The China Commodity Price Index (CBPI) for August 2024, released by the China Federation of Logistics and Purchasing, was 110.3 points, a month-on-month decrease of 3.6% and a year-on-year decrease of 4.6%.

According to Futubull Financial App, a joint survey conducted by the China Federation of Logistics and Purchasing, the China Bulk Commodity Price Index (CBPI) for August 2024 was 110.3 points, a month-on-month decrease of 3.6% and a year-on-year decrease of 4.6%. From the operation of the index, CBPI in August was significantly affected by global hot and rainy weather, seasonal production slowdown in some industries, and the violent fluctuations in the financial market. With the arrival of the peak season for production and construction in September and October, and the implementation of various macro-control policies, the market demand is expected to gradually recover. From the trend of domestic and international commodity indices, the pressure of enterprise production costs has eased, and the increased possibility of the Federal Reserve's interest rate cut has also provided support for commodity prices. It is expected that the downward space of the market will be limited, but problems such as insufficient effective demand and greater operational pressure for enterprises still remain prominent, and the role of the logistics industry in guiding production and promoting consumption still needs to be further enhanced.

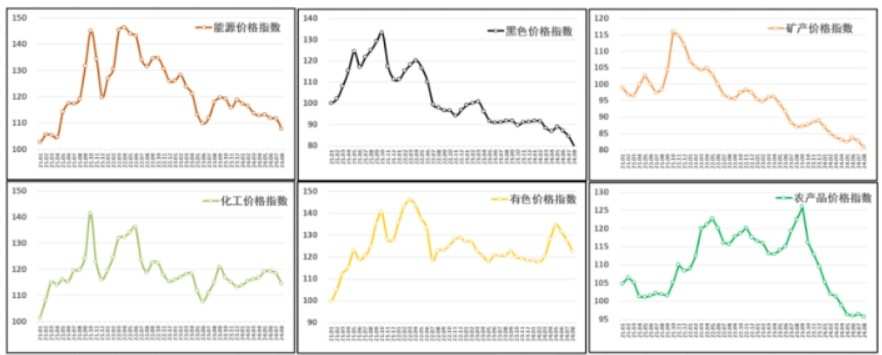

By industry, the price index for black commodities continued to decline, with a reported value of 79.4 points, a month-on-month decrease of 5.9% and a year-on-year decrease of 13.3%; the price index for non-ferrous metals showed a reversal of gains, with a reported value of 122.6 points, a month-on-month decrease of 3.8%, and a year-on-year increase of 1.6%; the price index for chemical products continued to decline, with a reported value of 114.4 points, a month-on-month decrease of 3.4%, and a year-on-year decrease of 0.5%; the price index for energy products widened its decline, with a reported value of 107.7 points, a month-on-month decrease of 3.6%, and a year-on-year decrease of 8.7%; the price index for minerals continued to fluctuate downward, with a reported value of 80.7 points, a month-on-month decrease of 2.4%, and a year-on-year decrease of 7.3%; the price index for agricultural products fluctuated at a low level, with a reported value of 95.7 points, a month-on-month decrease of 0.7%, and a year-on-year decrease of 21.9%.

In terms of specific commodities, among the 50 bulk commodities monitored by the China Federation of Logistics and Purchasing, prices compared to the previous month, 47 (94%) commodities saw a decrease in price, while 3 (6%) commodities saw an increase. The top three in terms of price increase were apples, praseodymium-neodymium oxide, and natural rubber, with month-on-month increases of 12.3%, 6.5%, and 3.9% respectively. The top three commodities with the largest price decrease were silicon manganese, lithium carbonate, and coke, with month-on-month decreases of 11.9%, 11.4%, and 10.6% respectively.

In terms of specific commodities, among the 50 bulk commodities monitored by the China Federation of Logistics and Purchasing, prices compared to the previous month, 47 (94%) commodities saw a decrease in price, while 3 (6%) commodities saw an increase. The top three in terms of price increase were apples, praseodymium-neodymium oxide, and natural rubber, with month-on-month increases of 12.3%, 6.5%, and 3.9% respectively. The top three commodities with the largest price decrease were silicon manganese, lithium carbonate, and coke, with month-on-month decreases of 11.9%, 11.4%, and 10.6% respectively.

In comparison with domestic and international indices, the CBPI trend is basically consistent with the Producer Price Index (PPI) and Consumer Price Index (CPI). Among them, the CPI for July changed from a decrease of 0.2% in the previous month to an increase of 0.5%, mainly due to the increase in prices of pork and fresh vegetables, which is consistent with the trend of CBPI agricultural product price index in the previous month; the PPI for July decreased by 0.2% month-on-month, which is consistent with the trend of CBPI. CBPI and the S&P GSCI index declined, while the CRB index rose slightly by 0.1%, mainly due to seasonal factors, combined with the interest rate hike in Japan, the appreciation of the Japanese yen, and mixed economic data from the United States, especially the weaker-than-expected PMI for manufacturing from the Institute for Supply Management.

分商品看:在中国物流与采购联合会重点监测的50种大宗商品中,本月价格与上月相比,47种(94%)大宗商品价格下跌,3种(6%)大宗商品价格上涨。其中,涨幅前三的为苹果、氧化镨钕和天然橡胶,月环比分别上涨12.3%、6.5%和3.9%;跌幅前三的大宗商品为硅锰、碳酸锂和焦炭,月环比分别下跌11.9%、11.4%和10.6%。

分商品看:在中国物流与采购联合会重点监测的50种大宗商品中,本月价格与上月相比,47种(94%)大宗商品价格下跌,3种(6%)大宗商品价格上涨。其中,涨幅前三的为苹果、氧化镨钕和天然橡胶,月环比分别上涨12.3%、6.5%和3.9%;跌幅前三的大宗商品为硅锰、碳酸锂和焦炭,月环比分别下跌11.9%、11.4%和10.6%。