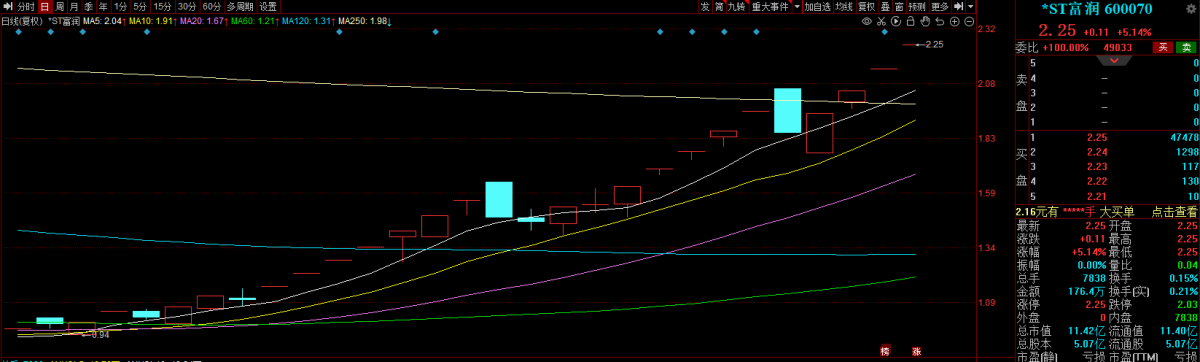

*Zhejiang Furun Digital Technology has accumulated 18 consecutive trading days of limit up from August 2, 2024 to September 3, 2024, with a stock price increase of 100.89% and significant volatility. In the announcement, Zhejiang Furun Digital Technology specifically emphasized the six major risks faced by the company's stocks.

The Financial Associated Press reported on September 3 that *Zhejiang Furun Digital Technology, whose stock price has doubled in the past month, announced a trading suspension for verification.

Tonight, *Zhejiang Furun Digital Technology announced that from August 2, 2024 to September 3, 2024, the company's stock has accumulated 18 consecutive trading days of limit up, with a stock price increase of 100.89% and significant volatility. In order to protect the interests of investors, the company will conduct a review of the stock trading situation. Upon application, the company's stock will be suspended from trading starting on September 4, 2024, and will resume trading after the disclosure of the verification announcement. The suspension period is expected to be no more than 3 trading days. The company reminds investors to pay attention to the risks in the secondary market trading.

In terms of information disclosure, the announcement shows that following self-inspection by the board of directors and written confirmation to the controlling shareholders and actual controllers, apart from the disclosed matters, the company, controlling shareholders, and actual controllers have not planned any significant information related to the company that should be disclosed but has not been disclosed.

In terms of information disclosure, the announcement shows that following self-inspection by the board of directors and written confirmation to the controlling shareholders and actual controllers, apart from the disclosed matters, the company, controlling shareholders, and actual controllers have not planned any significant information related to the company that should be disclosed but has not been disclosed.

In addition, in the announcement, *Zhejiang Furun Digital Technology specifically emphasized the six major risks faced by the company's stocks and reminded investors to be cautious of investment risks, including the company's stocks being subject to delisting risk warnings and the additional risk of other warnings being implemented, as well as the risk of the company's stocks potentially being delisted.

(1) The company's stocks are subject to delisting risk warnings and the additional risk of other warnings being implemented

1. The relevant situation of the company's stocks being subject to delisting risk warnings

(1) The audited revenue of the company in 2023 was 93.2317 million yuan. After deducting the revenue unrelated to the main business and the revenue without commercial substance, the operating income was 72.8977 million yuan. The net profit attributable to shareholders of the listed company, excluding non-recurring gains and losses, was -514.252 million yuan, which violated the provisions of Article 9.3.2(1)(a) of the Shanghai Stock Exchange Listing Rules (revised in August 2023).

(2) Asia-Pacific (Group) Certified Public Accountants (Special General Partnership) issued an audit report on the company for the year 2023 with an inability to express an opinion, which violated the provisions of Article 9.3.2(3) of the Shanghai Stock Exchange Listing Rules (revised in August 2023). In summary, the company will be subject to delisting risk warning starting from April 30, 2024.

2. Relevant information on the company's stocks being subject to other risk warnings

(1) Asia-Pacific (Group) Certified Public Accountants (Special General Partnership) issued a negative opinion on the internal control audit report for the year 2023, and the company's stocks will continue to be subject to other risk warnings in accordance with the provisions of Article 9.8.1(3) of the Shanghai Stock Exchange Listing Rules (revised in August 2023).

