Every investor on earth makes bad calls sometimes. But you want to avoid the really big losses like the plague. So take a moment to sympathize with the long term shareholders of Guardant Health, Inc. (NASDAQ:GH), who have seen the share price tank a massive 81% over a three year period. That'd be enough to cause even the strongest minds some disquiet. And the ride hasn't got any smoother in recent times over the last year, with the price 27% lower in that time. Unfortunately the share price momentum is still quite negative, with prices down 19% in thirty days. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

With the stock having lost 4.3% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

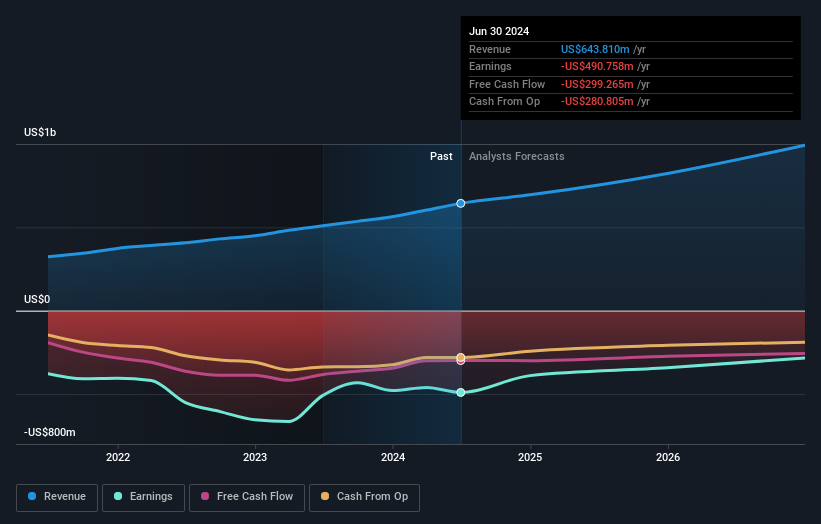

Because Guardant Health made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over three years, Guardant Health grew revenue at 22% per year. That is faster than most pre-profit companies. So on the face of it we're really surprised to see the share price down 22% a year in the same time period. You'd want to take a close look at the balance sheet, as well as the losses. Sometimes fast revenue growth doesn't lead to profits. Unless the balance sheet is strong, the company might have to raise capital.

Over three years, Guardant Health grew revenue at 22% per year. That is faster than most pre-profit companies. So on the face of it we're really surprised to see the share price down 22% a year in the same time period. You'd want to take a close look at the balance sheet, as well as the losses. Sometimes fast revenue growth doesn't lead to profits. Unless the balance sheet is strong, the company might have to raise capital.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. You can see what analysts are predicting for Guardant Health in this interactive graph of future profit estimates.

A Different Perspective

Investors in Guardant Health had a tough year, with a total loss of 27%, against a market gain of about 25%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 11% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Guardant Health is showing 3 warning signs in our investment analysis , and 1 of those is a bit concerning...

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.