In the second quarter of 2024, global wearable wristband device shipments increased by 0.2% to reach 44.3 million units.

According to Futu Securities, in the second quarter of 2024, global wearable wristband device shipments increased by 0.2% to reach 44.3 million units. This growth is mainly attributed to the outstanding performance of Huawei and Xiaomi (01810), with basic watches continuing to lead market growth and shipments increasing by 6% year-on-year. In the entire wearable wristband device market, the market share of basic watches reached 48%, reaching a historical high. In comparison, the shipment volume of smartwatches remained flat compared to the second quarter of 2023, with the impressive performance of Samsung, Garmin (GRMN.US), Huawei, and Google (GOOG.US) partially offsetting the decline in Apple's (AAPL.US) shipments. The shipment volume of basic wristbands continued its downward trend, with a year-on-year decline of 14%.

Futu Securities' research manager Cynthia Chen commented, 'Basic watches continue to be a key pillar of the wearable wristband device market. Last year, the strong growth of basic watches was mainly driven by the domestic market in India, while the latest growth trend is mainly promoted by Huawei and Xiaomi, with a global market share of 15% and 13% respectively. These two manufacturers have achieved excellent performance in the greater China region by employing effective pricing strategies and by positioning high-end fitness tracking features in their basic watch models. In recent quarters, leading basic watch manufacturers have prioritized shipments, but they still need to focus more on brand awareness and market positioning in order to enter the high-end market. Developing strategic partnerships will also help improve product quality and brand positioning. For example, Xiaomi uses advanced algorithms from Suunto in its own sports watches.'

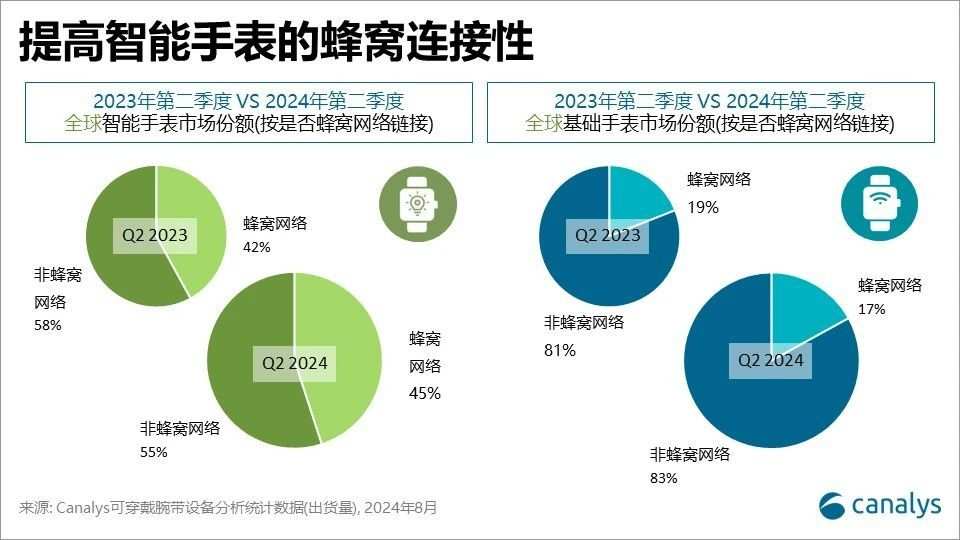

Canalys research analyst Jack Leathem pointed out, 'In order to capture new market opportunities, wearable wristband device manufacturers are committed to enriching their product portfolios and focusing on emerging niche markets, technologies, and software applications. Ecosystem device manufacturers are gradually exploring eSIM watches that support 4G/5G connectivity. This is aimed at deepening cooperation with telecommunications operators and exploring new sources of revenue. In the second quarter of 2024, although various manufacturers and telecommunications companies have shown strong interest in this field, the penetration rate of wearable wristband devices with cellular network functionality still remains at 45%. Google's two-year free cellular subscription service through Google Fi for the new Pixel Watch 3 in the United States aims to test whether this strategy can increase product appeal. In addition, an increasing number of manufacturers are launching high-end sports watches in the market, such as Xiaomi's Watch S4 Sport and Samsung's Galaxy Watch Ultra, aiming to attract a wider range of users, further enhance the market position of their high-end flagship products, and surpass their performance in the niche market in 2023 to secure a place in the market.'