(2) On May 17, 2024, the company received the "Administrative Penalty Decision" (No. [2024] 18, [2024] 19, [2024] 20) issued by the Zhejiang Regulatory Bureau of the China Securities Regulatory Commission. Starting from the date of receiving the penalty decision, the company's stocks will be subject to other risk warnings. Investors are advised to pay attention to investment risks!

(2) Risk warning of possible delisting of company stocks

According to the company's disclosed "2024 Semi-Annual Report", the net profit attributable to shareholders of the listed company for the first half of 2024 was negative. If the audited total profit, net profit, or net profit after deducting non-recurring gains and losses for the year 2024 is negative and the operating income is less than 0.3 billion yuan, the company's stocks will be delisted after the disclosure of the 2024 annual report in accordance with the relevant provisions of the Shanghai Stock Exchange Listing Rules (revised in April 2024). Investors are advised to make rational investments and pay attention to investment risks!

(3) Risk warning of the company's receipt of the "Administrative Penalty Decision"

On May 17, 2024, the company received the "Administrative Penalty Decision" (No. 18, No. 19, No. 20) issued by the Zhejiang Regulatory Bureau of the China Securities Regulatory Commission. If the company is subsequently subject to securities false statement litigation, the company will fully accrue the estimated liabilities for investor claims, promptly disclose the progress of related matters, and provide risk reminders.

(4) Risk reminders of significant uncertainties in the transfer of controlling shareholders' shares.

On August 17, 2021, Zhejiang Furun Holdings Group Co., Ltd. (referred to as "Furun Group") signed the "Acquisition Agreement on Share Acquisition" with Guosen Huaxia Information Systems Group Co., Ltd. and Zhejiang Guosen Chengzhi Information Technology Co., Ltd. As of the date of this announcement, the above-mentioned share transfer has not progressed as expected, and there are significant uncertainties in the transfer of controlling shareholders' shares!

(5) Risk reminders of the stock pledged by the controlling shareholder and its concerted action persons.

As of the date of this announcement, the company's controlling shareholder, Zhejiang Furun Holdings Group, and its concerted action party, Zhejiang Zhuji Huifeng Entrepreneurship Investment Co., Ltd., collectively hold 126.520708 million shares of the company, accounting for 24.94% of the total share capital of the company. The pledged shares of the company totaled 100.5 million, accounting for 79.43% of its total holdings and 19.81% of the total share capital of the company. In case of any other significant changes, the company will fulfill its disclosure obligations in a timely manner. We kindly remind all investors to pay attention to the risks!

(6) Risks associated with uncertainties in the company's repurchase plan.

On June 18, 2024, the company disclosed the "Announcement on the Repurchase of Company Shares by Centralized Bidding Trading" (Announcement No. 2024-065). The company's repurchase plan may face the following uncertainties:

(1) Risks of the company's stock price continuously exceeding the upper price limit disclosed in the repurchase plan, leading to the inability to implement the repurchase plan.

(2) Due to significant changes in the company's production, operation, financial condition, and external objective circumstances, there may be risks of changing or terminating the share repurchase program according to the rules.

(3) If new regulatory regulatory documents on share repurchases are issued by regulatory authorities, there is a risk of adjusting the corresponding terms of the share repurchase during the implementation of this share repurchase. The company will make repurchase decisions based on market conditions within the repurchase period, and will strive to facilitate the smooth implementation of this share repurchase program and fulfill its obligation to disclose information in a timely manner based on the progress of the share repurchase matters. Investors are advised to pay attention to investment risks!

It is worth mentioning that in terms of performance, Zhejiang Furun Digital Technology (ST Furun) has experienced four consecutive years of losses since 2020. According to the interim report this year, the company is still in a continuous loss state. In the first half of the year, the company achieved revenue of 41.0941 million yuan, a year-on-year decrease of 28.58%, and a net loss attributable to shareholders of 88.0445 million yuan.

在信息披露方面,公告显示,经公司董事会自查并向控股股东及实际控制人函证,除已披露的事项外,公司、控股股东及实际控制人不存在筹划涉及公司的应披露而未披露的重大信息。

在信息披露方面,公告显示,经公司董事会自查并向控股股东及实际控制人函证,除已披露的事项外,公司、控股股东及实际控制人不存在筹划涉及公司的应披露而未披露的重大信息。