Edit / Emily

Highlight:

The dividend of the new system reform of the HKEx continues to be released, and the amount of capital raised in Hong Kong continues to reach the top.

The performance of new stocks is generally good this year, and technology stocks are very popular.

2020 HKEx still has a lot of work to do

In 2019, with trade frictions, Brexit and other events, the overall stability of the global economy and capital markets has been affected to a certain extent. However, 2019 is an extremely special year for HKEx: the first anniversary of the reform of the new system, the fifth anniversary of interconnection, the return of BABA.

This year, there are countless keywords that can sum up the IPO market of Hong Kong stocks.

I. the reform dividend continues to be released.

1. The amount of funds raised continues to reach the peak: Hong Kong's status as an international financial center will not waver.

Despite the grim global political and macroeconomic environment, Hong Kong once again ranked first in the amount of capital raised by the world's major exchanges IPO in 2019, the fourth time in nearly five years, further consolidating its position in the world's leading IPO market. Hong Kong raised $37.9 billion in initial public offerings as of December 16, well ahead of Saudi Arabia, which came in second place, according to data disclosed by the Hong Kong Stock Exchange.

Hong Kong stocks continue to top the list, higher than in 2018, but overall, the number of new issues this year is significantly lower than last year, especially on the gem. As of December 16, Hong Kong stocks had a total of 156 companies listed in the whole year, of which 141 were listed on the main board and only 15 on the gem. In 2018, a total of 218 companies were listed on the Hong Kong stock market, including 143 on the main board and 75 on the gem. Public data show that the number of companies listed on Hong Kong's gem this year is the lowest in nearly seven years.

The number of new shares decreased compared with last year, but the amount of capital raised rose rather than decreased, mainly due to the return of BABA. The total amount raised by the top 10 IPO in 2019 was HK $207.64 billion, up 11.3% from the HK $186.57 billion raised by the top 10 IPO last year.

According to the statistics of the Hong Kong Stock Exchange, among the 10 newly listed companies with the highest initial public offerings since 1986, BABA and Budweiser Brewing Company APAC Limited were on the list this year, ranking third and ninth respectively.

Since the beginning of this year, a number of macroeconomic and geopolitical factors have begun to be in a state of uncertainty and uncertainty, and have continued to develop indecisively. As a result of the greater impact of the incident in Hong Kong, the drag on the economy has become apparent. The Hong Kong Financial Secretary has previously said that Hong Kong's economy has reached the brink of recession. At the same time, Hong Kong's status as an international financial centre is threatened.

However, from the fact that the amount of IPO raised in Hong Kong continues to reach the top this year, we can see that although the total number of listed companies has decreased compared with last year, there has been an increase in the listing of many large-scale projects around the world. Hong Kong is still the preferred place for many companies' IPO, has a strong attraction to global issuers, and remains an international financial center.

2. The first anniversary of the reform of the new system: BABA returned smoothly

The continued success of Hong Kong's total IPO fund-raising this year is mainly due to the two large-scale IPO projects of BABA and Budweiser Brewing Company APAC Limited in the second half of the year. In particular, with the smooth return of BABA, BABA raised as much as HK $101.2 billion, accounting for about 34 per cent of the annual capital raised by Hong Kong's IPO.

BABA's stock price trend after listing on the Hong Kong Stock Exchange, source: Futu Niuniu

The smooth return of BABA is also an important achievement of the first anniversary of the reform of the new system of the HKEx.

BABA landed on the HKEx with the B2B concept on his head in 2007 and then chose to go private in 2012 because of the depressed stock price. BABA carried out transformational reform after privatization and wanted to seek IPO again in 2014. His first hope was to return to Hong Kong again. However, the HKEx system at that time restricted the acceptance of different rights of the same shares and did not recognize BABA's partnership system. Finally, BABA chose to log on to the New York Stock Exchange, setting a record for the highest amount of IPO financing in the history of US stocks.

