Takahashi Tsuneyuki stated in a speech on Thursday that it is necessary to adjust the 'degree of looseness' of monetary policy if the inflation trend aligns with the forecast.

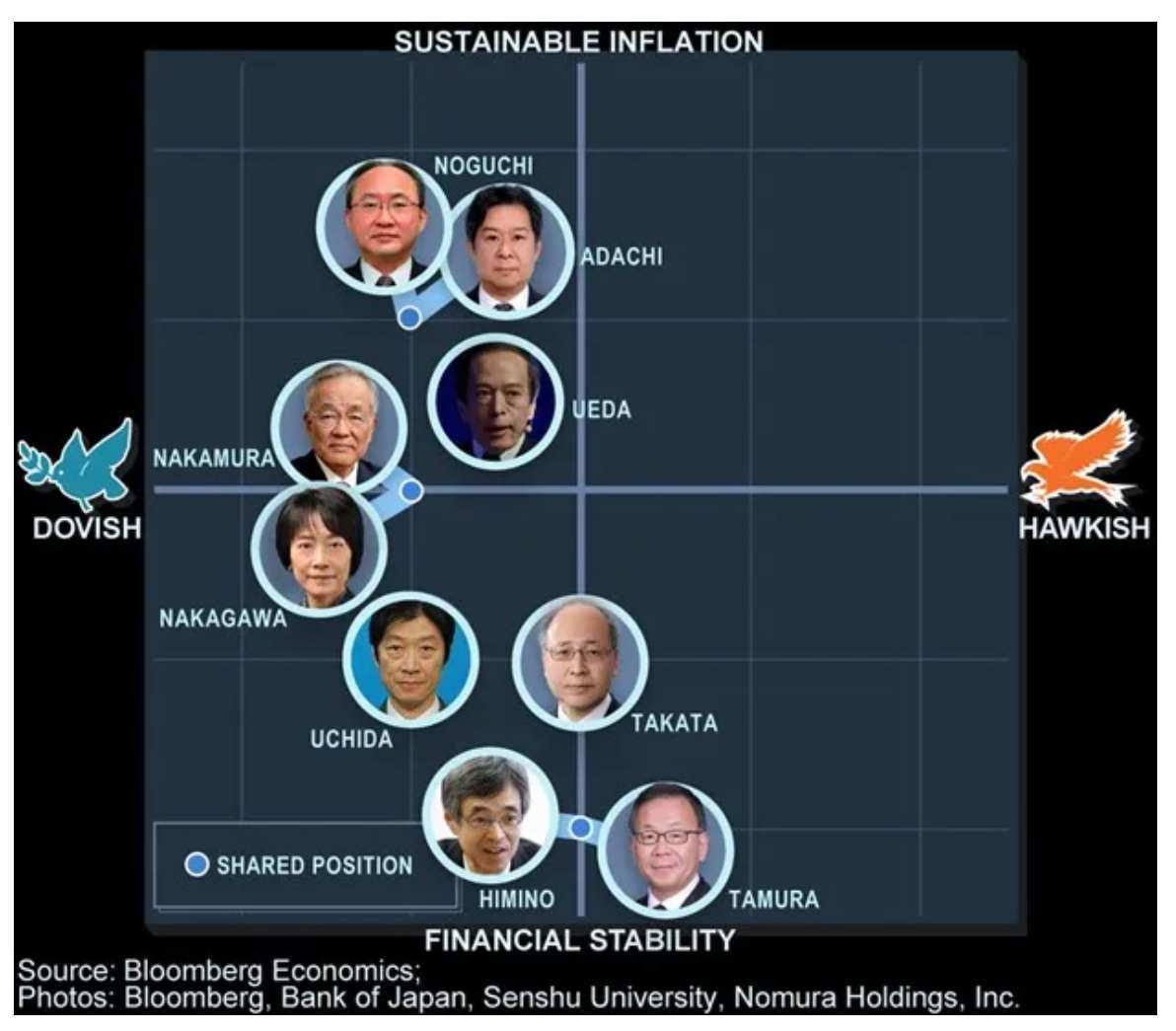

Bank of Japan director Hajime Takata stated that if the economic data aligns with the Bank of Japan's forecast, the Bank of Japan will continue to phase out the loose policy of the past decades.

In a speech on Thursday, Takada Tsune stated that if the inflation trend is consistent with the forecast, it is necessary to adjust the 'degree of monetary easing' of the mmf policy.

Takata's remarks confirm the recent message from the Governor of the Bank of Japan, Haruhiko Kuroda, that the central bank will continue to normalize its policy settings as long as the economic conditions allow. At the same time, he stated that it is necessary to monitor the financial markets in light of the global market turmoil that occurred at the beginning of last month, and therefore there is no rush to take immediate action.

He pointed out that since it is difficult to determine the natural interest rate, it is necessary to pay attention to the impact of each interest rate hike on the economy. This position indicates that the authorities will not take rapid and consecutive measures to adjust interest rates.

Before making the above remarks, Hajime Takata, the real wages of Japanese workers rose for the second consecutive month in July. In this data, an important indicator that avoids sampling issues and excludes bonuses and overtime shows a record 3% increase in wages for full-time workers.

Economist Taro Kimura stated, 'In terms of policy, wage data has strengthened our confidence that there will be a rate hike at the October meeting - although the uncertainty about the slowdown in the pace of the US economy means this is not a definite decision.'

The Bank of Japan stated that it expects robust wage growth to support inflation, with the central bank seeking to achieve a virtuous cycle where rising wages stimulate consumption, thereby driving demand to push prices up.

Almost all economists predict that the Bank of Japan will keep interest rates unchanged at the next policy meeting on September 20. Most expect the central bank to take action between October and January.

Editor/ping