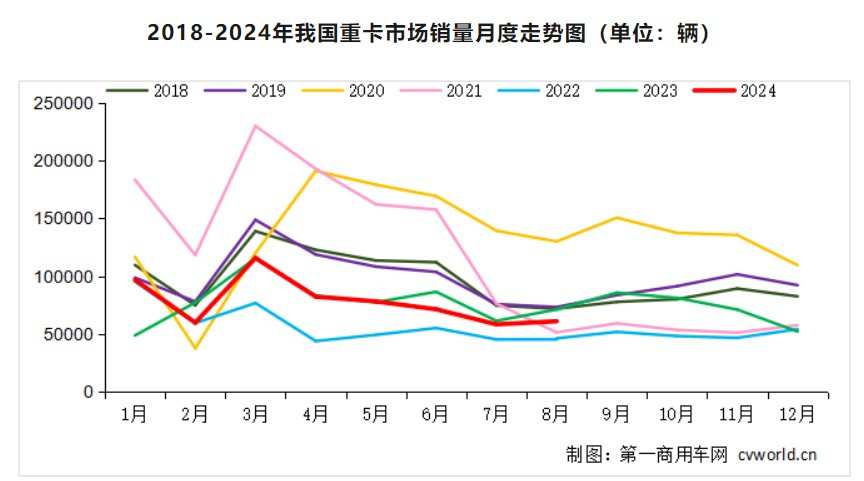

According to the latest data from the First Commercial Vehicle Network, in August 2024, China's heavy truck market sold approximately 0.061 million vehicles (wholesale volume, including exports and new energy), a slight increase of 5% compared to July.

According to the latest data from the First Commercial Vehicle Network, in August 2024, China's heavy truck market sold approximately 0.061 million vehicles (wholesale volume, including exports and new energy), a slight increase of 5% compared to July. Compared to the same period last year of 0.0712 million vehicles, it decreased by 14%, a reduction of approximately 0.01 million vehicles. In addition to exports, as one of the 'three pillars' of the heavy truck market, new energy heavy trucks continued their strong momentum in August, and terminal sales are expected to reach 5,500 vehicles or more, a year-on-year increase of 90%. With the launch and implementation of the truck replacement program in various provinces and autonomous regions, September is expected to see significant month-on-month growth in the heavy truck market, which is very likely. However, whether it can achieve the same level of growth or a slight increase year-on-year remains to be seen.

Xie Guangyao of the First Commercial Vehicle Network stated that the August sales volume of 0.061 million vehicles is only higher than that of August 2022 (0.0462 million vehicles) and August 2021 (0.0513 million vehicles), and lower than the sales volume in August of other years. Cumulatively, from January to August 2024, China's heavy truck market has sold approximately 0.624 million vehicles of various types, with a further narrowing cumulative growth rate of 0.45%.

In fact, the slight increase in wholesale sales is mainly due to strong exports of heavy trucks, which has supported the overall situation. After continuous year-on-year declines in the export volume of heavy trucks in June and July, the export volume of heavy trucks in August finally returned to an upward trajectory, with an expected year-on-year increase of 5%. As Russia is set to significantly increase the scrap car processing tax on imported vehicles starting from October 1, the export volume of heavy trucks in August has maintained year-on-year growth, and the performance in September will not be inferior.

In fact, the slight increase in wholesale sales is mainly due to strong exports of heavy trucks, which has supported the overall situation. After continuous year-on-year declines in the export volume of heavy trucks in June and July, the export volume of heavy trucks in August finally returned to an upward trajectory, with an expected year-on-year increase of 5%. As Russia is set to significantly increase the scrap car processing tax on imported vehicles starting from October 1, the export volume of heavy trucks in August has maintained year-on-year growth, and the performance in September will not be inferior.

In addition to exports, as one of the 'three pillars' of the heavy truck market, new energy heavy trucks continued their strong momentum in August, and terminal sales are expected to reach 5,500 vehicles or more, a year-on-year increase of 90%.

In August, apart from exports and new energy, the performance of other markets was disappointing. According to the First Commercial Vehicle Network's preliminary forecast, the terminal sales of the domestic heavy truck market in August are estimated to be less than 0.04 million vehicles, a month-on-month decrease of 16%, and a decrease of over 25% compared to the same period last year. The reasons for the year-on-year and month-on-month decline in terminal sales are twofold: on the one hand, in a market environment of low freight rates, low profits, and low demand, the overall terminal demand is weak; on the other hand, there is a strong market wait-and-see sentiment, with many users waiting for the operational details of the policy on scrapping and replacing old operating trucks and the implementation of local policies.

The consecutive 20-month growth of natural gas heavy trucks also came to an end in August. The continuous rise in LNG prices caused a year-on-year and month-on-month decline in the sales volume of natural gas heavy trucks. According to the First Commercial Vehicle Network's judgment, the terminal sales of natural gas heavy trucks in August are estimated to be around 0.012 million to 0.013 million vehicles, a year-on-year decrease of about 34% and a decrease of 30% compared to the previous month. The penetration rate has dropped from 38.5% in July to around 32%; the penetration rate of domestic tractor truck market is estimated to be less than 60%, a new low since February this year, only higher than the 42% in January.