Li Xiaojia, president of the HKEx, once said that he regretted missing BABA because of the restrictions on different rights of the same shares. In 2017, former Hong Kong Financial Secretary Antony Leung said in a speech: "it was a big mistake not to let BABA be listed in Hong Kong a few years ago. "

Subsequently, the HKEx also began to propose the reform of Hong Kong's IPO system. In April 2018, the HKEx passed new rules to allow biotech companies that fail to pass the financial qualification test on the motherboard, companies with different voting structures to be listed, and to set up new listing channels for Greater China and international companies seeking secondary listing in Hong Kong.

Since then, Hong Kong stocks have ushered in a new era and ushered in a wave of listings of new economy companies and biotechnology companies.

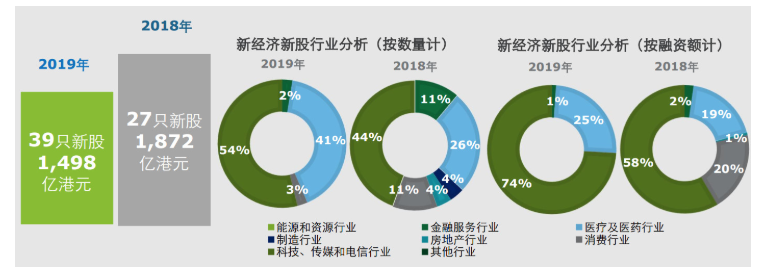

According to the estimates and analysis of HKEx and Deloitte, a total of 27 new shares were listed in 2018, raising as much as HK $187.2 billion. The reform dividend continued to be released in 2019, with a total of 39 New economy companies listed, raising HK $149.8 billion. On the whole, both the number of new shares and the amount of financing are dominated by the technology, media and telecommunications industries, followed by the medical and pharmaceutical industries. The number of new shares and the amount of financing in the medical and pharmaceutical industries this year have increased significantly compared with last year.

Source: Deloitte

In a review of the first anniversary of the new listing rules of the HKEx, Hong Kong has become the second largest biotechnology listing centre in the world. Hong Kong's biotech ecosystem is slowly taking shape, and Hong Kong's capital market is attracting more and more biotech professionals, including analysts, investors and consultants.

Under the reform of the new system, Hong Kong has become more and more attractive. more and more new economy companies, companies with different rights of the same shares and unprofitable biotechnology companies have chosen Hong Kong as a listing place, and their status as an international financial center has been further strengthened. This year also marks the fifth anniversary of the interconnection mechanism between the stock markets of Hong Kong and the mainland. More and more capital inflows and outflows from all over the world have also enhanced the liquidity of Hong Kong's international capital market, and Hong Kong's unique advantages remain undiminished.

Second, the performance of new stocks this year: technology stocks continue to be sought after by capital

1. Double and halve together

Is the arrival of the new economy of Hong Kong stocks the best or the worst for investors?

Since the reform of the new rules last year, many new economy stocks have been broken on the same day, which has disappointed investors who subscribed for new shares, and even there has been the voice that "this is the failure of the listing reform."

As a mature and liquid market, Hong Kong's IPO market always tends to be rational. If the new shares continue to break and the market turns cold, the subsequent issuers will often lower their expectations and issue prices, thus pushing up the earnings of potential new share subscriptions; on the contrary, if the new shares continue to soar and the market atmosphere is warm, the latter issuers will often raise their expectations and issue prices, thus driving down the earnings of new share subscriptions.

