-on-year in the first half of the year, optimizing to 44.8%. In addition, R&D expenses have also been effectively controlled, reflecting the significant progress of the company in R&D efficiency and management optimization, driving the overall operational efficiency of the company.

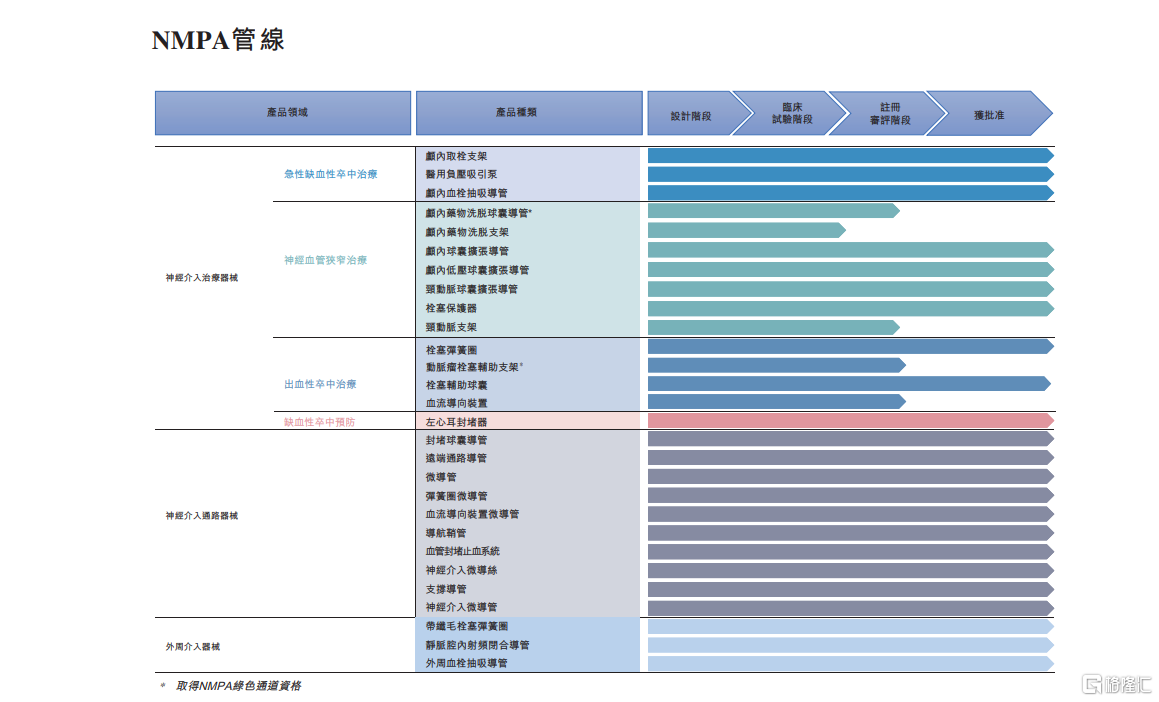

The company has a rich R&D pipeline, which helps to continue opening up market growth opportunities in the future. As of the mid-term performance disclosure date of 2024, the company has obtained NMPA approval for 29 medical device products, FDA approval for three medical device products, and CE marking for one product.

Among them, it includes approved products and a wide range of products in the late stage of R&D, covering the treatment of acute ischemic stroke and neurovascular stenosis, hemorrhagic stroke treatment, prevention of ischemic stroke, interventional pathways, and peripheral interventional devices.

In the field of ischemic stroke treatment, the company's core product is the Captor clot retrieval stent, which is the first domestically approved multi-point imaging clot retrieval stent. In addition, the company also has intracranial thrombus suction catheters and suction pumps, both of which have been approved by the NMPA. These product combinations can be used for emergency treatment of different subtypes of acute ischemic stroke.

In the mid-year performance announcement for 2024, the company disclosed that in the next 18 months, it is expected to launch at least five major neurointerventional treatment devices, including intracranial drug eluting balloon catheters for stenosis treatment (NMPA innovative medical device qualification), self-expanding drug stents, and carotid artery stents. It also includes arterial aneurysm embolization assist stents (NMPA innovative medical device qualification) and blood flow-guided devices for the treatment of hemorrhagic stroke.

At the same time, in response to the emergency surgical needs of different subtypes of ischemic stroke, the company aims to enhance the competitiveness of key clot retrieval products (suction catheters and retrieval stents) and one-stop medical device solutions to meet the growing demand for stroke treatment in the Chinese market, driven by the aging population.