Canalys research analyst Jack Leathem pointed out, 'In order to capture new market opportunities, wearable wristband device manufacturers are committed to enriching their product portfolios and focusing on emerging niche markets, technologies, and software applications. Ecosystem device manufacturers are gradually exploring eSIM watches that support 4G/5G connectivity. This is aimed at deepening cooperation with telecommunications operators and exploring new sources of revenue. In the second quarter of 2024, although various manufacturers and telecommunications companies have shown strong interest in this field, the penetration rate of wearable wristband devices with cellular network functionality still remains at 45%. Google's two-year free cellular subscription service through Google Fi for the new Pixel Watch 3 in the United States aims to test whether this strategy can increase product appeal. In addition, an increasing number of manufacturers are launching high-end sports watches in the market, such as Xiaomi's Watch S4 Sport and Samsung's Galaxy Watch Ultra, aiming to attract a wider range of users, further enhance the market position of their high-end flagship products, and surpass their performance in the niche market in 2023 to secure a place in the market.'

Leathem continued: "After experiencing a continuous decline for six consecutive quarters, the shipment volume of smartwatches rebounded by 0.1% in the second quarter of 2024. While the overall market performance was relatively weak, Garmin achieved counter-cyclical growth with a 16% increase in shipment volume this quarter, thanks to strong consumer demand and increased advertising investment. The market's resurgence before the sales season and the second half of the year product launch season brought some positive signals to manufacturers."

Canalys predicts that in the second half of 2024, the shipment volume of smartwatches will achieve double-digit growth, mainly due to the launch of new products by Apple, Samsung, and Google. These ecosystem manufacturers will introduce advanced health and fitness tracking features to address the challenges posed by Garmin's outstanding market performance, which will stimulate a wave of device upgrades. In order to succeed in this competitive market, smartwatch manufacturers must achieve significant improvements in health tracking functions and battery life compared to previous generations. The basic watch market is also expected to continue to grow, and manufacturers like Xiaomi and Huawei need to add more advanced features to attract consumers while maintaining an aggressive pricing strategy. As smartwatches return to innovative development, market competition will further intensify.

Smartwatches and basic watches are expected to maintain sustained growth in the short term, but in the next few years, these markets may cannibalize each other due to the similarity of target functions and market. In order to avoid this situation, smartwatch manufacturers must introduce new differentiated functions or application scenarios, such as gesture control or generative AI, which can fully leverage the powerful computing capabilities of smartwatches. These advanced features are crucial for maintaining the attractiveness of smartwatches, as basic watches without these functions will ultimately face bottlenecks in terms of these features and innovation.

Canalys研究分析师Jack Leathem指出:“为了捕获市场新机遇,可穿戴腕带设备厂商正致力于不断丰富其产品组合,重点关注新兴细分市场、技术和软件应用,设备生态系统厂商正逐步探索支持4G/5G连接的eSIM手表,此举旨在深化与电信运营商的合作,并挖掘新的收入来源。2024年第二季度,尽管各厂商和电信公司对此领域展现出浓厚的兴趣,但蜂窝网络功能的可穿戴腕带设备的普及率仍然保持在45%。谷歌在美国通过Google Fi为新款Pixel Watch 3提供的两年免费蜂窝订阅服务,来验证这一策略是否能够提高产品吸引力。此外,越来越多的厂商在市场上推出高端运动手表,如小米的Watch S4 Sport和三星的Galaxy Watch Ultra,旨在吸引更广泛的用户群体,进一步提升其高端旗舰产品的市场地位,并争取远超2023年在细分市场中的表现,以占据一席之地。”

Canalys研究分析师Jack Leathem指出:“为了捕获市场新机遇,可穿戴腕带设备厂商正致力于不断丰富其产品组合,重点关注新兴细分市场、技术和软件应用,设备生态系统厂商正逐步探索支持4G/5G连接的eSIM手表,此举旨在深化与电信运营商的合作,并挖掘新的收入来源。2024年第二季度,尽管各厂商和电信公司对此领域展现出浓厚的兴趣,但蜂窝网络功能的可穿戴腕带设备的普及率仍然保持在45%。谷歌在美国通过Google Fi为新款Pixel Watch 3提供的两年免费蜂窝订阅服务,来验证这一策略是否能够提高产品吸引力。此外,越来越多的厂商在市场上推出高端运动手表,如小米的Watch S4 Sport和三星的Galaxy Watch Ultra,旨在吸引更广泛的用户群体,进一步提升其高端旗舰产品的市场地位,并争取远超2023年在细分市场中的表现,以占据一席之地。”