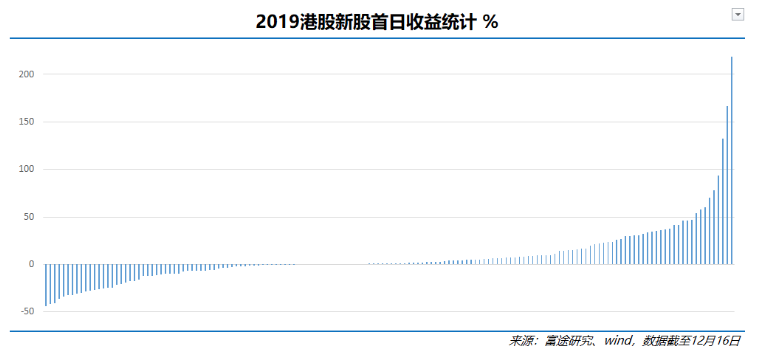

This year, it is true that a lot of stocks were broken on the day of listing, but on the whole, they rose mainly. The data show that 99 of the 156 new stocks (including the main board and the gem) made profits or were flat on the first day, and the probability of rising on the first day is 63.5%. And most of the new stocks are not low.

Of the top 10 Hong Kong new shares that rose on the first day of 2019, three new shares doubled their earnings. Among them, Master Lu, who led the increase, rose as high as 218.5% on the first day, allowing investors to achieve a rapid increase in wealth.

However, the cost of each new stock is different, and the new stock with the highest gain on the first day does not mean that it is the one that earns the most. According to statistics, in terms of first-hand profit, the most profitable new stock is Hansoh Pharmaceutical Group, with an increase of 36.7%, not on the list, but the first-hand profit is as high as 10,000. If you look at the first-hand profit, there is more overlap with the increase list.

Of course, profits and losses are the same. In 2019, Hong Kong new stocks fell first on the first day, and profit maritime fell as much as 44.0% on the first day. However, compared with the top 10 of the decline, the gain is still greater than the loss. However, whether it is the top 10 growth or decline of the top 10 companies, are basically non-essential consumer goods industry.

Similarly, from a cost point of view, the new shares that fell first on the first day were not the ones that lost the most. The new shares that lost the most money this year lost 1640 yuan to China International.

For whether new shares are broken, there is usually a view in the market that good companies will not break, but bad companies will break.

From the perspective of statistics, in fact, whether the new shares are broken or not has nothing to do with the quality of the listed companies, the broken companies are not necessarily bad companies, good companies are not necessarily broken.

So from the probability point of view, which factors will have a greater impact on new shares?

2. By industry: information technology is popular, with the lowest average winning rate and the highest increase

According to the Hang Seng industry, most of the new shares issued this year belong to non-essential consumer industries, with a total of 51. The listed companies are mainly engaged in the production and sales of education, clothing and textiles, as well as furniture and household appliances. Larger companies include Topsports International Holdings Limited, China Oriental Education and so on. The second is the real estate construction industry, this year a number of real estate companies split the property sector listed, such as Blu-ray Garbo and so on.

However, from the perspective of the winning rate and the average rise and fall, the information technology industry has noticed that the average increase of 13 new stocks is as high as 26.0%, but the average winning rate is only 36.8%. In the financial sector, which has the highest success rate, nine new shares fell by an average of 7.8 per cent. On the whole, the average success rate of Hong Kong new shares is not low, the overall success rate is more than 60%, and the average income is also considerable.

Looking at the 13 new stocks in the IT industry alone, only one new stock broke, while the other 12 new stocks rose or closed on the first day. However, in terms of revenue, Master Lu has driven up the first-day increase of the entire information technology industry on his own. In terms of the winning rate, the IT industry is generally not high, basically at the level of 10%, 60%, and only BABA's winning rate is as high as 80%.

Apart from the information technology industry, the average earnings of the industrial, real estate construction, health care and essential consumer industries are also good. But the average return only reflects the average situation, in fact, the performance of individual stocks is more differentiated.

Take the health care industry as an example, the new system reform has attracted a large number of biotechnology companies to list in Hong Kong. After the new system reform in April last year, five biotechnology companies were listed in 2018, while this year the figure increased to nine. Judging from the performance of the first day of IPO, four of the nine biotech IPOs broke, and nearly half of them broke. However, CANSINOBIO, who had the largest increase on the first day, rose 57.7% on the first day, a gratifying increase. Regardless of the market heat, listing performance, winning rate and other factors, the biotechnology sector is seriously divided, so it is necessary to carefully choose new targets.