In terms of overseas markets, the company's clot retrieval stents, occlusion balloon catheters, remote access catheters, and microcatheters have obtained CE or FDA certification, and have been registered and commercialized in countries or regions such as Thailand. At the same time, the company is also carrying out product registration in more than 10 other countries or regions, expanding sales channels and laying the foundation for achieving the long-term goal of overseas sales.

Looking ahead, the company is committed to becoming a leader in the Chinese neurointerventional medical device market and gaining a competitive advantage in the domestic innovative medical device market. To achieve this goal, the company has developed three core strategies: first, enhance brand awareness, expand the commercial sales of existing products, and accelerate the market introduction of R&D products; second, strengthen manufacturing capabilities to ensure high product supply reliability; and third, focus on emerging treatment areas with high growth potential to promote the development of innovative medical devices. This is aimed at building a second competitive commercial product combination business unit outside the neurointerventional business.

The following is a partial record of the Q&A session between investors and management at the earnings conference:

Q1: How does the company view the recent pricing issues of innovative medical devices? What are the follow-up effects on the market and the company's response strategies?

A1: Regarding the pricing issues of innovative medical devices, the development cycle of innovative medical devices is now shorter than before, unlike in the past where a product had a long period of exclusivity after release. As for our strategy, we still believe that innovative products are important and that there are many supportive policies from the government that can speed up the volume of production. The price of innovative products can maintain a competitive advantage for a certain period of time. In the future, we will continue to utilize innovative products, focus on academic and hospital promotion to lay a foundation for future volume and centralized procurement. At the same time, we also need to continuously optimize product performance and innovate.

Q2: What is the company's outlook for future revenue and profit?

A2: Starting in 2024, the next 2-3 years will be a test for all domestic medical device companies engaged in neurointerventional business. The competition for channel-type products is intense, and it will become the basic revenue base in the future. The company needs to control costs and expand its therapeutic product reserves. The revenue structure in the next three years will gradually shift towards therapeutic products, and both the gross profit margin and pre-tax profit margin are expected to increase gradually.

Q3: What is the progress of the research and development and existing data of intracranial narrow stents and drug-coated stents?

A3: The intracranial drug-coated stents have just completed enrollment in the first half of this year and are currently under follow-up, and the final data has not yet been released. The intracranial retrievable stents were submitted for registration last year and have shown good results, and specific approval is currently being communicated with the drug regulatory authorities.

Q4: What is the company's layout and growth prospects for the future development of the bleeding product line?

A4: The company attaches great importance to the bleeding business and has established a dedicated sales team. In the next 1-3 years, with the launch of heavyweight products such as embolization-assisted stents and coated mesh stents, the bleeding business line will provide strong growth momentum, with a growth rate higher than the overall company growth rate.

Q5: What is the current situation and future plans for the company's overseas market?

A5: In the first half of the year, the overseas market generated revenue of more than 3 million yuan and has established sales or registration in multiple countries and regions. In the future, the company will focus on establishing a network of agents and local registrations, and it is expected to achieve long-term sales in more than 10 countries or regions next year, with an increasing growth rate.

Q6: How does the company balance the promotion strategy and the scale-up approach of high-end therapeutic products in the DRG context?

A6: Therapeutic products are the focus of the company's future. We will focus on specialized promotion, combining product differentiation innovation and clinical value to increase customer awareness. We will also deepen cooperation with major clients.

Q7: What is the company's plan for cost reduction and efficiency improvement in the second half of the year? What is the possibility of achieving positive annual profit and reducing pre-tax profit loss?

A7: The cost reduction and efficiency improvement policy will continue to be implemented, including controlling personnel costs and managing expenses. The company's goal is to maintain revenue growth while stabilizing the scale of expenses and gradually improving the team's capabilities. It is expected to achieve a balance between profit and loss this year, and the target for the next few years is to control the expense ratio at 45-50% and achieve a pre-tax profit margin of around 20%.

Q8: Does the company have any other potential blockbuster products for overseas markets in the future?

A8: The company has multiple products in active international registration, including vascular occluders, distal access catheters, clot retrieval devices, and coil systems. Once registered and approved, these products will quickly gain momentum in overseas markets and support the development of our international business.

从核心财务指标来看,上半年,公司实现营收1.28亿元,同比增长17.24%,展现出稳健的增长态势,体现了面对复杂多变的金融市场环境以及集采政策等多重挑战下强大的市场适应能力和业务韧性,为公司在行业内的持续发展奠定了坚实的基础。

从核心财务指标来看,上半年,公司实现营收1.28亿元,同比增长17.24%,展现出稳健的增长态势,体现了面对复杂多变的金融市场环境以及集采政策等多重挑战下强大的市场适应能力和业务韧性,为公司在行业内的持续发展奠定了坚实的基础。