①Benefiting from factors such as the rise in the prices of main nonferrous metal products, tibet huayu mining H1 net income increased by more than 30% year-on-year; ②A client of tibet huayu mining told reporters that the actual grade of antimony ore at Taliang Metal Industry was not as high as expected.

Caishixin news on August 31st (Reporter Liang Xiangcai) benefited from the impact of the rise in the prices of main nonferrous metal products, tibet huayu mining (601020.SH) H1 net income increased by more than 30% year-on-year.

Reporter of Caishixin consulted the company about the grade of antimony ore in Taliang Metal Industry as an investor. The staff stated that if this year's processing volume of 1.5 million tons of ore is used to calculate, under the conditions of meeting the original ore mining quantity, ore grade, technology, etc., the output of antimony is approximately 4000 metal tons, but the actual production volume will be the final determinant.

On August 30th, tibet huayu mining released the 2024 interim financial report, with H1 achieving total operating income of 59.3 billion yuan, a year-on-year increase of 31.94%; net profit attributable to the parent company was 10.9 billion yuan, a year-on-year increase of 32.40%.

On August 30th, tibet huayu mining released the 2024 interim financial report, with H1 achieving total operating income of 59.3 billion yuan, a year-on-year increase of 31.94%; net profit attributable to the parent company was 10.9 billion yuan, a year-on-year increase of 32.40%.

The overall strong operation of nonferrous metal prices such as gold, silver, and antimony is one of the main reasons for the company's performance growth. In the first half of the year, the price of gold rose to $2330 per ounce, an increase of 13.5%; the main continuous increase in Shanghai silver was 29.87%; the average price of antimony 1# in the Changjiang nonferrous market increased by 94.28%.

In terms of production, in the first half of the year, the gold concentrate, lead-antimony concentrate (including silver), zinc concentrate, and antimony concentrate of the company were 521.96 kg, 4780.24 metal tons, 6104.18 metal tons, and 1415.31 metal tons, respectively.

It is worth noting that, under the high prosperity of the industry's supply and demand this year, the price of antimony has continued to rise, doubling so far. The output of antimony ore at Taliang Metal Industry in Tajikistan of tibet huayu mining has attracted much attention in the market; because the previous output of antimony ore at Taliang Metal Industry did not meet expectations. According to the company's 2023 financial report, the planned production of antimony that year was 5200 tons, and the actual completion was 469.21 tons, with a completion rate of 8.9%.

Based on the output of 1415.31 metal tons of antimony ore in the first half of this year, there has been a significant improvement compared to last year. According to the company's previous plan, the Taliang Metal Industry's Kangqiaoqi project has transitioned from the infrastructure period to the production period since April 2022. According to the characteristics of the mining industry, it requires a 1-1.5 year ramp-up production cycle, with the goal of achieving production in 2024.

It should be pointed out that there have been market voices questioning the low grade of antimony ore in Ta Aluminum Industry. Recently, a customer of Tibet Huayu Mining told reporters that the actual grade of local antimony ore is not as high as expected, and it may be difficult to fully release the antimony production capacity according to the previous plan.

In fact, the above situation has been taken seriously by the relevant departments. Tibet Huayu Mining mentioned in its response to the regulatory letter from the Shanghai Stock Exchange on July 13, 2023, that the reasons and rationality for the lower-than-expected production volume and performance loss of Ta Aluminum Industry in 2022-2023 were explained. The average selected gold grade during this period was 1.16 grams per ton, and the antimony grade was 0.65%. The mining volume of selected ores basically reached the expected target, but the grade of selected ores was lower than the average grade designed in the feasibility study.

According to the feasibility study report of the closed joint-stock company Ta Aluminum Industry Kangqiao Qiduo Metal Mine and Selection Project, the gold grade of the Ta Aluminum Industry project in the mining supply conditions was 2.49g/t, and the selected grade of gold-antimony ore was antimony (Sb) 2.00%, Au 0.73g/t.

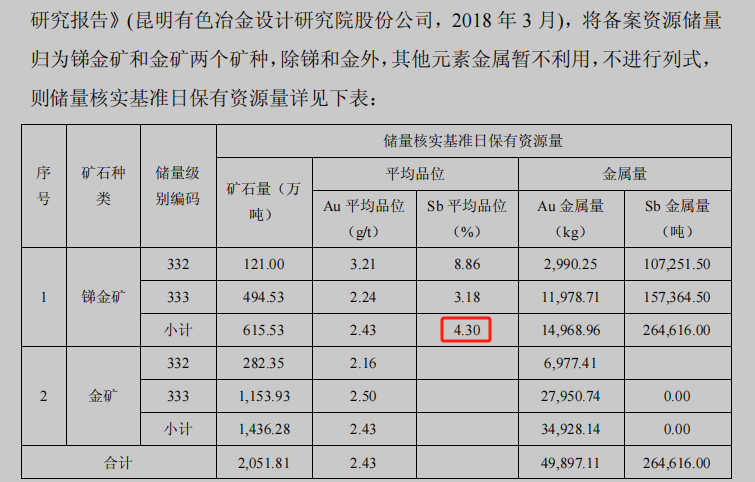

In a relevant announcement in May 2018, the comprehensive average grade of antimony in Ta Aluminum Industry's antimony-gold ore was 4.3%.

Screenshot source: company announcement

8月30日,华钰矿业发布2024年半年度财报,H1实现营业总收入5.93亿元,同比增加31.94% ;归母净利润为1.09亿元,同比增加32.40%。

8月30日,华钰矿业发布2024年半年度财报,H1实现营业总收入5.93亿元,同比增加31.94% ;归母净利润为1.09亿元,同比增加32.40%。