It can be seen that the Hong Kong new stock market is not a sure business, and it is not possible to hit the new market blindly.

From an industry point of view, the information technology industry will be favored by the market. And the raw materials industry with the worst average decline, excluding Baobao Technology, which is listed in the way of introduction, the remaining three new stocks have been broken, except for the flat trading of China's Xuyang Group, Dayu Financial and Xinhe Holdings. Dayu Financial fell as much as 41.1%, and is also one of the top 10 companies this year.

In addition to industry factors, there are many other factors that can affect market sentiment.

The amount of financing, whether it is a large-cap stock, the number of overbought multiple, the level of the issue price and so on can have an impact on the breaking of new shares. In short, the IPO market does not fully reflect the fundamentals of stocks, and the first day of listing does not fully reflect market sentiment. China Tobacco Hong Kong, with its halo on its head, did not do well on its first day of trading, rising 9.63% on the first day, but its share price rose as high as HK $28.5 in the next few days, up 484% from its offering price of HK $4.88!

The stock price trend of China Tobacco since its listing in Hong Kong, source: Futuo Niuniu

The IPO market is a complex market, and fundamentals are not the only criterion for judging the performance of IPOs.

Li Xiaojia, chief executive of the HKEx, once said in a review of the new Hong Kong listing rules in 2018 that the frame of reference for whether new shares were broken was only the offering price at the time of IPO, and that it was a natural reaction of investors to constantly adjust their expectations according to the cold and warm market and the level of valuation.

Third, bid farewell to the 2019 of BABA, is there anything interesting for the HKEx in 2020?

The overall macroeconomic situation is grim this year, especially in the second half of the year, when only one new stock was listed in August. However, driven by BABA's large-scale project, Hong Kong still tops the world with a financing amount of US $37.9 billion, and its position as an international financial center remains solid.

So is there anything interesting to say goodbye to BABA's 2019 and HKEx's 2020?

Judging from the current form, although the first stage of the Sino-US economic and trade agreement has been reached, there is still a 250 billion tariff on goods to be discussed. At the same time, there will be major events such as the US presidential election and Brexit next year. Under the influence of global political, economic and social instability, the market environment in 2020 is not clear. However, the successful listing of BABA may lead to the return of more Chinese stocks. After all, before the reform of the new system, there were many outstanding Chinese companies going to the IPO in the United States, and even formed a plate of Chinese stocks. Now BABA's return is a clear signal and may lead to the return of those undervalued Chinese stocks in the US stock market.

However, from this year's summary, we can also think about the future direction. Will the IPO market get hotter and hotter? Will the earnings of the hot new stock market decline?

The issuance of new shares in Hong Kong is closely related to the capital side of the market. 2019, which is also the fifth anniversary of interconnection, the exchange of funds between the two places is getting deeper and deeper. Since the opening of the stock market connectivity mechanism between Hong Kong and the mainland in 2014, with the deepening of investors' understanding of the connectivity mechanism between the two places, the Land Link and the Hong Kong Stock Connect have grown steadily, and the total amount of cross-border funds has repeatedly reached record highs, injecting new vitality into the markets of the two places.

Judging from this year's statistics, the income of the Hong Kong new stock market is relatively considerable. However, it is a pity that at present, it is not possible to participate in the subscription, over-allotment and over-allotment of Hong Kong new shares through Land Stock Link. That is, at present, it is not possible to participate in the innovation of Hong Kong stocks through Land Stock Link. On the issue of Lu Shitong's participation in the Hong Kong stock market, the HKEx mentioned it as early as in the Strategic Plan 2016-2018.