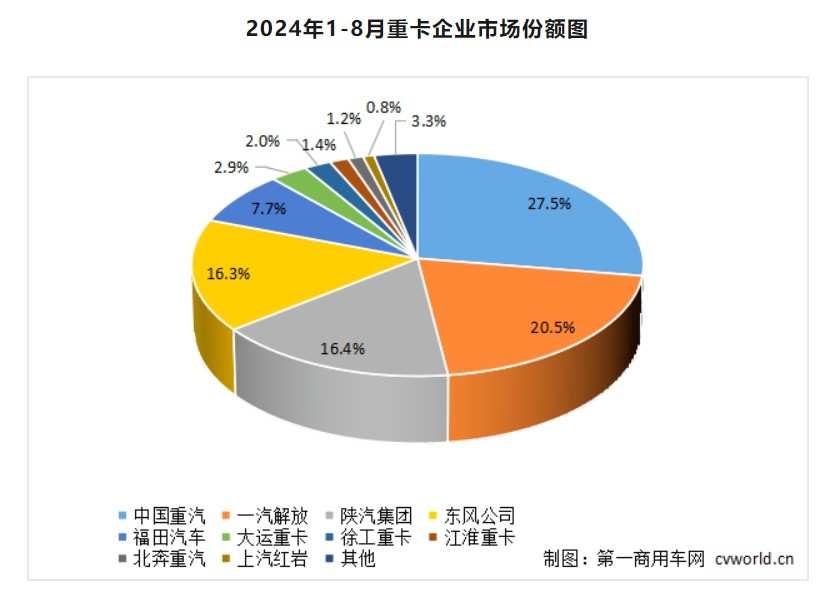

According to data from the First Commercial Vehicle Network, in the 'ranking race' of the market in August, there were four companies with sales exceeding 10,000 vehicles. Sinotruk (03808) came in first place with 0.016 million vehicles, and the other three companies with over 10,000 vehicles were Jiefang (0.011 million vehicles), Shaanxi Auto (0.011 million vehicles), and Dongfeng (0.01 million vehicles). The only company that achieved year-on-year growth was Xugong (41%). Cumulatively, from January to August, seven companies achieved year-on-year growth in market share, including Sinotruk, Jiefang, Dongfeng, Shaanxi Auto, Dayun, Xugong, and Beiben.

Specifically, sinotruk sold approximately 0.016 million heavy trucks in August, maintaining the industry's number one position; its cumulative sales from January to August were approximately 0.1714 million units, a year-on-year increase of 1%, with a market share rising to 27.5%, increasing by 0.1 percentage point.

Faw jiefang sold around 0.011 million heavy trucks in August this year; the cumulative sales of jiefang heavy trucks from January to August were approximately 0.1277 million units, a year-on-year increase of 3%, with a market share of about 20.5%, an increase of 0.5 percentage point year-on-year.

Shaanxi Automobile Group (including Shaanxi heavy trucks, Shaanxi commercial vehicles, etc.) sold approximately 0.011 million heavy trucks in August, and various heavy trucks were sold from January to August this year, totaling approximately 0.1026 million units, a year-on-year increase of 2%, with a market share of 16.4%, rising to the third place in the industry, an increase of 0.3 percentage point year-on-year. Dongfeng Company (including Dongfeng commercial vehicles, Dongfeng Liuzhou Chenglong automobiles, Dongfeng Huashen, etc.) sold various heavy trucks of approximately 0.01 million units in August; from January to August this year, Dongfeng Company accumulated sales of approximately 0.1016 million heavy trucks, a year-on-year increase of 4%, with a market share of approximately 16.3%, currently ranking fourth in the industry, with a market share increase of 0.6 percentage point.

beiqi foton motor (including Beiqi Foton Daimler Automobile) sold approximately 0.005 million heavy trucks in August, with a cumulative sales of various heavy trucks of around 0.0481 million units from January to August this year, with a market share of about 7.7%.

In the third echelon of the heavy truck industry, Dayun heavy trucks sold 2155 vehicles in August, ranking sixth in the industry; from January to August this year, Dayun heavy trucks accumulated sales of 0.0179 million units, a year-on-year increase of 3%, ranking sixth in the industry, with a market share of 2.9%, up by 0.1 percentage point. Xugong heavy trucks sold around 1550 vehicles in August, a 41% year-on-year increase against the trend; its cumulative sales from January to August were 0.0127 million units, a 12% year-on-year increase, ranking seventh in the industry, with a market share of 2%, up by 0.2 percentage point. Anhui Jianghuai Automobile Group Corp., Ltd. sold approximately 700 heavy trucks in August this year, with a cumulative sales of 0.0089 million units from January to August, ranking eighth in cumulative sales, with a market share of approximately 1.4%. Beiben Heavy Truck sold 597 heavy trucks in August, with a cumulative sales of 0.0072 million units from January to August, a 6% year-on-year increase, ranking ninth in cumulative sales, with a market share of about 1.2%, up by 0.1 percentage point. SAIC Hongyan sold approximately 300 heavy trucks in August, with cumulative sales of heavy trucks of about 0.0053 million units from January to August this year, with a market share of approximately 0.8%.

实际上,批发销量能环比略有增长,主要还是因为重卡海外出口给力,撑起了局势。继6、7月份重卡出口连续出现同比下降之后,8月份的重卡出口销量终于重回上升通道,预计同比上涨5%。由于俄罗斯将从10月1日起大幅提高进口汽车报废处理税,因此,8月份的重卡出口保持了同比增长,9月份的表现也不会差。

实际上,批发销量能环比略有增长,主要还是因为重卡海外出口给力,撑起了局势。继6、7月份重卡出口连续出现同比下降之后,8月份的重卡出口销量终于重回上升通道,预计同比上涨5%。由于俄罗斯将从10月1日起大幅提高进口汽车报废处理税,因此,8月份的重卡出口保持了同比增长,9月份的表现也不会差。