The plan says it will continue to expand the connectivity mechanism and enrich the Shanghai-Hong Kong Stock Connect, the Shenzhen-Hong Kong Stock Connect and the "New Stock Connect". The aim is to enable mainland and international investors to participate in the China-Hong Kong primary stock fund-raising market. Through the IPO framework, mainland investors can subscribe for IPOs in the Hong Kong market (southbound), while global investors in Hong Kong can subscribe for IPOs in the mainland market (northbound).

Unlike the listing mechanism of A-shares, the supply of Hong Kong stocks is very adequate. At the same time, compared with the "winning the lottery" of A shares, the Hong Kong IPO market is allocated according to the fair mechanism of "the more you subscribe, the more you distribute". The winning rate in one hand is as high as 100%, and the rest is allocated according to the proportional decreasing mechanism.

In the Strategic Plan 2019-2021 just launched this year, the HKEx said that it would continue to optimize the Shanghai-Shenzhen-Hong Kong Stock Connect and promote the new stock link mechanism. Li Xiaojia also mentioned more than once that on the basis of the "Shanghai-Shenzhen-Hong Kong Stock Connect" and "Bond Link", new stock links, primary market links, and so on, may be gradually discussed for investors to choose. It can be seen that the new stock pass has long been put on the agenda. If the new stock market is opened, it can be predicted that as more capital participates in the innovation of Hong Kong stocks, the liquidity of Hong Kong stocks will be enhanced, the market will be more efficient and rational, and the success rate of Hong Kong stocks will also be reduced.

In August and September this year, the new stock market was not as expected. There was only one new stock in August, but in October, a total of 21 new shares were listed. Driven by market sentiment, a number of new stocks soared. Five of the top 10 companies this year went public in October, including Lu Masters, Odema Motors, Yongsheng International, Xinkun Intelligence, and DeShijia, with increases of 218.5%, 93.8%, 78.1%, 70% and 46.7%, respectively.

But the market will eventually become rational. By late October, the fast food empire had put on a good show. At one point, the opening price soared by more than 80% and rose by more than 180% in early trading. However, near the midday close, the share price suddenly plunged, fell to a break, and finally closed down 6.15%, the end of a wave of harvest drama. Then in November and December, the new stock market began to cool down, and the number of stocks that skyrocketed and plummeted accordingly.

The stock price trend of the fast food empire on the day of listing, source: Futuo Niuniu

The market for new shares at the end of the year once again confirms the rationality of the Hong Kong market-if new shares continue to break and the market turns cold, the subsequent issuers will often lower their expectations and issue prices, thus pushing up the earnings of high-tech stock subscriptions; on the contrary, if new shares continue to soar and the market atmosphere is warm, subsequent issuers will often raise expectations and issue prices, thus driving down the earnings of new share subscriptions. What we can see is that if the new stock market is opened and more and more funds are involved in the Hong Kong stock market, Hong Kong's new stock market will become more and more rational.

Conclusion

Although the number of new shares has declined this year, thanks to BABA's successful listing, Hong Kong still ranks first among the world's major exchanges in terms of capital raised by IPO, a further release of the reform dividend last year. As the HKEx further optimizes the listing mechanism, encourages more new economy companies to list in Hong Kong, and continues to optimize and expand the Shanghai-Shenzhen-Hong Kong Stock Connect and Bond Link, the future Hong Kong Exchanges and Clearing will continue to stand at the top of the international exchange. Hong Kong will also become the brightest international financial center.

Review 2019

Review 2019

Futu Information team has grown all the way with the support of Niu friends.

We work hard together in the pursuit of return and practical value.

Looking forward to 2020

The complex and changeable environment will not change.

The unpredictable market is still full of charm.

We hope that through the efforts of the team

We hope that through the efforts of the team

Let the cattle friends advance hand in hand in the investment of chasing the waves.

It's easier, not alone!

Fu Tu Fund BaoCan help you at the end of the year and the beginning of the year

Better embrace life ~

The income does not rest, the wealth rolls in!

"" Click the link to learn about Fortune Fund Bao immediately ""